IBM 2000 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page no.

eighty

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

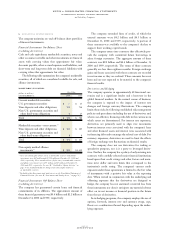

OTAXES

(dollars in millions)

FOR THE YEAR ENDED

DECEMBER 31: 2000 1999 1998

Income before income taxes:

U.S. operations $«««5,871 $«««5,892 $«2,960

Non-U.S. operations 5,663 5,865 6,080

$«11,534 $«11,757 $«9,040

The provision for income

taxes by geographic

operations is as follows:

U.S. operations «$«««1,692 $«««2,005 $««««991

Non-U.S. operations 1,749 2,040 1,721

Total provision for

income taxes $«««3,441 $«««4,045 $«2,712

The components of the provision for income taxes by taxing

jurisdiction are as follows:

(dollars in millions)

FOR THE YEAR ENDED

DECEMBER 31: 2000 1999 1998

U.S. federal:

Current $««««613 $«1,759 $«1,117

Deferred 286 (427) (475)

899 1,332 642

U.S. state and local:

Current 192 272 139

Deferred 47 7 (260)

239 279 (121)

Non-U.S.:

Current 2,607 2,727 2,062

Deferred (304) (293) 129

2,303 2,434 2,191

Total provision for

income taxes 3,441 4,045 2,712

Provision for social security,

real estate, personal

property and other taxes 2,766 2,831 2,859

Total provision for taxes $«6,207 $«6,876 $«5,571

The effect of tax law changes on deferred tax assets and

liabilities did not have a significant effect on the company’s

effective tax rate.

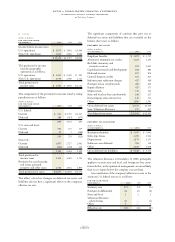

The significant components of activities that gave rise to

deferred tax assets and liabilities that are recorded on the

balance sheet were as follows:

DEFERRED TAX ASSETS

(dollars in millions)

AT DECEMBER 31: 2000 1999

Employee benefits $«««3,673 $«««3,737

Alternative minimum tax credits 1,424 1,244

Bad debt, inventory and

warranty reserves 953 1,093

Capitalized research and development 848 880

Deferred income 837 870

General business credits 655 605

Infrastructure reduction charges 617 918

Foreign tax loss carryforwards 489 406

Equity alliances 437 377

Depreciation 376 326

State and local tax loss carryforwards 246 227

Intracompany sales and services 149 153

Other 2,809 2,763

Gross deferred tax assets 13,513 13,599

Less: Valuation allowance 572 647

Net deferred tax assets $«12,941 $«12,952

DEFERRED TAX LIABILITIES

(dollars in millions)

AT DECEMBER 31: 2000 1999

Retirement benefits $«««3,447 $«««3,092

Sales-type leases 2,450 2,914

Depreciation 1,179 1,237

Software costs deferred 306 250

Other 1,836 2,058

Gross deferred tax liabilities $«««9,218 $«««9,551

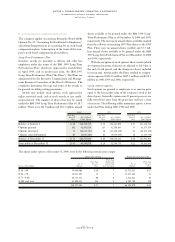

The valuation allowance at December 31, 2000, principally

applies to certain state and local, and foreign tax loss carry-

forwards that, in the opinion of management, are more likely

than not to expire before the company can use them.

A reconciliation of the company’s effective tax rate to the

statutory U.S. federal tax rate is as follows:

FOR THE YEAR ENDED

DECEMBER 31: 2000 1999 1998

Statutory rate 35% 35% 35%

Foreign tax differential (6) (2) (6)

State and local 111

Valuation allowance

related items (1) — (1)

Other 1— 1

Effective rate 30% 34% 30%