JetBlue Airlines 2011 Annual Report Download - page 58

Download and view the complete annual report

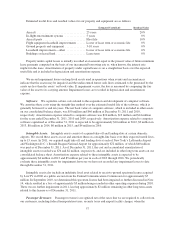

Please find page 58 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.market value or changes in technology. As our assets are all relatively new and we continue to have positive

operating cash flows, we have not identified any significant impairment related to our long-lived assets at this

time.

Lease accounting. We operate airport facilities, offices buildings and aircraft under operating leases with

minimum lease payments associated with these agreements recognized as rent expense on a straight-line basis

over the expected lease term. Within the provisions of certain leases there are minimum escalations in payments

over the base lease term and periodic adjustments of lease rates, landing fees, and other charges applicable under

such agreements, as well as renewal periods. The effects of the escalations and other adjustments have been

reflected in rent expense on a straight-line basis over the lease term, which includes renewal periods when it is

deemed to be reasonably assured at the inception of the lease that we would incur an economic penalty for not

renewing. The amortization period for leasehold improvements is the term used in calculating straight-line rent

expense or their estimated economic life, whichever is shorter.

Derivative instruments used for aircraft fuel. We utilize financial derivative instruments to manage the

risk of changing aircraft fuel prices. We do not purchase or hold any derivative instrument for trading purposes.

At December 31, 2011, we had a net $4 million liability related to the net fair value of these derivative

instruments; the majority of which are not traded on a public exchange. Fair values are assigned based on

commodity prices that are provided to us by independent third parties. When possible, we designate these

instruments as cash flow hedges for accounting purposes, as defined by the Derivatives and Hedging topic of the

Codification which permits the deferral of the effective portions of gains or losses until contract settlement.

The Derivatives and Hedging topic is a complex accounting standard and requires that we develop and

maintain a significant amount of documentation related to (1) our fuel hedging program and strategy,

(2) statistical analysis supporting a highly correlated relationship between the underlying commodity in the

derivative financial instrument and the risk being hedged (i.e. aircraft fuel) on both a historical and prospective

basis and (3) cash flow designation for each hedging transaction executed, to be developed concurrently with the

hedging transaction. This documentation requires that we estimate forward aircraft fuel prices since there is no

reliable forward market for aircraft fuel. These prices are developed through the observation of similar

commodity futures prices, such as crude oil and/or heating oil, and adjusted based on variations to those like

commodities. Historically, our hedges have settled within 24 months; therefore, the deferred gains and losses

have been recognized into earnings over a relatively short period of time.

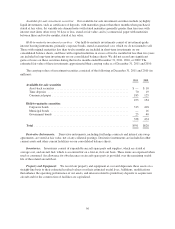

Fair value measurements. The Fair Value Measurements and Disclosures topic of the Codification

clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants. The Fair Value Measurements and

Disclosures topic also requires disclosure about how fair value is determined for assets and liabilities and

establishes a hierarchy for which these assets and liabilities must be grouped, based on significant levels of

inputs. We rely on unobservable (level 3) inputs, which are highly subjective, in determining the fair value of

certain assets and liabilities, including our interest rate swaps.

We elected to apply the fair value option under the Financial Instruments topic of the Codification to an

agreement with one of our ARS’ broker, to repurchase in 2010, ARS brokered by them at par. The fair value of

the put was determined by comparing the fair value of the related ARS to their par values and also considered the

credit risk associated with the broker. This put option was adjusted on each balance sheet date based on its then

fair value. The fair value of the put option was based on unobservable inputs and was therefore classified as level

3 in the hierarchy. This put option was fully exercised in 2010 upon its expiration.

In 2008 and 2009, we entered into various interest rate swaps, which qualify as cash flow hedges in

accordance with the Derivatives and Hedging topic. The fair values of our interest rate swaps were initially based

on inputs received from the counterparty. These values were corroborated by adjusting the active swap

indications in quoted markets for similar terms (6-8 years) for the specific terms within our swap agreements.

48