JetBlue Airlines 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Aircraft, engines, and other equipment and facilities having a net book value of $3.71 billion at

December 31, 2011 were pledged as security under various loan agreements. Cash payments for interest related

to debt and capital lease obligations, net of capitalized interest, aggregated $136 million, $138 million and $143

million in 2011, 2010 and 2009, respectively.

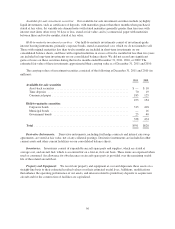

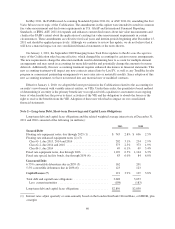

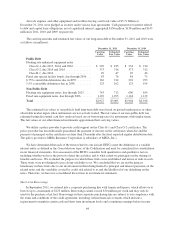

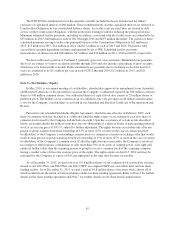

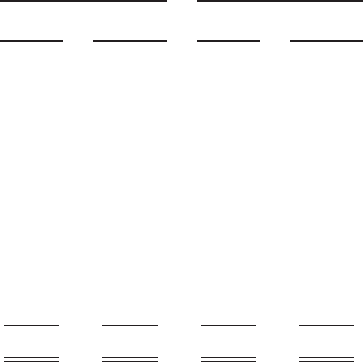

The carrying amounts and estimated fair values of our long-term debt at December 31, 2011 and 2010 were

as follows (in millions):

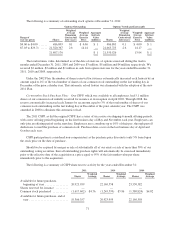

December 31, 2011 December 31, 2010

Carrying

Value

Estimated

Fair Value

Carrying

Value

Estimated

Fair Value

Public Debt

Floating rate enhanced equipment notes

Class G-1, due 2013, 2014, and 2016 ............ $ 202 $ 185 $ 234 $ 210

Class G-2, due 2014 and 2016 ................. 373 316 373 312

Class B-1, due 2014 ......................... 49 47 49 46

Fixed rate special facility bonds, due through 2036 . . . 83 76 84 75

6.75% convertible debentures due in 2039 .......... 162 214 201 293

5.5% convertible debentures due in 2038 ........... 123 162 123 194

Non-Public Debt

Floating rate equipment notes, due through 2025 .... 743 712 696 654

Fixed rate equipment notes, due through 2026 ....... 1,192 1,293 1,144 1,132

Total ....................................... $2,927 $3,005 $2,904 $2,916

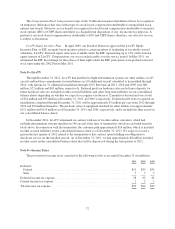

The estimated fair values of our publicly held long-term debt were based on quoted market prices or other

observable market inputs when instruments are not actively traded. The fair value of our non-public debt was

estimated using discounted cash flow analysis based on our borrowing rates for instruments with similar terms.

The fair values of our other financial instruments approximate their carrying values.

We utilize a policy provider to provide credit support on the Class G-1 and Class G-2 certificates. The

policy provider has unconditionally guaranteed the payment of interest on the certificates when due and the

payment of principal on the certificates no later than 18 months after the final expected regular distribution date.

The policy provider is MBIA Insurance Corporation (a subsidiary of MBIA, Inc.).

We have determined that each of the trusts related to our aircraft EETCs meet the definition of a variable

interest entity as defined in the Consolidations topic of the Codification and must be considered for consolidation

in our financial statements. Our assessment of the EETCs considers both quantitative and qualitative factors,

including whether we have the power to direct the activities and to what extent we participate in the sharing of

benefits and losses. We evaluated the purpose for which these trusts were established and nature of risks in each.

These trusts were not designed to pass along variability to us. We concluded that we are not the primary

beneficiary in these trusts due to our involvement in them being limited to principal and interest payments on the

related notes and the variability created by credit risk related to us and the likelihood of our defaulting on the

notes. Therefore, we have not consolidated these trusts in our financial statements.

Short-term Borrowings

In September 2011, we entered into a corporate purchasing line with American Express, which allows us to

borrow up to a maximum of $125 million. Borrowings cannot exceed $30 million per week and may only be

used for the purchase of jet fuel. Borrowings on this corporate purchasing line are subject to our compliance with

the terms and conditions of the credit agreement, including certain financial covenants which include a

requirement to maintain certain cash and short term investment levels and a minimum earnings before income

64