IBM 2000 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

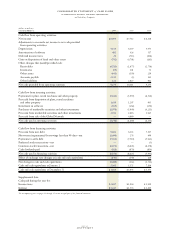

LOTHER LIABILITIES

(dollars in millions)

AT DECEMBER 31: 2000 1999

Nonpension postretirement

benefits

—

U.S. and

non-U.S. employees $«««7,128 $«««7,420

Deferred income taxes 1,623 1,354

Deferred income 1,266 1,081

Restructuring actions 854 1,162

Executive compensation accruals 769 746

Post-employment/

pre-retirement liability 585 710

Environmental accruals 226 228

Other 497 581

Total $«12,948 $«13,282

Post-employment/pre-retirement liabilities represent work-

force accruals for contractually obligated payments to

employees terminated in the ongoing course of business

other than those accruals presented separately above.

The company executed restructuring actions through

1993 and special actions in 1999. The non-current liabilities

relating to these actions are included in restructuring actions

in the table above. See note Q, “1999 Actions,” on pages 81

and 82 for more information regarding the 1999 actions.

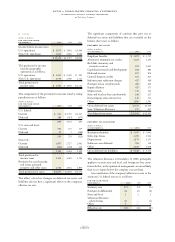

The reconciliation of the December 31, 1999 to 2000

balances of the current and non-current liabilities for

restructuring actions are presented below. The current

liabilities presented in the table are included in Other

accrued expenses and liabilities on the Consolidated State-

ment of Financial Position.

December 31, December 31,

1999 Other 2000

(dollars in millions) Balance Payments Adjustments*Balance

Current:

Workforce $««««188 $«178 $««138 $«148

Space 144 126 73 91

MiCRUS

Investment 152 152 — —

Total $««««484 $«456 $««211 $«239

Non-current:

Workforce $«0,659 $«««— $«(189) $«470

Space 503 — (119) 384

Total $«1,162 $«««— $«(308) $«854

*Principally represents reclassification of non-current to current and currency

translation adjustments.

The workforce accruals relate to terminated employees

who are no longer working for the company, but who were

granted annual payments to supplement their state pensions

in certain countries. These contractually required payments

will continue until the former employee dies.

The space accruals are for ongoing obligations to pay

rent for vacant space that could not be sublet or space that

was sublet at rates lower than the committed lease arrange-

ment. The length of these obligations varies by lease with

the longest extending through 2012.

The company employs extensive internal environmental

protection programs that primarily are preventive in nature.

The cost of these ongoing programs is recorded as incurred.

The company continues to participate in environmental

assessments and cleanups at a number of locations, including

operating facilities, previously owned facilities and Superfund

sites. The company accrues for all known environmental

liabilities when it becomes probable that the company will

incur cleanup costs, and those costs can reasonably be esti-

mated. In addition, estimated environmental costs that are

associated with post-closure activities (for example, the

removal and restoration of chemical storage facilities and

monitoring) are accrued when the decision is made to close

a facility. The total amounts accrued, including amounts

classified as current on the Consolidated Statement of

Financial Position, that do not reflect actual or anticipated

insurance recoveries, were $248 million and $240 million at

December 31, 2000 and 1999, respectively.

The amounts accrued do not cover sites that are in the

preliminary stages of investigation; that is, for which neither

the company’s percentage of responsibility nor the extent of

cleanup required has been identified. Estimated environ-

mental costs are not expected to materially affect the

financial position or results of the company’s operations in

future periods. However, estimates of future costs are subject

to change due to protracted cleanup periods and changing

environmental remediation regulations.

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

page no.

seventy-eight