JetBlue Airlines 2011 Annual Report Download - page 53

Download and view the complete annual report

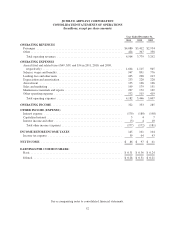

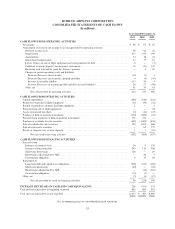

Please find page 53 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(5) the net borrowings of $88 million under our corporate purchasing line for purchase of jet fuel, (6) the

repayment of $10 million in principal related to our construction obligation for Terminal 5 and (7) the acquisition

of $4 million in treasury shares related to the withholding of taxes, upon the vesting of restricted stock units.

Financing activities during 2010 consisted primarily of (1) the required repurchase of $156 million of our

3.75% convertible debentures due 2035, (2) the net repayment of $56 million on our line of credit collateralized

by our auction rate securities, or ARS, (3) scheduled maturities of $177 million of debt and capital lease

obligations, (4) our issuance of $47 million in fixed rate equipment notes and $69 million in non-public floating

rate equipment notes secured by four EMBRAER 190 aircraft and five spare engines, (5) the reimbursement of

construction costs incurred for Terminal 5 of $15 million and (6) the repayment of $5 million in principal related

to our construction obligation for Terminal 5.

We may in the future issue, in one or more public offerings, debt securities, pass-through certificates,

common stock, preferred stock and/or other securities. At this time, we have no plans to sell any such securities.

None of our lenders or lessors are affiliated with us.

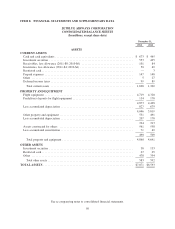

Capital Resources. We have been able to generate sufficient funds from operations to meet our working

capital requirements. Substantially all of our property and equipment is encumbered, excluding one aircraft and

10 spare engines which we own. We have historically financed our aircraft through either secured debt or lease

financing. At December 31, 2011, we operated a fleet of 169 aircraft, of which 60 were financed under operating

leases, four were financed under capital leases and all but one of the remaining 105 were financed by secured

debt. We are working on securing committed financing for the four EMBRAER 190 aircraft scheduled for

delivery in 2012. We may purchase some or all of the seven Airbus A320 aircraft scheduled for delivery in 2012

with cash and will only finance these aircraft at favorable borrowing terms relative to our weighted average cost

of debt. Although we believe that debt and/or lease financing should be available for our remaining aircraft

deliveries, we cannot give assurance that we will be able to secure financing on terms attractive to us, if at all.

While these financings may or may not result in an increase in liabilities on our balance sheet, our fixed costs

will increase significantly regardless of the financing method ultimately chosen. To the extent we cannot secure

financing, we may be required to pay in cash, further modify our aircraft acquisition plans or incur higher than

anticipated financing costs.

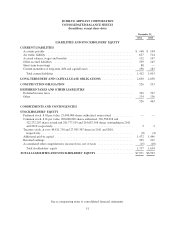

Working Capital. We had working capital of $216 million at December 31, 2011, compared to $267

million at December 31, 2010. Our working capital includes the fair value of our short-term fuel hedge

derivatives, which was a net liability of $4 million at December 31, 2011 and an asset of $19 million at

December 31, 2010.

In September 2011, we executed a corporate purchasing line with American Express, which allows us to

borrow up to a maximum of $125 million. Borrowings cannot exceed $30 million per week and may only be

used for the purchase of jet fuel. Borrowings on this corporate purchasing line are subject to our compliance with

the terms and conditions of the credit agreement, including certain financial covenants which include a

requirement to maintain certain cash and short-term investment levels and a minimum earnings before income

taxes, interest, depreciation and amortization, or EBITDA, margin, as well as customary events of default.

Borrowings, which are to be re-paid monthly, are subject to a 6.9% annual interest rate subject to certain

limitations. This borrowing facility will terminate no later than December 31, 2014. Since opening the line in

September 2011, our average outstanding daily balance was $50 million. As of December 31, 2011, we had $88

million drawn under this revolving credit facility. As of January 31, 2012, we had $44 million outstanding on the

corporate purchasing line, which was paid in full in early February 2012.

We expect to meet our obligations as they become due through available cash, investment securities and

internally generated funds, supplemented as necessary by financing activities, as they may be available to us. We

expect to continue to generate positive working capital through our operations. However, we cannot predict what

43