JetBlue Airlines 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Available-for-sale investment securities: Our available-for-sale investment securities include (a) highly

liquid investments, such as certificates of deposits, with maturities greater than three months when purchased,

stated at fair value; (b) variable rate demand notes with stated maturities generally greater than ten years with

interest reset dates often every 30 days or less, stated at fair value; and (c) commercial paper with maturities

between three and twelve months, stated at fair value.

Held-to-maturity investment securities: Our held-to-maturity investments consist of investment-grade

interest bearing instruments, primarily corporate bonds, stated at amortized cost, which we do not intend to sell.

Those with original maturities less than twelve months are included in short-term investments on our

consolidated balance sheets, and those with original maturities in excess of twelve months but less than two years

are included in long-term investments on our consolidated balance sheets. We did not record any significant

gains or losses on these securities during the twelve months ended December 31, 2011, 2010, or 2009. The

estimated fair value of these investments approximated their carrying value as of December 31, 2011 and 2010.

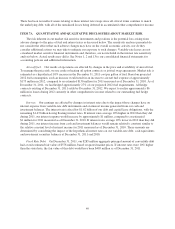

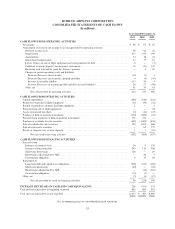

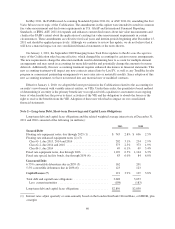

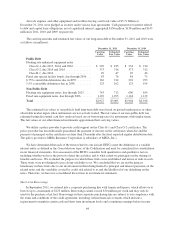

The carrying values of investment securities consisted of the following at December 31, 2011 and 2010 (in

millions):

2011 2010

Available-for-sale securities

Asset-back securities .................................................. $ — $ 10

Time deposits ....................................................... 70 19

Commercial paper .................................................... 183 125

253 154

Held-to-maturity securities

Corporate bonds ..................................................... 313 418

Municipal bonds ..................................................... — 16

Government bonds ................................................... 25 40

338 474

Total ................................................................ $591 $628

Derivative Instruments: Derivative instruments, including fuel hedge contracts and interest rate swap

agreements, are stated at fair value, net of any collateral postings. Derivative instruments are included in other

current assets and other current liabilities on our consolidated balance sheets.

Inventories: Inventories consist of expendable aircraft spare parts and supplies, which are stated at

average cost, and aircraft fuel, which is accounted for on a first-in, first-out basis. These items are expensed when

used or consumed. An allowance for obsolescence on aircraft spare parts is provided over the remaining useful

life of the related aircraft fleet.

Property and Equipment: We record our property and equipment at cost and depreciate these assets on a

straight-line basis to their estimated residual values over their estimated useful lives. Additions, modifications

that enhance the operating performance of our assets, and interest related to predelivery deposits to acquire new

aircraft and for the construction of facilities are capitalized.

56