IBM 2000 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

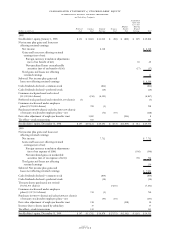

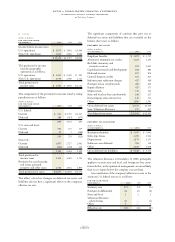

JBORROWINGS

Short-term debt

(dollars in millions)

AT DECEMBER 31: 2000 1999

Commercial paper $«««3,521 $«««5,074

Short-term loans 3,975 3,351

Long-term debt: Current maturities 2,709 5,805

Total $«10,205 $«14,230

The weighted-average interest rates for commercial paper at

December 31, 2000 and 1999, were 6.7 percent and 5.9 per-

cent, respectively. The weighted-average interest rates for

short-term loans at December 31, 2000 and 1999, were

2.9 percent and 4.0 percent, respectively.

Long-term debt

(dollars in millions)

AT DECEMBER 31: Maturities 2000 1999*

U.S. Dollars:

Debentures:

6.22% 2027 $««««««500 $««««««500

6.5% 2028 700 700

7.0% 2025 600 600

7.0% 2045 150 150

7.125% 2096 850 850

7.5% 2013 550 550

8.375% 2019 750 750

Notes: 6.3% average 2001-2014 2,933 4,191

Medium-term note

program: 5.8% average 2001-2014 4,305 6,230

Other: 6.8% average 2001-2012 1,092 1,618

12,430 16,139

Other currencies

(average interest rate

at December 31, 2000,

in parentheses):

Euros (5.3%) 2002-2005 3,042 —

Japanese yen (1.4%) 2001-2014 4,845 3,141

Canadian dollars (5.7%) 2002-2005 302 316

Swiss francs (3.5%) 2001-2003 231 78

Other (8.1%) 2001-2014 275 295

21,125 19,969

Less: Net unamortized

discount 45 40

21,080 19,929

Less: Current maturities 2,709 5,805

Total $«18,371 $«14,124

*Reclassified to conform with 2000 presentation.

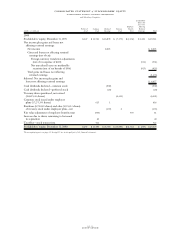

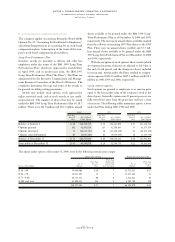

Annual maturities in millions of dollars on long-term debt

outstanding at December 31, 2000, are as follows: 2001,

$2,709; 2002, $5,405; 2003, $3,364; 2004, $763; 2005,

$1,873; 2006 and beyond, $7,011.

Interest on Debt

Interest paid and accrued on borrowings of the company and

its subsidiaries was $1,449 million in 2000, $1,475 million in

1999 and $1,585 million in 1998. Of these amounts, the

company capitalized $20 million in 2000, $23 million in

1999 and $28 million in 1998. Of the remainder, the company

charged $717 million in 2000, $727 million in 1999 and

$713 million in 1998 to Interest expense on the Consolidated

Statement of Earnings and charged $712 million in 2000,

$725 million in 1999 and $844 million in 1998 to Cost of

Global Financing in the Consolidated Statement of

Earnings. Refer to the table and related discussion on page

92 in note X, “Segment Information,” for the total interest

expense of the Global Financing segment.

The decrease in total interest in 2000 versus 1999 was

due primarily to lower average interest rates and a decline in

average debt outstanding during 2000. The decrease in total

interest in 1999 versus 1998 was due primarily to lower

average interest rates, partially offset by an increase in

average debt outstanding during 1999. The average effective

interest rate for total debt was 5.0 percent, 5.1 percent and

5.7 percent in 2000, 1999 and 1998, respectively. These rates

include the results of currency and interest rate swaps

applied to the debt previously described.

Lines of Credit

The company maintains a $10.0 billion global credit facility.

The company’s other committed and uncommitted lines of

credit were $4.7 billion and $5.5 billion at December 31,

2000 and 1999, respectively. Interest rates and other terms of

borrowing under these lines of credit vary from country to

country depending on local market conditions at the time of

the borrowing.

(dollars in billions)

AT DECEMBER 31: 2000 1999

Unused lines

From the global credit facility $«««9.1 $«««8.6

From other committed and

uncommitted lines 4.1 4.5

Total unused lines of credit $«13.2 $«13.1

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

page no.

seventy-five