IBM 2000 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

fourth quarter 2000. SAB No. 101 provides guidance on

applying generally accepted accounting principles to revenue

recognition in financial statements. The company’s policies

for revenue recognition are consistent with the views

expressed within SAB No.101. See note A, “Significant

Accounting Policies,” on pages 69 through 71 for a descrip-

tion of the company’s policies for revenue recognition.

Effective January 1, 1999, the company adopted American

Institute of Certified Public Accountants (AICPA) Statement

of Position (SOP) No. 98-1, “Accounting for the Costs of

Computer Software Developed or Obtained for Internal

Use.” The SOP requires a company to capitalize certain costs

that are incurred to purchase or to create and implement

internal use computer software. See note A, “Significant

Accounting Policies” on pages 69 through 71 for a descrip-

tion of the company’s policies for internal use software.

Effective December 31, 1998, the company adopted

Statement of Financial Accounting Standards (SFAS) No. 131,

“Disclosures about Segments of an Enterprise and Related

Information,” which establishes standards for reporting

operating segments and disclosures about products and serv-

ices, geographic areas and major customers. See note X,

“Segment Information,” on pages 89 through 93 for the

company’s segment information.

Effective December 31, 1998, the company adopted SFAS

No. 132, “Employers’ Disclosures about Pensions and Other

Postretirement Benefits,” which establishes standard disclo-

sures for defined benefit pension and postretirement benefit

plans. See note V, “Retirement Plans,” on pages 85 through

88 and note W, “Nonpension Postretirement Benefits,” on

pages 88 and 89 for the disclosures.

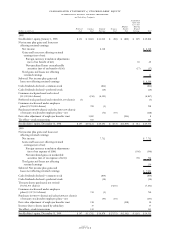

Effective January 1, 1998, the company adopted SFAS

No. 130, “Reporting Comprehensive Income,” which estab-

lishes standards for reporting and displaying in a full set of

general-purpose financial statements the gains and losses not

affecting retained earnings. The disclosures required by SFAS

No. 130 are presented in the Accumulated gains and losses

not affecting retained earnings section in the Consolidated

Statement of Stockholders’ Equity on pages 66 and 67 and

in note M, “Stockholders’ Equity Activity,” on page 79.

Effective January 1, 1998, the company adopted the

AICPA SOP No. 97-2, “Software Revenue Recognition.”

This SOP provides guidance on revenue recognition for

software transactions. See note A, “Significant Accounting

Policies” on pages 69 through 71 for a description of the

company’s policy for software revenue recognition.

New Standards to be Implemented

Effective January 1, 2001, the company adopted SFAS No.

140, “Accounting for Transfers and Servicing of Financial

Assets and Extinguishments of Liabilities

—

a replacement of

SFAS No. 125.” This statement provides accounting and

reporting standards for transfers and servicing of financial

assets and extinguishments of liabilities and revises the

accounting standards for securitizations and transfers of

financial assets and collateral. Management does not expect

the adoption to have a material effect on the company’s

results of operations and financial position. This standard

also requires new disclosures in 2000. Such requirements

were not applicable to the company.

On January 1, 2001, the company adopted SFAS No. 133,

“Accounting for Derivative Instruments and Hedging

Activities,” as amended by SFAS No. 138, “Accounting for

Certain Derivative Instruments and Certain Hedging

Activities.” SFAS No. 133, as amended, establishes accounting

and reporting standards for derivative instruments. Specifi-

cally, SFAS No. 133 requires an entity to recognize all

derivatives as either assets or liabilities in the statement of

financial position and to measure those instruments at fair

value. Additionally, the fair value adjustments will affect

either stockholders’ equity or net income depending on

whether the derivative instrument qualifies as a hedge for

accounting purposes and, if so, the nature of the hedging

activity. As of January 1, 2001, the adoption of the new

standard results in a net-of-tax increase of $219 million to

Accumulated gains and losses not affecting retained earnings

in the Consolidated Statement of Stockholders’ Equity

and a charge of $6 million to Cumulative effect of adopting

accounting principle, net of tax in the Consolidated

Statement of Earnings.

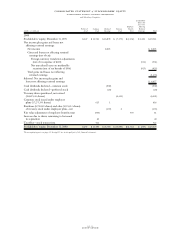

CCOMMON STOCK SPLIT

On April 27, 1999, the stockholders of the company

approved amendments to the Certificate of Incorporation to

increase the number of authorized shares of common stock

from 1,875.0 million to 4,687.5 million, which was required

to effect a two-for-one stock split approved by the company’s

Board of Directors on January 26, 1999. In addition, the

amendment reduced the par value of the common shares

from $.50 to $.20 per share. Common stockholders of record

at the close of business on May 10, 1999, received one addi-

tional share for each share held. All share and per share data

prior to the second quarter of 1999 presented in the consol-

idated financial statements and notes thereto reflect the

two-for-one stock split.

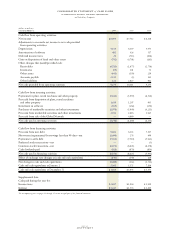

DACQUISITIONS/DIVESTITURES

Acquisitions

2000

In 2000, the company completed nine acquisitions at a cost

of approximately $511 million.

The largest acquisition was LGS Group Inc. (LGS). The

company acquired all the outstanding stock of LGS in April

for $190 million. LGS offers services ranging from application

development to information technology consulting.

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

page no.

seventy-two