IBM 2000 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Investments

The company’s investments for plant, rental machines and

other property were $5,616 million for 2000, a decrease of

$343 million from 1999.

In addition to software development expenses included in

research, development and engineering, the company capital-

ized $565 million of software costs during 2000, an increase

of $101 million from the 1999 period. The increase resulted,

in part, from the adoption of Emerging Issues Task Force

Issue No. 00-2, “Accounting for Web Site Development

Costs.” In 2000 the company capitalized $81 million of certain

Web site development costs.

Investments and sundry assets were $14,447 million at the

end of 2000, an increase of $775 million from 1999, primarily

the result of increases in prepaid pension assets and deferred

taxes, offset by declines in alliance investments and goodwill.

See note H, “Investments and Sundry Assets,” on page 74

for additional information.

The company continues to invest significantly in its rap-

idly growing services business, primarily in the management

of customers’ information technology and in manufacturing

capacity for microelectronics. The company has announced

plans to redirect approximately $1 billion in 2001 to the

open-source Linux operating system including hardware

and software development, the operation of its Linux

Technology Center, and various marketing initiatives across

the country. Additionally, the company plans to invest $4 bil-

lion over the next three years in the information technology

outsourcing sector.

On October 10, 2000, the company announced plans to

invest $5.0 billion in the following projects: (1) building an

advanced chip-making facility in East Fishkill, New York; (2)

expanding its chip-making capacity in Burlington, Vermont

and Yasu, Japan, as well as at a joint venture in Essonnes,

France; and (3) expanding its organic and ceramic chip pack-

aging operations worldwide. The company anticipates these

actions to be completed over the next four years.

The company has remaining authorization as of

December 31, 2000, to purchase $2,870 million of IBM

common shares in the open market from time to time, based

on market conditions.

The company expects to fund these investments prima-

rily with cash from ongoing operations.

Debt and Equity

The majority of the company’s funding is executed by

Corporate Treasury in support of the Global Financing

segment. A process has been established for monitoring the

Global Financing funding requirements and executing

strategies to manage the company’s overall asset and liability

profile. Additionally, the company maintains sufficient

flexibility to access global funding sources as needed.

During 2000, the company issued debt denominated in U.S.

dollars, Japanese yen, Euros and Swiss francs to meet exist-

ing financing needs.

The company’s total debt increased $222 million to

$28,576 million. Financing businesses have different capital

structures than non-financing businesses, and therefore the

analysis of this change and certain ratios are discussed below

on both a Global Financing and a non-global financing basis.

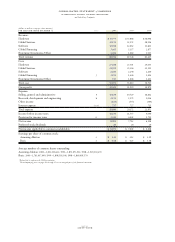

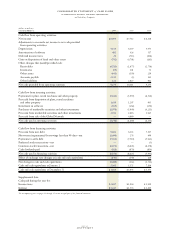

GLOBAL FINANCING

(dollars in millions)

AT DECEMBER 31: 2000 1999

Assets*$«40,822 $«39,686

Debt** 27,514 26,799

Equity ÷«4,142 «««4,864

Debt/Equity 6.6x5.5x

*Global Financing assets include cash, financing receivables (see note F, “Financing

Receivables,” on page 74), intercompany amounts, rental machine fixed assets and

other assets.

** Global Financing debt includes external debt of the Global Financing business

that generates the interest expense included in Cost of Global Financing on

the Consolidated Statement of Earnings. Global Financing debt also includes

intercompany borrowings from other company units. The total interest expense

related to Global Financing debt is presented in note X, “Segment Information,”

on pages 89 through 93.

The Global Financing segment is a financial services business

and is, therefore, more debt dependent than the company’s

other businesses. At December 31, 2000, more than 95 per-

cent of the company’s total debt was attributable to this

business, and supported almost half of the company’s total

assets. In 2000, Global Financing debt to equity ratio

increased to 6.6x, which is within management’s acceptable

target range. Typically, a financial services business has a

higher leverage than an industrial or technology business

given its low return on asset characteristics.

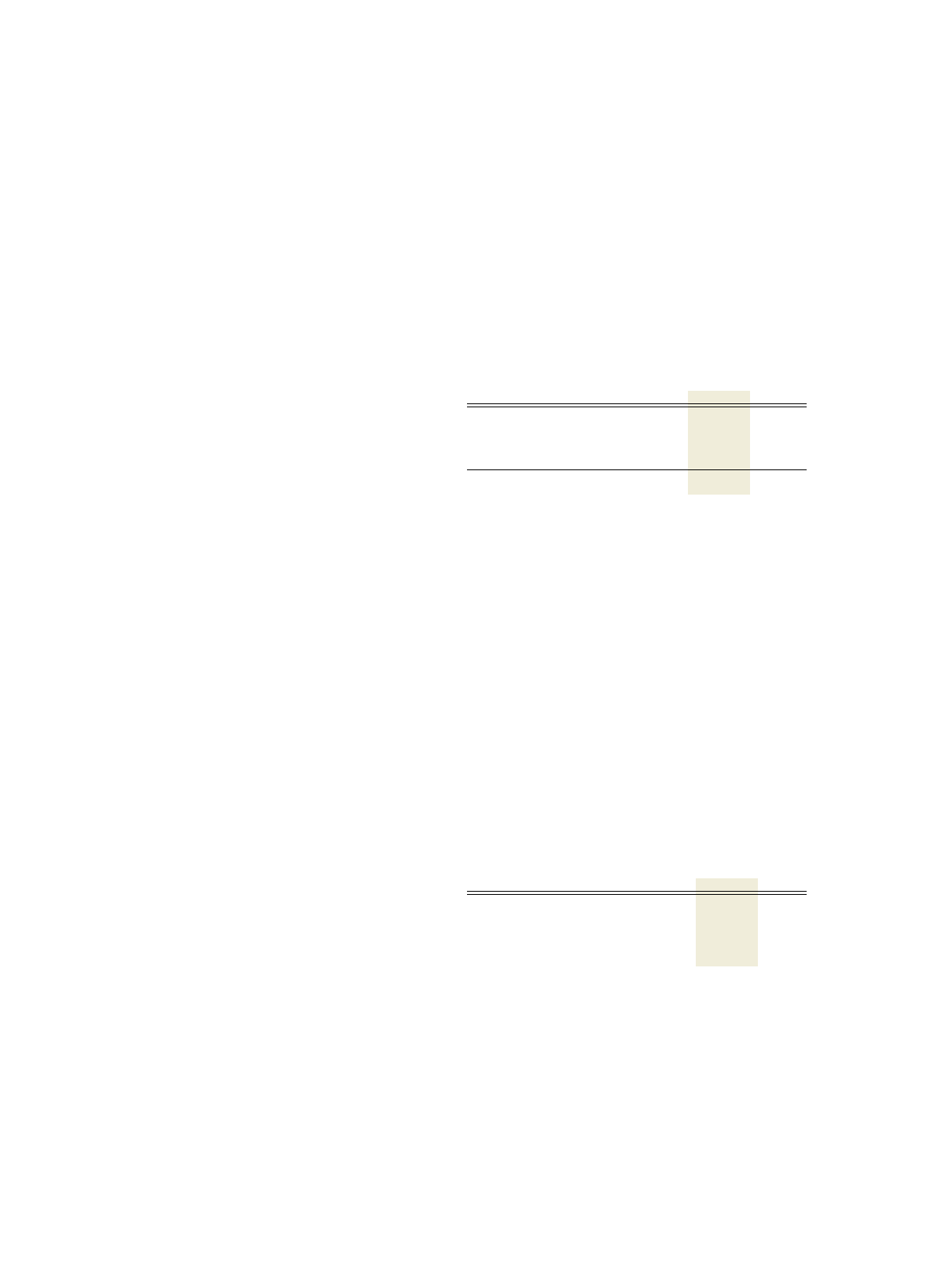

non-global financing

(dollars in millions)

AT DECEMBER 31: 2000 1999

Debt*$«1,062 $«1,555

Debt/Capitalization 6.1% 9.0%

EBITDA/Interest Expense** ÷«24x«««19x

*Non-global financing debt is the company’s total external debt less the Global

Financing debt described in the Global Financing table above.

** EBITDA is earnings before interest and taxes, plus depreciation and amortization,

adjusted for minimum rental commitments and for one-time items such as the

1999 actions and the sale of the Global Network. The interest expense used in

the denominator represents the company’s total interest expense less the Global

Financing interest expense disclosed in note X, “Segment Information,” on pages

89 through 93.

management discussion

international business machines corporation

and Subsidiary Companies

page no.

sixty