IBM 2000 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL CONDITION

During 2000, the company continued to demonstrate strong

financial performance, enabling it to make significant invest-

ments to fund future growth and increase shareholder value

without increasing its non-global financing debt. The com-

pany spent $5,645 million for research, development and

engineering, excluding $9 million of IPR&D; $4,360 million

for plant and other property, including machines used in

strategic outsourcing contracts; $1,256 million for machines

on operating leases with customers; and $6,659 million for

the repurchase of the company’s common shares. In addition,

of the company’s nine acquisitions in 2000, the company

paid cash totaling approximately $300 million of the aggregate

$511 million purchase price. The company had $3,722 million

in cash and cash equivalents and current marketable securities

at December 31, 2000. The company’s debt levels remained

essentially flat with a small increase in Global Financing

debt, offset by a decline in non-global financing debt.

The company maintains a $10 billion committed global

credit facility that expires in February 2002. As of Dec-

ember 31, 2000 and 1999, $9.1 billion and $8.6 billion were

unused and available, respectively. In addition, the company

had outstanding other committed and uncommitted lines

of credit of approximately $4.7 billion and $5.5 billion as

of December 31, 2000 and 1999, respectively. As of

December 31, 2000 and 1999, $4.1 billion and $4.5 billion

were unused and available, respectively.

The company managed assets of $136 million and $273

million at December 31, 2000 and 1999, respectively, from

the securitization of loans, leases and trade receivables. For

additional information, see note I, “Sale and Securitization

of Receivables,” on page 74.

The changes in the company’s U.S. pension plan, including

the increased benefits for retirees and the 1999 amendment

to the plan, are not expected to have a material effect on the

company’s financial condition.

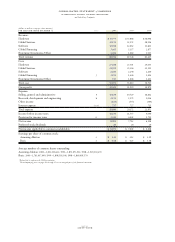

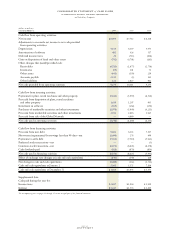

The major rating agencies’ ratings of the company’s debt

securities and preferred stock as of December 31, 2000,

appear in the table below:

Standard Moody’s

and Investors

Poor’s Service Fitch, Inc.

Senior long-term debt A+ A1 AA-

Commercial paper A-1 Prime-1 F-1+

Preferred stock Aa1A+

Cash Flows

The company’s cash flows from operating, investing and

financing activities, as reflected in the Consolidated State-

ment of Cash Flows on page 68, are summarized in the

following table:

(dollars in millions) 2000 1999 1998

Net cash provided from/

(used in):

Operating activities $««9,274 $«10,111 $««««9,273

Investing activities (4,248) (1,669) (6,131)

Financing activities (6,359) (8,625) (4,993)

Effect of exchange rate

changes on cash and

cash equivalents (147) (149) 120

Net change in cash and

cash equivalents $«(1,480) $«««««(332) $«««(1,731)

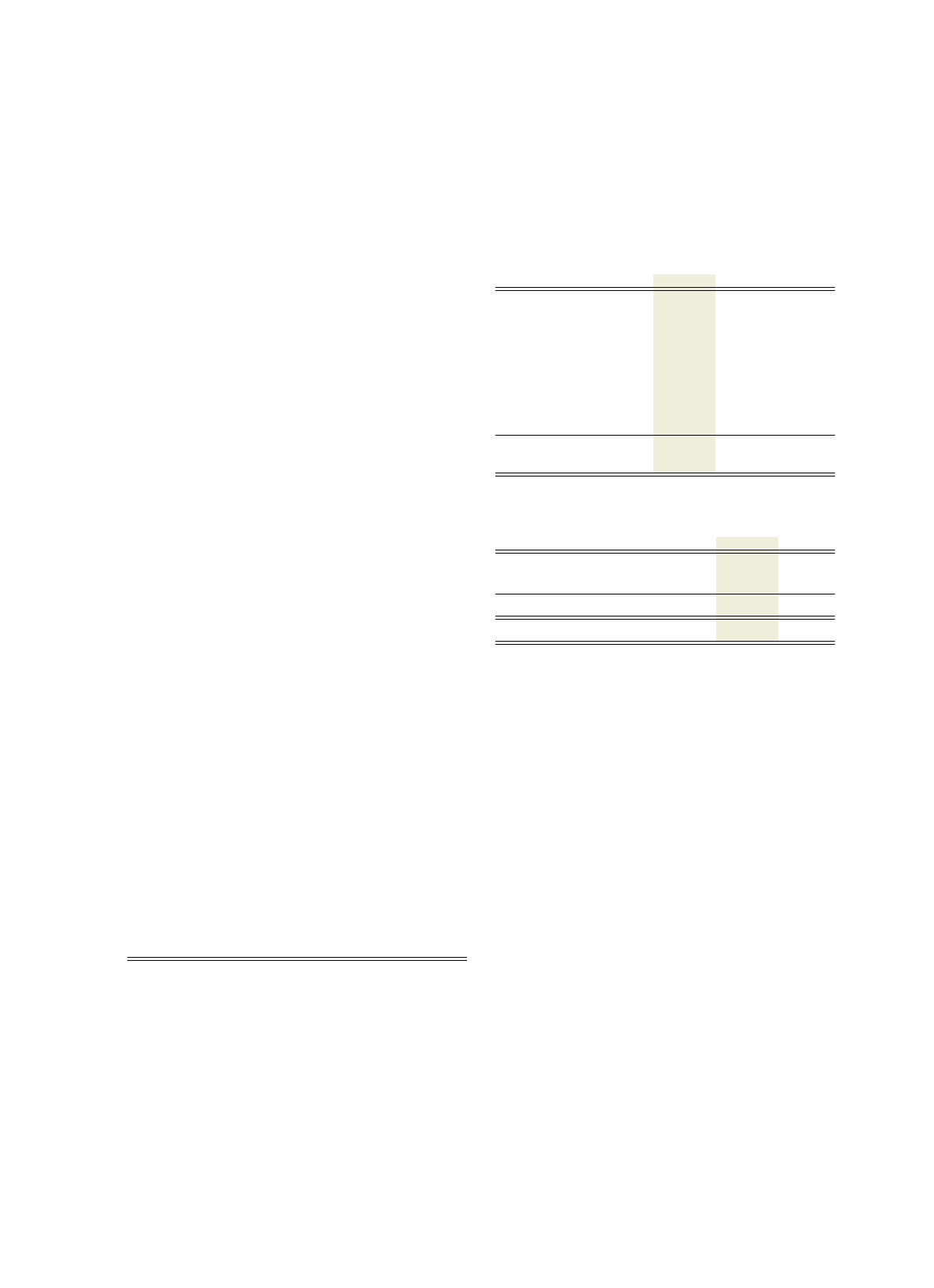

Working Capital

(dollars in millions)

AT DECEMBER 31: 2000 1999

Current assets $«43,880 $«43,155

Current liabilities 36,406 39,578

Working capital $÷«7,474 $«««3,577

Current ratio 1.21:1 1.09:1

Current assets increased $725 million due primarily to an

increase in accounts receivable of $3,108 million, offset by

decreases of $2,109 million in cash and cash equivalents and

current marketable securities, and $206 million in deferred

taxes. The increase in accounts receivable was due to strong

year-end business volumes and global financing activity in

the software and services businesses across all geographies.

The decrease in cash and cash equivalents and current mar-

ketable securities resulted primarily from stock repurchases

and capital expenditures, partially offset by cash generated

from operations.

The company ended 2000 with inventories of $4,765 mil-

lion, the lowest level since 1983, primarily a result of lower

inventory levels within Enterprise Systems segment and

Microelectronics Division, and currency translation on inven-

tories outside the United States. The company’s inventory

turnover ratio improved to 6.3 in 2000 from 5.9 in 1999.

Current liabilities declined $3,172 million from year-end

1999, primarily due to decreases of $4,025 million in short-

term debt and $922 million in other accrued expenses and

liabilities, offset by an increase in accounts payable of $1,792

million. The increase was primarily due to strong year-end

business volumes, primarily in the Enterprise Systems seg-

ment, across all geographies.

management discussion

international business machines corporation

and Subsidiary Companies

page no.

fifty-nine