JetBlue Airlines 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

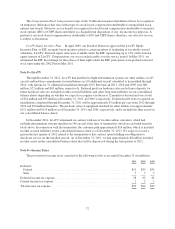

allowance to reduce the deferred tax assets to an amount that we consider is more likely than not to be realized.

Our valuation allowance at December 31, 2011 includes $20 million related to a capital loss carryforward which

expires in 2015 and 2016.

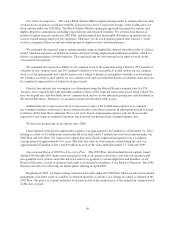

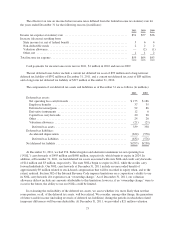

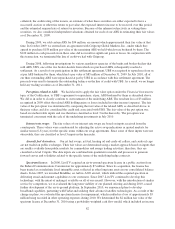

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follow (in millions):

Unrecognized tax benefits December 31, 2008 ............................... $ 8

Increases for tax positions taken during the period ............................. 1

Unrecognized tax benefits December 31, 2009 ............................... 9

Increases for tax positions taken during the period ............................. 2

Unrecognized tax benefits December 31, 2010 ............................... 11

Increases for tax positions taken during the period ............................. 1

Unrecognized tax benefits December 31, 2011 ............................... $12

Interest and penalties accrued on unrecognized tax benefits were not significant. If recognized, $9 million of

the unrecognized tax benefits at December 31, 2011 would impact our effective tax rate. We do not expect any

significant change in the amount of the unrecognized tax benefits within the next twelve months. As a result of

NOLs and statute of limitations in our major tax jurisdictions, years 2001 through 2010 remain subject to

examination by the relevant tax authorities.

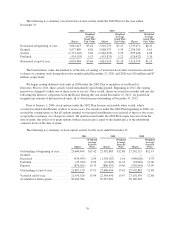

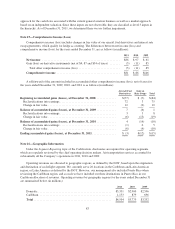

Note 10—Employee Retirement Plan

We sponsor a retirement savings 401(k) defined contribution plan, or the Plan, covering all of our

employees. In 2011, we matched 100% of our employee contributions up to 5% of their compensation in cash,

which vests over five years of service measured from an employee’s hire date. Participants are immediately

vested in their voluntary contributions.

Another component of the Plan is a profit sharing contribution. In 2007, we amended the Plan to provide for

a Company discretionary contribution of at least 5% of eligible non-management employee compensation. These

contributions vest 100% after three years of service measured from an employee’s hire date. Our total

contributions expensed for the Plan in 2011, 2010 and 2009 were $61 million, $55 million and $48 million,

respectively. Discretionary profit sharing amounts exceeding the minimum contribution described above may be

paid to employees in cash.

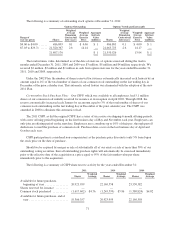

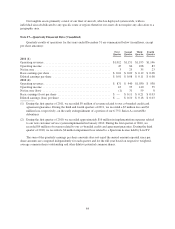

Note 11—Commitments

In October 2011, we executed a new purchase agreement with Airbus S.A.S., which supersedes our original

purchase agreement and related amendments. In this new agreement, we substituted 30 of our then remaining

A320 aircraft deliveries with A321 aircraft and placed a new order for 40 A320 new engine option, or A320neo,

aircraft with delivery scheduled in 2018 through 2021.

In December 2011, we executed a memorandum of understanding with Pratt and Whitney for the engines to

be used on the 40 Airbus A320neo aircraft. In addition to the required engines for the firm aircraft order, we

intend to purchase six spare engines.

During 2011, we cancelled the orders for a total of 14 EMBRAER 190 aircraft previously scheduled for

delivery in 2013, 2014, 2017 and 2018. We also deferred seven EMBRAER 190 aircraft previously scheduled for

delivery in 2013 and 2014 to 2018. Some or all of these deferred aircraft may either be returned to their

previously committed to delivery dates or cancelled and subject to cancellation fees if we elect not to further

amend our purchase agreement prior to July 31, 2012 to order a new EMBRAER 190 variant, if developed.

74