IBM 2000 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page no.

ninety-two

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

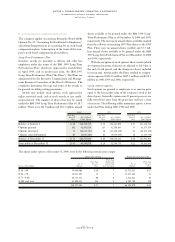

Immaterial Items

INVESTMENT IN EQUITY ALLIANCES AND EQUITY

ALLIANCES GAINS/LOSSES

The investments in equity alliances and the resulting gains

and losses from these investments that are attributable to the

segments do not have a significant effect on the financial

results of the segments.

Segment Assets and Other Items

The assets of the hardware segments primarily are inventory

and plant, property and equipment. The software segment

assets mainly are plant, property and equipment, and invest-

ment in capitalized software. In the past, many of the assets

utilized in the Global Services segment were shared and

under ownership of the company’s geographic marketing and

distribution organizations and therefore were not included

in any of the segment asset amounts below. In 2000, the

assets discretely identifiable to and managed by the Global

Services segment have been allocated to the segment and are

reflected in the following table. Previously, these assets had

not been allocated to any of the segments. This change was

made in order to increase the level of focus and ownership

on services-managed assets and to provide a more appropri-

ate basis for business and competitive analysis. The assets

primarily are accounts receivable, maintenance inventory,

and plant, property and equipment including those associated

with the segment’s outsourcing business.

To accomplish the efficient use of the company’s space

and equipment, it usually is necessary for several segments to

share plant, property and equipment assets. Where assets are

shared, landlord ownership of the assets is assigned to one

segment and is not allocated to each user segment. This is

consistent with the company’s management system and is

reflected accordingly in the schedule below. In those cases,

there will not be a precise correlation between segment pre-

tax income and segment assets.

Similarly, the depreciation amounts reported by each

segment are based on the assigned landlord ownership and

may not be consistent with the amounts that are included in

the segments’ pre-tax income. The amounts that are

included in pre-tax income reflect occupancy charges from

the landlord segment and are not specifically identified by

the management reporting system.

Capital expenditures that are reported by each seg-

ment also are in line with the landlord ownership basis of

asset assignment.

The Global Financing segment amounts below for interest

income and interest expense reflect the interest income and

interest expense associated with the financing business, as well

as the income from the investment in cash and marketable

securities. Such Global Financing interest expense consists of

interest expense on external debt of the Global Financing busi-

ness, as well as interest expense on intercompany borrowings

from other units of the company. The remaining amounts of

interest income and interest expense under the caption “Total

Segments” are not discretely identified to the other segments,

but are included as part of an indirect expense allocation.

The segment information for 1999 and 1998 has been

reclassified to reflect the organizational changes, product

transfers between the segments and the aforementioned

Global Services asset reclassifications.

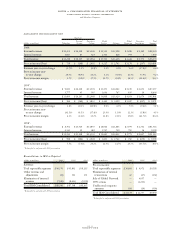

MANAGEMENT SYSTEM SEGMENT VIEW

Hardware

Personal Enterprise Global Global Enterprise Total

(dollars in millions) Technology Systems Systems Services Software Financing Investments Segments

2000:

Assets $«««9,632 $«2,442 $«3,141 $«10,492 $«2,488 $«40,822 $«246 $«69,263

Depreciation/amortization 1,074 156 409 1,243 665 2,696 12 6,255

Capital expenditures/

investment in software 1,754 193 302 1,311 770 2,898 9 7,237

Interest income —————3,051 — 3,051

Interest expense —————1,318 — 1,318

1999*:

Assets $«««9,459 $«1,611 $«3,596 $«««9,312 $«2,527 $«39,686 $«369 $«66,560

Depreciation/amortization 2,088 147 225 1,259 576 2,976 15 7,286

Capital expenditures/

investment in software 1,803 177 338 1,292 656 3,217 12 7,495

Interest income —————2,961 — 2,961

Interest expense —————1,232 — 1,232

1998*:

Assets $«10,191 $«1,729 $«2,957 $«««9,882 $«2,577 $«40,109 $«307 $«67,752

Depreciation/amortization 1,163 137 206 1,331 681 2,768 15 6,301

Capital expenditures/

investment in software 2,006 173 309 1,528 424 3,438 19 7,897

Interest income —————2,725 — 2,725

Interest expense —————1,252 — 1,252

*Reclassified to conform with 2000 presentation.