JetBlue Airlines 2011 Annual Report Download - page 69

Download and view the complete annual report

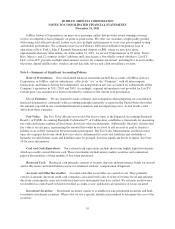

Please find page 69 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Advertising Costs: Advertising costs, which are included in sales and marketing, are expensed as incurred.

Advertising expense in 2011, 2010 and 2009 was $57 million, $55 million and $53 million, respectively.

Share-Based Compensation: We record compensation expense in the financial statements for share-based

awards based on the grant date fair value of those awards. Share-based compensation expense includes an

estimate for pre-vesting forfeitures and is recognized over the requisite service periods of the awards on a

straight-line basis, which is generally commensurate with the vesting term.

Under the Compensation-Stock Compensation topic of the Codification, the benefits associated with tax

deductions in excess of recognized compensation cost are required to be reported as a financing cash flow. We

recorded an insignificant amount in excess tax benefits generated from option exercises in each of 2011, 2010

and 2009.

Our policy is to issue new shares for purchases under all of our stock based plans, including our

Crewmember Stock Purchase Plan, or CSPP, and 2011 Crewmember Stock Purchase Plan and issuances under

our Amended and Restated 2002 Stock Incentive Plan, or 2002 Plan and our 2011 Incentive Compensation Plan,

or 2011 Plan.

Income Taxes: We account for income taxes utilizing the liability method. Deferred income taxes are

recognized for the tax consequences of temporary differences between the tax and financial statement reporting

bases of assets and liabilities. A valuation allowance for deferred tax assets is provided unless realizability is

judged by us to be more likely than not. Our policy is to recognize interest and penalties accrued on any

unrecognized tax benefits as a component of income tax expense.

New Accounting Standards: Our financial statements are prepared in accordance with the Codification

which was established in 2009 and superseded all then existing accounting standard documents and has become

the single source of authoritative non-governmental U.S. GAAP. New accounting rules and disclosure

requirements can impact our financial results and the comparability of our financial statements. Authoritative

literature that has recently been issued which we believe will impact our consolidated financial statements is

described below. There are also several new proposals under development, including proposals related to leases,

revenue recognition and financial instruments, if and when enacted, may have a significant impact on our

financial statements.

In December 2011, the FASB issued Accounting Standards Update 2011-11, or ASU 2011-11, amending

the Balance Sheet topic of the Codification. This update enhances the disclosure requirements regarding

offsetting assets and liabilities. ASU 2011-11 requires entities to disclose both gross information and net

information about both instruments and transactions eligible for offset in the statement of financial position and

instruments and transactions subject to an agreement similar to a master netting arrangement. These amendments

are effective for annual and interim reporting periods beginning on or after January 1, 2013 and should be applied

retrospectively. We will evaluate any instruments and transactions, including derivative instruments, which are

eligible for offset but we do not expect that the adoption of this standard will have a material impact on our

statement of financial condition.

In June 2011, the FASB issued Accounting Standards Update 2011-05, or ASU 2011-05, amending the

Comprehensive Income topic of the Codification. This update changes the requirements for the presentation of

other comprehensive income, eliminating the option to present components of other comprehensive income as

part of the statement of changes in stockholders’ equity, among other things. ASU 2011-05 requires that all

non-owner changes in stockholders’ equity be presented either in a single continuous statement of comprehensive

income or in two separate but consecutive statements. These amendments are effective for fiscal years and

interim periods beginning after December 15, 2011 and should be applied retrospectively. Since the update only

requires a change in presentation, we do not expect that the adoption of this standard will have a material impact

on our results of operations, cash flows or financial condition.

59