JetBlue Airlines 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In May 2011, the FASB issued Accounting Standards Update 2011-04, or ASU 2011-04, amending the Fair

Value Measurement topic of the Codification. The amendments in this update were intended to result in common

fair value measurement and disclosure requirements in U.S. GAAP and International Financial Reporting

Standards, or IFRS. ASU 2011-04 expands and enhances current disclosures about fair value measurements and

clarifies the FASB’s intent about the application of existing fair value measurement requirements in certain

circumstances. These amendments are effective for fiscal years and interim periods beginning after December 15,

2011 and should be applied prospectively. Although we continue to review this update, we do not believe that it

will have a material impact on our consolidated financial statements or the notes thereto.

On January 1, 2011, the September 2009 Emerging Issues Task Force updates to the Revenue Recognition

topic of the Codification rules became effective, which changed the accounting for certain revenue arrangements.

The new requirements change the allocation methods used in determining how to account for multiple element

arrangements and may result in accounting for more deliverables and potentially change the amount of revenue

deferrals. Additionally, this new accounting treatment requires enhanced disclosures in financial statements. This

new accounting treatment will impact any new contracts entered into by LiveTV, as well as any TrueBlue loyalty

program or commercial partnership arrangements we may enter into or materially modify. Since adoption of this

new accounting treatment, we have not entered into any material new or modified contracts.

Effective January 1, 2010, we adopted the latest provisions in the Codification related to the accounting for

an entity’s involvement with variable interest entities, or VIEs. Under these rules, the quantitative based method

of determining if an entity is the primary beneficiary was replaced with a qualitative assessment on an ongoing

basis of which entity has the power to direct activities of the VIE and the obligation to absorb the losses or the

right to receive the benefits from the VIE. Adoption of these new rules had no impact on our consolidated

financial statements.

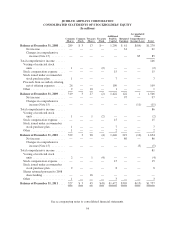

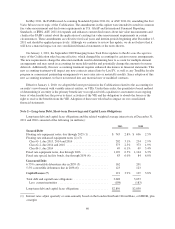

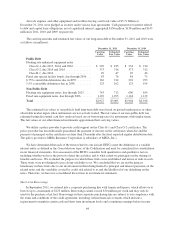

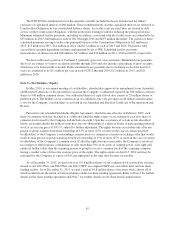

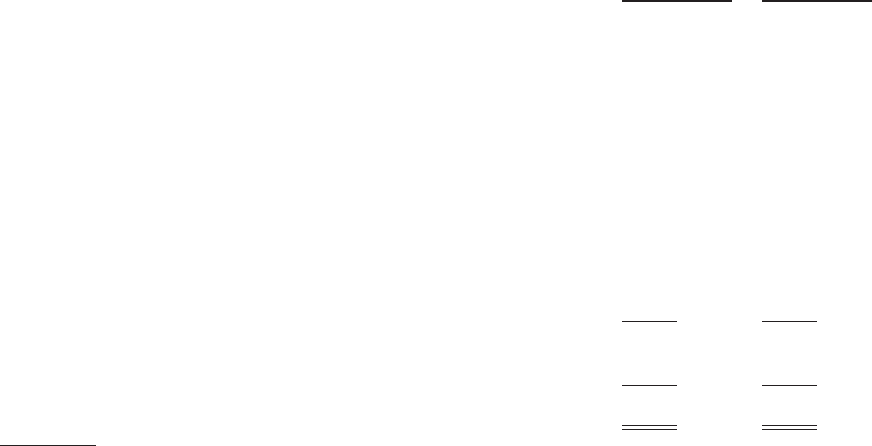

Note 2—Long-term Debt, Short-term Borrowings and Capital Lease Obligations

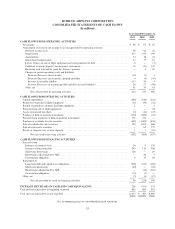

Long-term debt and capital lease obligations and the related weighted average interest rate at December 31,

2011 and 2010 consisted of the following (in millions):

2011 2010

Secured Debt

Floating rate equipment notes, due through 2025 (1) ............. $ 743 2.8% $ 696 2.5%

Floating rate enhanced equipment notes (2) (3)

Class G-1, due 2013, 2014 and 2016 ....................... 202 3.1% 234 2.9%

Class G-2, due 2014 and 2016 ............................ 373 2.5% 373 1.9%

Class B-1, due 2014 .................................... 49 6.1% 49 5.4%

Fixed rate equipment notes, due through 2026 .................. 1,192 6.3% 1,144 6.3%

Fixed rate special facility bonds, due through 2036 (4) ........... 83 6.0% 84 6.0%

Unsecured Debt

6.75% convertible debentures due in 2039 (5) .................. 162 201

5.5% convertible debentures due in 2038 (6) ................... 123 123

Capital Leases (7) 121 3.9% 129 3.8%

Total debt and capital lease obligations ....................... 3,048 3,033

Less: current maturities .................................. (198) (183)

Long-term debt and capital lease obligations ................... $2,850 $2,850

(1) Interest rates adjust quarterly or semi-annually based on the London Interbank Offered Rate, or LIBOR, plus

a margin.

60