JetBlue Airlines 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Southwest Airlines. We believe building and maintaining solid foundations, including preserving our cost

advantage and strong liquidity position, profitable growth and making prudent investments, will allow us to

continue our commitment to growing organically, even in this uncertain economic environment.

We have built a strong financial foundation, the cornerstones of which are maintaining one of the best

liquidity positions and one of the lowest cost structures in the industry. This strong foundation affords us the

ability to expand and profitably grow our route network and our customer offerings as well as the flexibility to

take advantage of market opportunities as they become available, such as the slot auctions in New York and

Washington D.C. during 2011. In 2011, despite rising fuel prices, our ability to attract higher yielding traffic and

execution of our sustainable growth strategy has resulted in a third consecutive year of positive free cash flows,

which we define as cash flows from operations less capital expenditures.

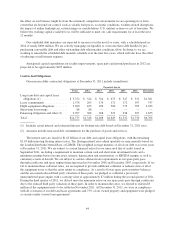

In 2011, we invested in five new owned EMBRAER 190 aircraft and four new owned Airbus A320 aircraft

to our fleet. Even with the addition of these aircraft, all of which were debt financed, our long-term debt balance

only grew by a modest $15 million.

In 2011, we made several modifications to our aircraft purchase commitments. In October 2011, we

executed a new purchase agreement with Airbus S.A.S., which supersedes our original purchase agreement and

related amendments. In this new agreement, we substituted 30 of our remaining A320 aircraft deliveries with

A321 aircraft and placed a new order for 40 A320 new engine option, or A320neo, aircraft with delivery

scheduled in 2018 through 2021. We also modified our EMBRAER 190 purchase agreement in 2011, canceling

two aircraft previously scheduled for delivery in 2013 and one aircraft scheduled for delivery in 2014; deferring

seven aircraft previously scheduled for delivery in 2013 and 2014 to 2018; and terminating 11 aircraft previously

scheduled for delivery in 2017 and 2018. During the second quarter of 2011, we extended the leases on four

Airbus A320 aircraft, which were previously set to expire in 2012. We may further modify our fleet growth

through additional aircraft sales, leasing of aircraft, returns of leased aircraft and/or deferral of aircraft deliveries

in order to prudently manage our capacity and growth plans. We believe the new mix of our fleet and revised

delivery schedules will allow us to better manage our network and continue to improve upon the JetBlue

Experience we offer to our valued customers.

We maintain one of the lowest cost structures in the industry relative to the product we offer due to the

young average age of our fleet, a productive non-union workforce, and cost discipline. During 2011, while

building upon our network strategy, we maintained our focus on cost control and ran an efficient operation,

which helped mitigate the impact of rising fuel prices. This was demonstrated in our year over year cost per

available seat mile, excluding fuel, which remained relatively flat. We remain focused on managing those costs

within our control as we believe this is crucial to maintaining our competitive advantage. In 2012, we plan to

continue our focus on cost control while improving the JetBlue Experience for our customers. The largest

components of our operating expenses are aircraft fuel and related taxes and salaries, wages and benefits

provided to our crewmembers. Unlike most airlines, we make an investment in our culture by having a policy of

not furloughing crewmembers during economic downturns, and we have a non-union workforce, which we

believe provides us with more flexibility and allows us to be more productive. However, the increasing seniority

of our crewmembers and rising healthcare costs are presenting cost pressures. The price and availability of

aircraft fuel, which is our single largest operating expense, are extremely volatile due to global economic and

geopolitical factors that we can neither control nor accurately predict. Sales and marketing expenses include

advertising, fees paid to credit card companies, and commissions paid for our participation in GDSs and OTAs.

The majority of our customers book their flights directly through our website, our preferred means of

distribution; however distribution costs have increased with our increased participation in GDSs and OTAs since

2010. Maintenance materials and repairs are expensed when incurred unless covered by a third party services

contract. Because the average age of our aircraft is 6.1 years, all of our aircraft currently require less maintenance

than they will in the future. Our maintenance costs will increase significantly, both on an absolute basis and as a

percentage of our unit costs, as our fleet ages. We are continuously exploring opportunities to mitigate the

increase in maintenance expense, including new or revised business partner agreements and improving

34