JetBlue Airlines 2011 Annual Report Download - page 71

Download and view the complete annual report

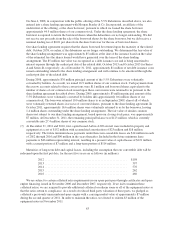

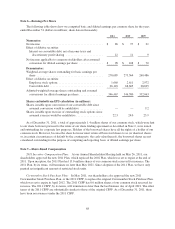

Please find page 71 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) In November 2006, we completed a public offering of $124 million of pass-through certificates to finance

certain of our owned aircraft spare parts. Separate trusts were established for each class of these certificates.

In November 2011, we redeemed $3 million of class G-1 certificates. The remaining principal amount of the

Class G-1 and Class B-1 certificates is scheduled to be paid in a lump sum on the applicable maturity date.

In April 2009, we entered into interest rate swap agreements that have effectively fixed the interest rate

increases for the remaining term of half of the Class G-1 certificates and all of the Class B-1 certificates for

the November 2006 offering. The swapped portion of the Class G-1 and Class B-1 certificates had a balance

of $37 million and $49 million, respectively, at December 31, 2011, and the effective interest rates included

in the above table. The interest rate for the remaining $34 million of the Class G-1 certificates is based on

three month LIBOR plus a margin. Interest is payable quarterly.

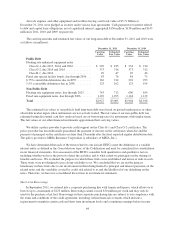

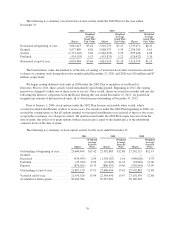

(3) In November 2004 and March 2004, we completed public offerings of $498 million and $431 million,

respectively, of pass-through certificates to finance the purchase of 28 new Airbus A320 aircraft delivered

through 2005. Separate trusts were established for each class of these certificates. Quarterly principal

payments are required on the Class G-1 certificates. The entire principal amount of the Class G-2

certificates is scheduled to be paid in a lump sum on the applicable maturity dates. In June and November

2008, we fully repaid the principal balances of the Class C certificates. In February 2008, we entered into

interest rate swap agreements that have effectively fixed the interest rate for the remaining term of the Class

G-1 certificates for the November 2004 offering. These certificates had a balance of $91 million at

December 31, 2011 and an effective interest rate of 4.5%. In February 2009, we entered into interest rate

swap agreements that have effectively fixed the interest rate for the remaining term of the Class G-2

certificates for the November 2004 offering. These certificates had a balance of $185 million at

December 31, 2011 and the effective interest rate is included in the above table. The interest rate for all

other certificates is based on three month LIBOR plus a margin. Interest is payable quarterly.

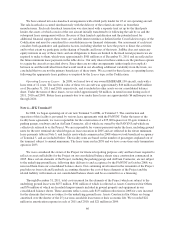

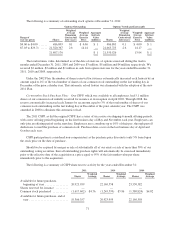

(4) In December 2006, the New York City Industrial Development Agency issued special facility revenue

bonds for JFK and, in November 2005, the Greater Orlando Aviation Authority issued special purpose

airport facilities revenue bonds, in each case for reimbursement to us for certain airport facility construction

and other costs. We have recorded the principal amount of these bonds, net of discounts, as long-term debt

on our consolidated balance sheets because we have issued a guarantee of the debt payments on the bonds.

This fixed rate debt is secured by leasehold mortgages of our airport facilities.

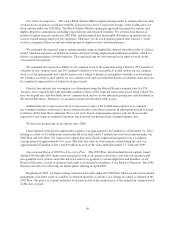

(5) On June 9, 2009, we completed a public offering of $115 million aggregate principal amount of 6.75%

Series A convertible debentures due 2039, or the Series A 6.75% Debentures, and $86 million aggregate

principal amount of 6.75% Series B convertible debentures due 2039, or the Series B 6.75% Debentures,

and collectively with the Series A 6.75% Debentures, the 6.75% Debentures. The 6.75% Debentures are

general obligations and rank equal in right of payment with all of our existing and future senior unsecured

debt, effectively junior in right of payment to our existing and future secured debt, including our secured

equipment debentures, to the extent of the value of the assets securing such debt, and senior in right of

payment to any subordinated debt. In addition, the 6.75% Debentures are structurally subordinated to all

existing and future liabilities of our subsidiaries. The net proceeds were approximately $197 million after

deducting underwriting fees and other transaction related expenses. Interest on the 6.75% Debentures is

payable semi-annually on April 15 and October 15. The first interest payment on the 6.75% Debentures was

paid October 15, 2009.

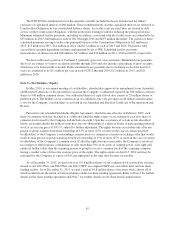

Holders of either the Series A or Series B 6.75% Debentures may convert them into shares of our common

stock at any time at a conversion rate of 204.6036 shares per $1,000 principal amount of the 6.75%

Debentures. The conversion rates are subject to adjustment should we declare common stock dividends or

effect any common stock splits or similar transactions. If the holders convert the 6.75% Debentures in

connection with a fundamental change that occurs prior to October 15, 2014 for the Series A 6.75%

Debentures or October 15, 2016 for the Series B 6.75% Debentures, the applicable conversion rate may be

increased depending on our then current common stock price. The maximum number of shares into which all

of the 6.75% Debentures are convertible, including pursuant to this make-whole fundamental change

provision, is 235.2941 shares per $1,000 principal amount of the 6.75% Debentures outstanding, as adjusted.

61