IBM 2000 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page no.

eighty-five

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

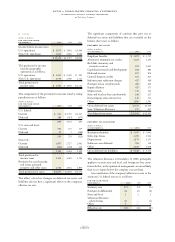

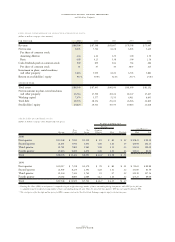

2000 1999 1998

(dollars in millions except per share amounts) As Reported Pro Forma As Reported Pro Forma As Reported Pro Forma

Net income applicable to

common stockholders $«8,073 $«7,183 $«7,692 $«7,044 $«6,308 $«5,985

Earnings per share of common stock

:

Assuming dilution $«««4.44 $«««3.99 $«««4.12 $«««3.78 $«««3.29 $«««3.12

Basic $÷«4.58 $«««4.07 $«««4.25 $«««3.89 $«««3.38 $«««3.20

IBM Employees Stock Purchase Plan

The IBM Employees Stock Purchase Plan (ESPP) enables

substantially all regular employees to purchase full or fractional

shares of IBM common stock through payroll deductions of

up to 10 percent of eligible compensation. Effective July 1,

2000, ESPP was amended whereby the share price paid by an

employee changed from 85 percent of the average market

price on the last business day of each pay period, to the lesser

of 85 percent of the average market price on the first busi-

ness day of each offering period or 85 percent of the average

market price on the last business day of each pay period. The

current plan provides semi-annual offerings over the five-

year period commencing July 1, 2000. ESPP participants are

restricted from purchasing more than $25,000 of common

stock in one calendar year or 1,000 shares in an offering

period. This change is not expected to have a significant

effect on the company’s financial condition. The stockholders

approved the current plan in 2000. Approximately 26.3 mil-

lion, 57.3 million and 63.0 million reserved unissued shares

were available for purchase under ESPP at December 31,

2000, 1999 and 1998, respectively. Shares for ESPP may be

sourced from authorized but unissued shares, treasury shares

or shares repurchased from time to time.

Pursuant to the provisions of the ESPP, during 2000,

1999 and 1998, employees paid $621 million, $514 million

and $415 million, respectively, to purchase 6.9 million, 5.7

million and 8.0 million shares, respectively, all of which were

treasury shares.

Pro Forma Disclosure

In accordance with APB Opinion No. 25, the company does

not recognize expense for stock options granted under the

Plans or for employee stock purchases under the ESPP.

SFAS No. 123, “Accounting for Stock-Based Compensation,”

requires a company to determine the fair market value of all

awards of stock-based compensation at the grant date and to

disclose pro forma net income and earnings per share as if

the resulting stock-based compensation amounts were

recorded in the Consolidated Statement of Earnings. The

table below presents these pro forma disclosures.

The pro forma amounts that are disclosed in accordance

with SFAS No. 123 reflect the portion of the estimated fair

value of awards that was earned for the years ended Dec-

ember 31, 2000, 1999 and 1998.

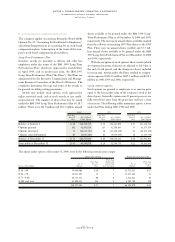

The fair market value of stock option grants is estimated

using the Black-Scholes option-pricing model with the

fol

lowing assumptions:

2000 1999 1998

Term (years)*4/55/65/6

Volatility** 32.0% 27.3% 26.4%

Risk-free interest rate (zero

coupon U.S. treasury note) 5.1% 6.6% 5.1%

Dividend yield 0.5% 0.4% 0.8%

Weighted-average fair

value per option $«36 $«46 $«18

*Option term is 4 years for tax incentive options and 5 years for non-tax incentive

options for the year ended December 31, 2000. Option term is 5 years for tax

incentive options and 6 years for non-tax incentive options for the years ended

December 31, 1999 and 1998.

** To determine volatility, the company measured the daily price changes of the stock

over the respective term for tax incentive options and non-tax incentive options.

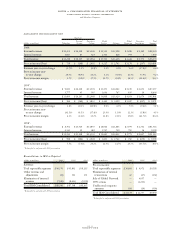

VRETIREMENT PLANS

The company and its subsidiaries have defined benefit and

defined contribution retirement plans that cover substan-

tially all regular employees, and a supplemental retirement

plan that covers certain executives. Total retirement plan

(income)/cost for the years ended December 31, 2000, 1999

and 1998, was $(728) million, $(288) million and $(89) mil-

lion, respectively. Total retirement-related (income)/cost

including postretirement medical coverage (see note W,

“Nonpension Postretirement Benefits,” on pages 88 and 89)

for the years ended December 31, 2000, 1999 and 1998, was

$(327) million, $83 million and $286 million, respectively.

U.S. Plans

U.S. regular, full-time and part-time employees are covered

by a noncontributory plan that is funded by company con-

tributions to an irrevocable trust fund, which is held for the

sole benefit of participants.