IBM 2000 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page no.

eighty-seven

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

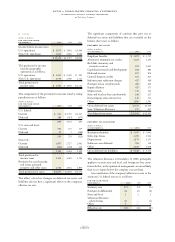

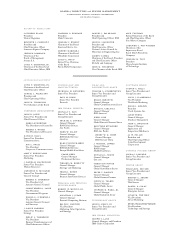

The changes in the benefit obligations and plan assets of the U.S. and material non-U.S. defined benefit plans for 2000 and

1999 were as follows:

U.S. Plan Non-U.S. Plans

(dollars in millions) 2000 1999 2000 1999

Change in benefit obligation:

Benefit obligation at beginning of year $«34,434 $«36,561 $«21,770 $«22,048

Service cost 563 566 445 475

Interest cost 2,553 2,404 1,234 1,282

Plan participants’ contributions — — 28 29

Acquisitions/divestitures, net 36 68 (65) (47)

Amendments 645 75 63 —

Actuarial losses/(gains) 1,729 (2,766) 243 522

Benefits paid from trust (2,421) (2,474) (728) (737)

Direct benefit payments — — (218) (257)

Foreign exchange impact — — (1,626) (1,552)

Plan curtailments/settlements/termination benefits —— 4 7

Benefit obligation at end of year 37,539 34,434 21,150 21,770

Change in plan assets:

Fair value of plan assets at beginning of year 45,584 41,593 27,843 25,294

Actual return on plan assets 1,395 6,397 (196) 5,184

Employer contribution — — 66 143

Acquisitions/divestitures, net 36 68 (50) (36)

Plan participants’ contributions — — 28 29

Benefits paid from trust (2,421) (2,474) (728) (737)

Foreign exchange impact — — (2,015) (1,995)

Settlements — — (115) (39)

Fair value of plan assets at end of year 44,594 45,584 24,833 27,843

Fair value of plan assets in excess of benefit obligation 7,055 11,150 3,683 6,073

Unrecognized net actuarial gains (2,768) (7,003) (1,860) (4,597)

Unrecognized prior service costs 883 269 168 140

Unrecognized net transition asset (491) (632) (56) (72)

Adjustment to recognize minimum liability — — (90) (84)

Net prepaid pension asset recognized in the

Consolidated Statement of Financial Position $«««4,679 $«««3,784 $«««1,845 $«««1,460

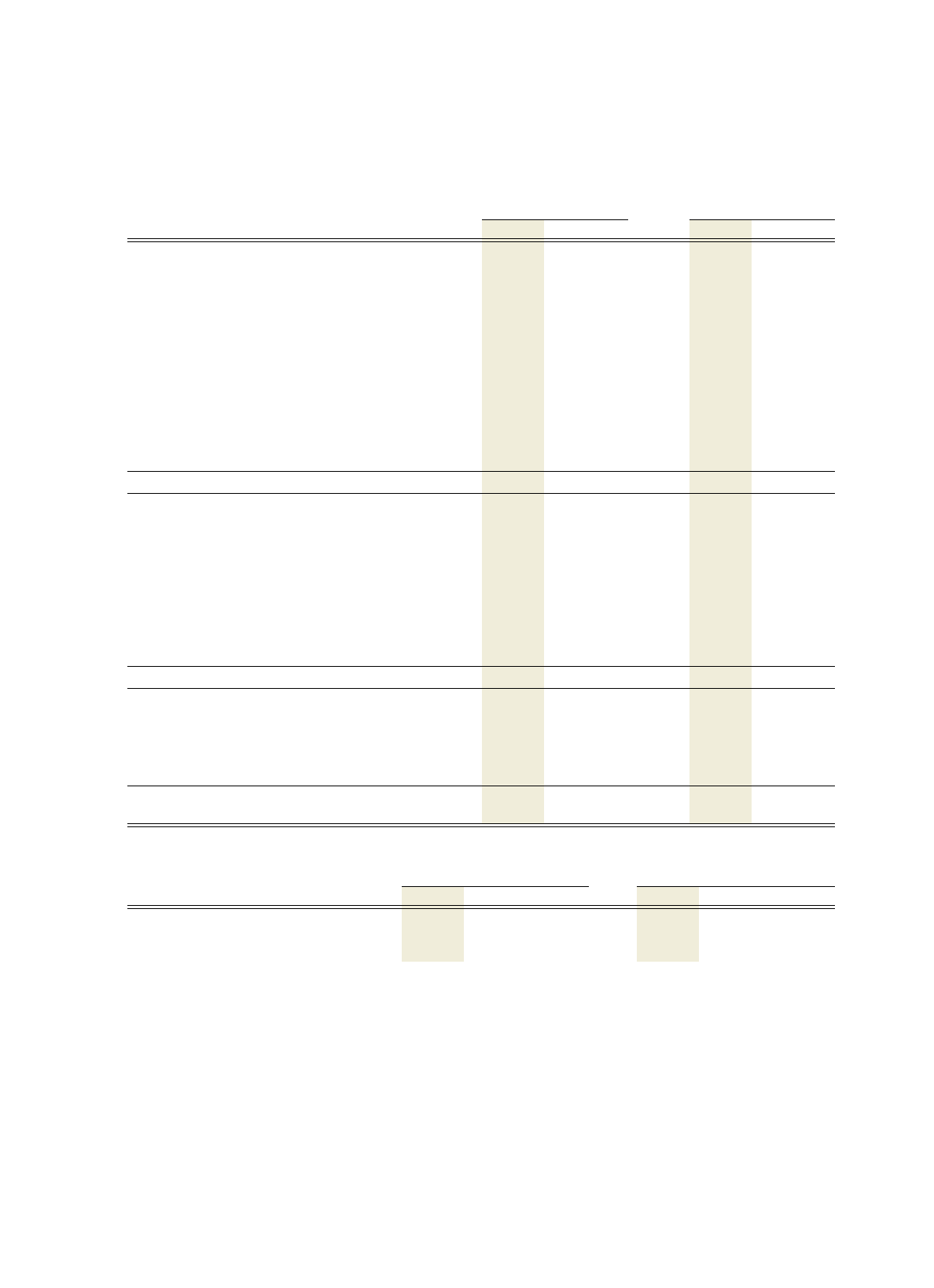

Actuarial assumptions used to determine costs and benefit obligations for principal pension plans follow:

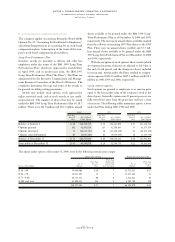

WEIGHTED-AVERAGE ACTUARIAL ASSUMPTIONS U.S. Plans Non-U.S. Plans

AS OF DECEMBER 31: 2000 1999 1998 2000 1999 1998

Discount rate 7.25% 7.75% 6.5% 4.5-7.1% 4.5-7.3% 4.5-7.5%

Expected return on plan assets 10.0% 9.5% 9.5% 5.0-11.0% 6.0-10.5% 6.5-10.0%

Rate of compensation increase 6.0% 6.0% 5.0% 2.6-6.1% 2.6-6.1% 2.7-6.1%

The company evaluates its actuarial assumptions on an annual

basis and considers changes in these long-term factors based

upon market conditions and the requirements of SFAS No.

87, “Employers’ Accounting for Pensions.”

The change in expected return on plan assets and the

discount rate for the 2000 U.S. plan year had an effect of an

additional $(195) million and $(26) million of net retirement

plan (income)/cost, respectively, for the year ended

December 31, 2000. This compares with an additional $46

million and $65 million of net retirement plan (income)/cost

for the year ended December 31, 1999, as a result of plan

year 1999 changes in the rate of compensation increase and

the discount rate, respectively.

Net periodic pension cost is determined using the

Projected Unit Credit actuarial method.

Funding Policy

It is the company’s practice to fund amounts for pensions

sufficient to meet the minimum requirements set forth in

applicable employee benefits laws and local tax laws. From