JetBlue Airlines 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

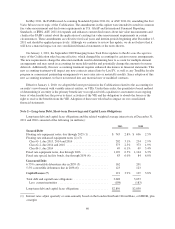

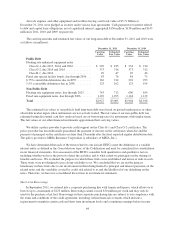

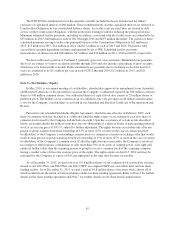

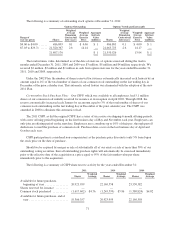

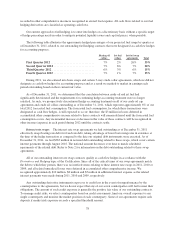

Note 6—Earnings Per Share

The following table shows how we computed basic and diluted earnings per common share for the years

ended December 31 (dollars in millions; share data in thousands):

2011 2010 2009

Numerator:

Net income .......................................... $ 86 $ 97 $ 61

Effect of dilutive securities:

Interest on convertible debt, net of income taxes and

discretionary profit sharing ......................... 12 11 9

Net income applicable to common stockholders after assumed

conversion for diluted earnings per share ................ $ 98 $ 108 $ 70

Denominator:

Weighted-average shares outstanding for basic earnings per

share ............................................. 278,689 275,364 260,486

Effect of dilutive securities:

Employee stock options .............................. 1,660 2,611 2,972

Convertible debt .................................... 66,118 68,605 68,605

Adjusted weighted-average shares outstanding and assumed

conversions for diluted earnings per share ................ 346,467 346,580 332,063

Shares excluded from EPS calculation (in millions):

Shares issuable upon conversion of our convertible debt since

assumed conversion would be antidilutive ............... — — 9.2

Shares issuable upon exercise of outstanding stock options since

assumed exercise would be antidilutive .................. 22.3 24.0 23.9

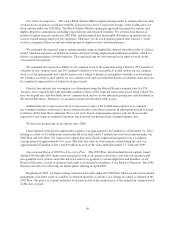

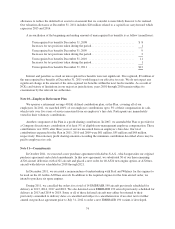

As of December 31, 2011, a total of approximately 1.4 million shares of our common stock, which were lent

to our share borrower pursuant to the terms of our share lending agreement as described in Note 2, were issued

and outstanding for corporate law purposes. Holders of the borrowed shares have all the rights of a holder of our

common stock. However, because the share borrower must return all borrowed shares to us (or identical shares

or, in certain circumstances of default by the counterparty, the cash value thereof), the borrowed shares are not

considered outstanding for the purpose of computing and reporting basic or diluted earnings per share.

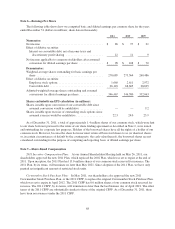

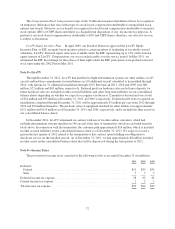

Note 7—Share-Based Compensation

2011 Incentive Compensation Plan: At our Annual Shareholders Meeting held on May 26, 2011, our

shareholders approved the new 2011 Plan, which replaced the 2002 Plan, which was set to expire at the end of

2011. Upon inception, the 2011 Plan had 15.0 million shares of our common stock reserved for issuance. The

2011 Plan, by its terms, will terminate no later than May 2021. Since adoption of the 2011 Plan, we have only

granted an insignificant amount of restricted stock units.

Crewmember Stock Purchase Plan: In May 2011, our shareholders also approved the new 2011

Crewmember Stock Purchase Plan, or the 2011 CSPP, to replace the original Crewmember Stock Purchase Plan,

which was set to expire in April 2012. The 2011 CSPP has 8.0 million shares of our common stock reserved for

issuance. The 2011 CSPP, by its terms, will terminate no later than the last business day of April 2021. The other

terms of the 2011 CSPP are substantially similar to those of the original CSPP. As of December 31, 2011, there

have been no issuances under the 2011 CSPP.

68