JetBlue Airlines 2011 Annual Report Download - page 73

Download and view the complete annual report

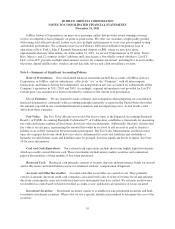

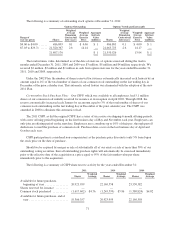

Please find page 73 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On June 4, 2008, in conjunction with the public offering of the 5.5% Debentures described above, we also

entered into a share lending agreement with Morgan Stanley & Co. Incorporated, an affiliate of the

underwriter of the offering, or the share borrower, pursuant to which we loaned the share borrower

approximately 44.9 million shares of our common stock. Under the share lending agreement, the share

borrower is required to return the borrowed shares when the debentures are no longer outstanding. We did

not receive any proceeds from the sale of the borrowed shares by the share borrower, but we did receive a

nominal lending fee of $0.01 per share from the share borrower for the use of borrowed shares.

Our share lending agreement requires that the shares borrowed be returned upon the maturity of the related

debt, October 2038, or earlier, if the debentures are no longer outstanding. We determined the fair value of

the share lending arrangement was approximately $5 million at the date of the issuance based on the value

of the estimated fees the shares loaned would have generated over the term of the share lending

arrangement. The $5 million fair value was recognized as a debt issuance cost and is being amortized to

interest expense through the earliest put date of the related debt, October 2013 and October 2015 for Series

A and Series B, respectively. As of December 31, 2011, approximately $1 million of net debt issuance costs

remain outstanding related to the share lending arrangement and will continue to be amortized through the

earliest put date of the related debt.

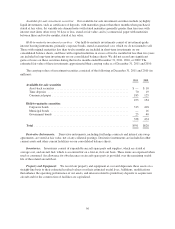

During 2008, approximately $76 million principal amount of the 5.5% Debentures were voluntarily

converted by holders. As a result, we issued 16.9 million shares of our common stock. Cash payments from

the escrow accounts related to these conversions were $11 million and borrowed shares equivalent to the

number of shares of our common stock issued upon these conversions were returned to us pursuant to the

share lending agreement described above. During 2009, approximately $3 million principal amount of the

5.5% Debentures were voluntarily converted by holders into approximately 0.6 million shares of our

common stock. The borrower returned 10.0 million shares to us in September 2009, almost all of which

were voluntarily returned shares in excess of converted shares, pursuant to the share lending agreement. In

October 2011, approximately 16.6 million shares were voluntarily returned to us by the borrower, leaving

1.4 million shares outstanding under the share lending arrangement. The fair value of similar common

shares not subject to our share lending arrangement, based upon our closing stock price, was approximately

$7 million. At December 31, 2011, the remaining principal balance was $123 million, which is currently

convertible into 27.4 million shares of our common stock.

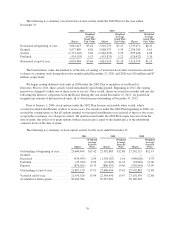

(7) At December 31, 2011 and 2010, four capital leased Airbus A320 aircraft were included in property and

equipment at a cost of $152 million with accumulated amortization of $23 million and $18 million,

respectively. The future minimum lease payments under these non-cancelable leases are $14 million in each

of 2012 through 2016 and $96 million in the years thereafter. Included in the future minimum lease

payments is $46 million representing interest, resulting in a present value of capital leases of $121 million

with a current portion of $7 million and a long-term portion of $114 million.

Maturities of long-term debt and capital leases, including the assumption that our convertible debt will be

redeemed upon the first put date, for the next five years are as follows (in millions):

2012 ........................................................ $198

2013 ........................................................ 397

2014 ........................................................ 576

2015 ........................................................ 262

2016 ........................................................ 460

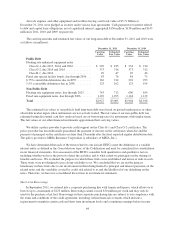

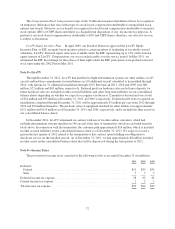

We are subject to certain collateral ratio requirements in our spare parts pass-through certificates and spare

engine financing issued in November 2006 and December 2007, respectively. If we fail to maintain these

collateral ratios, we are required to provide additional collateral or redeem some or all of the equipment notes so

that the ratios return to compliance. As a result of reduced third party valuation of these parts, we pledged as

collateral a previously unencumbered spare engine with a carrying market value of approximately $7 million

during the second quarter of 2011. In order to maintain the ratios, we elected to redeem $3 million of the

equipment notes in November 2011.

63