JetBlue Airlines 2011 Annual Report Download - page 55

Download and view the complete annual report

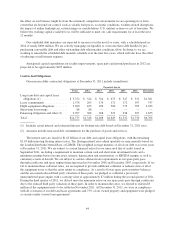

Please find page 55 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have operating lease obligations for 60 aircraft with lease terms that expire between 2013 and 2026.

Five of these leases have variable-rate rent payments that adjust semi-annually based on LIBOR. We also lease

airport terminal space and other airport facilities in each of our markets, as well as office space and other

equipment. We have approximately $33 million of restricted assets pledged under standby letters of credit related

to certain of our leases which will expire at the end of the related lease terms.

Our firm aircraft orders at December 31, 2011 consisted of 21 Airbus A320 aircraft, 30 Airbus A321

aircraft, 40 Airbus A320 neo aircraft and 35 EMBRAER 190 aircraft scheduled for delivery as follows: 11 in

2012, 9 in 2013, 11 in 2014, 17 in 2015, 18 in 2016, 13 in 2017, 17 in 2018, 10 in 2019, 10 in 2020 and 10 in

2021. We meet our predelivery deposit requirements for our aircraft by paying cash or by using short-term

borrowing facilities for deposits required six to 24 months prior to delivery. Any predelivery deposits paid by the

issuance of notes are fully repaid at the time of delivery of the related aircraft. We also have options to acquire 56

additional EMBRAER 190 aircraft for delivery from 2013 through 2018.

Our aircraft orders reflect contract modifications undertaken in 2011, including a new purchase agreement

with Airbus S.A.S., which superseded our original purchase agreement and related amendments. In this new

agreement, we substituted 30 of our then remaining A320 aircraft deliveries with A321 aircraft and placed a new

order for 40 A320neo aircraft with delivery scheduled in 2018 through 2021. We also modified our EMBRAER

190 purchase agreement in February 2011, canceling two aircraft previously scheduled for delivery in 2013. In

October 2011, we further amended our EMBRAER 190 purchase agreement, terminating 11 aircraft previously

scheduled for delivery in 2017 and 2018, deferring seven aircraft previously scheduled for delivery in 2013 and

2014 to 2018 and cancelling the order for one EMBRAER 190 aircraft previously scheduled for delivery in

2014. Some or all of these deferred aircraft may either be returned to their previously committed to delivery dates

or cancelled and subject to cancellation fees if we elect not to further amend our purchase agreement to order a

new EMBRAER 190 variant, if developed.

In October 2008, we began operating out of our new Terminal 5 at JFK, or Terminal 5, which we had been

constructing since November 2005. The construction and operation of this facility is governed by a lease

agreement that we entered into with the PANYNJ in 2005. We are responsible for making various payments

under the lease, including ground rents for the terminal site which began on lease execution in 2005 and facility

rents that commenced in October 2008 upon our occupancy of the terminal. The facility rents are based on the

number of passengers enplaned out of the terminal, subject to annual minimums. The PANYNJ has reimbursed

us for costs of this project in accordance with the terms of the lease, except for approximately $78 million in

leasehold improvements that have been provided by us. For financial reporting purposes, this project is being

accounted for as a financing obligation, with the constructed asset and related liability being reflected on our

balance sheets. Minimum ground and facility rents for this terminal totaling $1.17 billion are included in the

commitments table above as lease commitments and financing obligations.

Our commitments also include those of LiveTV, which has several noncancelable long-term purchase

agreements with its suppliers to provide equipment to be installed on its customers’ aircraft, including JetBlue’s

aircraft.

We enter into individual employment agreements with each of our FAA-licensed employees. Each

employment agreement is for a term of five years and automatically renews for an additional five-year term

unless the employee is terminated for cause or the employee elects not to renew it. Pursuant to these agreements,

these employees can only be terminated for cause. In the event of a downturn in our business that would require a

reduction in work hours, we are obligated to pay these employees a guaranteed level of income and to continue

their benefits. As we are not currently obligated to pay this guaranteed income and benefits, no amounts related

to these guarantees are included in the table above.

45