JetBlue Airlines 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

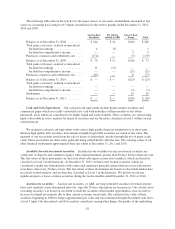

The Compensation-Stock Compensation topic of the Codification requires that deferred taxes be recognized

on temporary differences that arise with respect to stock-based compensation attributable to nonqualified stock

options and awards. However, no tax benefit is recognized for stock-based compensation attributable to incentive

stock options (ISO) or CSPP shares until there is a disqualifying disposition, if any, for income tax purposes. A

portion of our stock-based compensation is attributable to ISO and CSPP shares; therefore, our effective tax rate

is subject to fluctuation.

LiveTV Equity Incentive Plan. In April 2009, our Board of Directors approved the LiveTV Equity

Incentive Plan, or EIP, an equity based incentive plan for certain members of leadership at our wholly-owned

subsidiary, LiveTV. Notional equity units were available under the EIP, representing up to 12% of the notional

equity interest of LiveTV. Compensation cost was recorded ratably over the service period. In May 2011, we

terminated the EIP. In exchange for the release of their rights under the EIP, participants were granted restricted

stock units under the 2002 Plan in May 2011.

Note 8—LiveTV

Through December 31, 2011, LiveTV had installed in-flight entertainment systems for other airlines on 413

aircraft and had firm commitments for installations on 110 additional aircraft scheduled to be installed through

2014, with options for 31 additional installations through 2013. Revenues in 2011, 2010 and 2009 were $82

million, $72 million and $65 million, respectively. Deferred profit on hardware sales and advance deposits for

future hardware sales are included in other accrued liabilities and other long term liabilities on our consolidated

balance sheets depending on whether we expect to recognize it in the next 12 months or beyond and was a total

of $54 million and $35 million at December 31, 2011 and 2010, respectively. Deferred profit to be recognized on

installations completed through December 31, 2011 will be approximately $3 million per year from 2012 through

2016 and $10 million thereafter. The net book value of equipment installed for other airlines was approximately

$111 million and $114 million as of December 31, 2011 and 2010, respectively, and is included in other assets on

our consolidated balance sheets.

In December 2011, LiveTV terminated its contract with one of its other airline customers, which had

in-flight entertainment systems installed on 140 aircraft at the time of termination, which are excluded from the

totals above. In connection with the termination, the customer paid approximately $16 million, which is included

in other accrued liabilities on the consolidated balance sheet as of December 31, 2011. We expect to record a

gain in the first quarter of 2012 related to the termination of this contract upon fulfilling our obligation to

deactivate service on the installed aircraft. As of December 31, 2011, we had approximately $8 million included

in other assets on the consolidated balance sheet that will be disposed of during the first quarter of 2012.

Note 9—Income Taxes

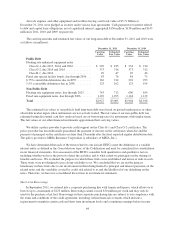

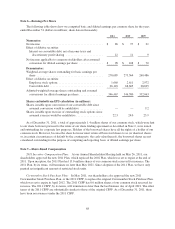

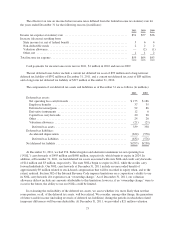

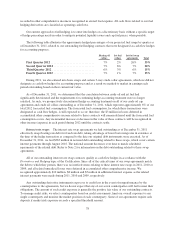

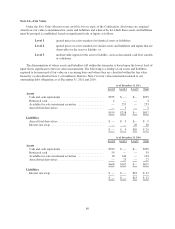

The provision for income taxes consisted of the following for the years ended December 31 (in millions):

2011 2010 2009

Deferred:

Federal ................................................................ $51 $55 $35

State .................................................................. 7 7 7

Deferred income tax expense ................................................. 58 62 42

Current income tax expense .................................................. 1 2 1

Total income tax expense .................................................... $59 $64 $43

72