JetBlue Airlines 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the effect on our business might be from the extremely competitive environment we are operating in or from

events that are beyond our control, such as volatile fuel prices, economic conditions, weather-related disruptions,

the impact of airline bankruptcies, restructurings or consolidations, U.S. military actions or acts of terrorism. We

believe the working capital available to us will be sufficient to meet our cash requirements for at least the next

12 months.

Our scheduled debt maturities are expected to increase over the next five years, with a scheduled peak in

2014 of nearly $600 million. We are actively managing our liquidity to overcome these debt hurdles by pre-

purchasing convertible debt and other outstanding debt when market conditions allow. In doing so, we are

working to smooth the scheduled debt maturity schedule over the next five years, which will also have the effect

of reducing overall interest expense.

Anticipated capital expenditures for facility improvements, spare parts and ground purchases in 2012 are

projected to be approximately $215 million.

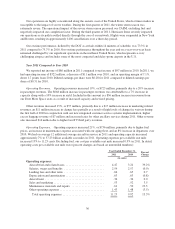

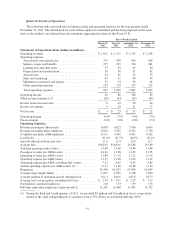

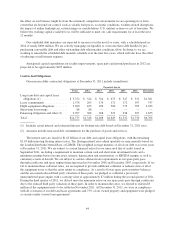

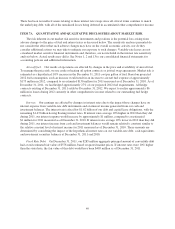

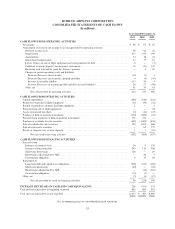

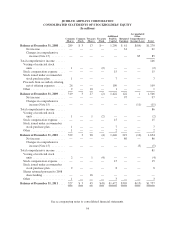

Contractual Obligations

Our noncancelable contractual obligations at December 31, 2011 include (in millions):

Payments due in

Total 2012 2013 2014 2015 2016 Thereafter

Long-term debt and capital lease

obligations (1) ................. $ 3,752 $ 324 $ 514 $ 675 $ 347 $ 531 $1,361

Lease commitments ............... 1,578 205 176 171 172 107 747

Flight equipment obligations ........ 5,960 425 450 580 775 785 2,945

Short-term borrowings ............. 88 88———— —

Financing obligations and other (2) . . . 2,997 306 268 223 238 307 1,655

Total ........................... $14,375 $1,348 $1,408 $1,649 $1,532 $1,730 $6,708

(1) Includes actual interest and estimated interest for floating-rate debt based on December 31, 2011 rates.

(2) Amounts include noncancelable commitments for the purchase of goods and services.

The interest rates are fixed for $1.62 billion of our debt and capital lease obligations, with the remaining

$1.43 billion having floating interest rates. The floating interest rates adjust quarterly or semi-annually based on

the London Interbank Offered Rate, or LIBOR. The weighted average maturity of all of our debt was seven years

at December 31, 2011. We are subject to certain financial ratios for our unsecured line of credit issued in

September 2011, including a requirement to maintain certain cash and short-term investment levels and a

minimum earnings before income taxes, interest, depreciation and amortization, or EBITDA margin, as well as

customary events of default. We are subject to certain collateral ratio requirements in our spare parts pass-

through certificates and spare engine financing issued in November 2006 and December 2007, respectively. If we

fail to maintain these collateral ratios, we are required to provide additional collateral or redeem some or all of

the equipment notes so that the ratios return to compliance. As a result of lower spare parts inventory balances

and the associated reduced third party valuation of these parts, we pledged as collateral a previously

unencumbered spare engine with a carrying value of approximately $7 million during the second quarter of 2011.

During the third quarter of 2011, we did not meet the minimum ratios on our spare parts pass-through certificates

due to the reduced third party valuation of these parts. In order to maintain the ratios, we elected to redeem $3

million of the equipment notes to be settled in November 2011. At December 31, 2011, we were in compliance

with all covenants of our debt and lease agreements and 75% of our owned property and equipment were pledged

as security under various loan agreements.

44