IBM 2000 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

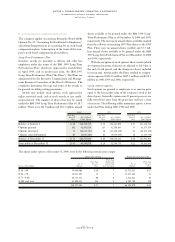

MSTOCKHOLDERS’ EQUITY ACTIVITY

Stock Repurchases

From time to time, the Board of Directors authorizes the

company to repurchase IBM common stock. The company

repurchased 61,041,820 common shares at a cost of $6.7 bil-

lion and 71,618,800 common shares at a cost of $7.3 billion

in 2000 and 1999, respectively. In 2000 and in 1999, the

company did not retire the shares it repurchased. In 2000

and 1999, the company issued 2,174,594 and 906,829 treas-

ury shares, respectively, as a result of exercises of stock options

by employees of certain recently acquired businesses and by

non-U.S. employees. At December 31, 2000, approximately

$2.9 billion of Board authorized repurchases remained. The

company plans to purchase shares on the open market from

time to time, depending on market conditions.

In 1995, the Board of Directors authorized the company

to repurchase all of its outstanding Series A 7-1⁄2 percent

callable preferred stock. The company did not repurchase

any shares in 2000 or in 1999. The company plans to pur-

chase the outstanding shares on the open market and in

private transactions from time to time, depending on market

conditions. There were 2,546,011 shares outstanding at

December 31, 2000 and 1999.

Employee Benefits Trust

Effective November 1, 1997, the company created an

employee benefits trust to which it contributed 20 million

shares of treasury stock. The company is authorized to

instruct the trustee to sell shares from time to time and to

use proceeds from those sales, and any dividends paid on the

contributed stock, toward the partial satisfaction of the com-

pany’s future obligations under certain of its compensation

and benefits plans. The shares held in trust are not consid-

ered outstanding for purposes of calculating earnings per

share until they are committed to be released. The trustee

will vote the shares in accordance with its fiduciary duties.

As of December 31, 2000 and 1999, the company had not

committed any shares to be released.

At December 31, 1998, the company began adjusting its

valuation of the employee benefits trust to fair value. These

adjustments affect only line items within stockholders’

equity; not total stockholders’ equity or net income.

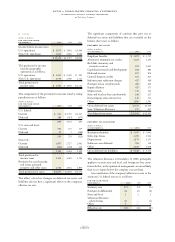

Accumulated Gains and Losses Not Affecting

Retained Earnings*

Net Total

Unrealized Gains/(Losses)

Foreign Gains/(Losses) Not Affecting

Currency on Marketable Retained

(dollars in millions) Items Securities Earnings

January 1, 1998 $««791 $«108 $««««899

Change for period 69 (57) 12

December 31, 1998 860 51 911

Change for period (546) 796 250

December 31, 1999 314 847 1,161

Change for period (531) «(925) «««(1,456)

December 31, 2000 $«(217) $««(78) $«««(295)

*Net of tax.

NET CHANGE IN UNREALIZED GAINS/(LOSSES) ON

MARKETABLE SECURITIES (NET OF TAX)

(dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2000 1999

Net unrealized (losses)/gains arising

during the period $«(810) $«943

Less net gains included in net income

for the period 115 147

Net change in net unrealized (losses)/

gains on marketable securities $«(925) $«796

Unrealized losses arising in 2000 relate primarily to previous

unrealized gains from original cost occurring in prior years.

NCONTINGENCIES

The company is subject to a variety of claims and suits that

arise from time to time in the ordinary course of its business,

including actions with respect to contracts, intellectual

property, product liability and environmental matters. The

company is a defendant and/or third-party defendant in a

number of cases in which claims have been filed by current

and former employees, independent contractors, estate rep-

resentatives, offspring and relatives of employees seeking

damages for wrongful death and personal injuries allegedly

caused by exposure to chemicals in various of the company’s

facilities from 1964 to the present. The company believes

that plaintiffs’ claims are legally baseless and without factual

support. The company will defend itself vigorously.

While it is not possible to predict the ultimate outcome

of the matters discussed above, the company believes that

any losses associated with any of such matters will not have

a material effect on the company’s business, financial condi-

tion or results of operations.

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

page no.

seventy-nine