IBM 2000 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Global Services revenue increased 3.0 percent (6 percent

at constant currency) in 2000 over 1999 and 11.3 percent (11

percent at constant currency) in 1999 over 1998. Revenue

comparisons in 2000 were adversely affected by two events:

the sale of the Global Network to AT&T in 1999 and the

decline in Y2Kservices activity year over year. After adjusting

for those two factors, Global Services revenue (excluding

maintenance) increased 9 percent in 2000 and 17 percent in

1999. (See note D, “Acquisitions/Divestitures,” on pages 72

through 74 for additional information about the Global

Network sale.) Maintenance revenue was flat in 2000 when

compared to 1999 and declined 1 percent in 1999 versus 1998.

Strategic Outsourcing Services and Integrated Technology

Services were the major contributors to the revenue growth

in 2000 and 1999. Strategic Outsourcing Services continued

to demonstrate good revenue growth in 2000 as compared to

1999, with particularly strong growth in Asia Pacific. Inte-

grated Technology Services benefited from growth in OEM

alliance revenue, especially as related to Cisco Systems

products. These increases were partially offset by the loss of

revenue due to the sale of the Global Network and lower

revenue growth from Business Innovation Services primarily

resulting from the decline in Y2Kactivity. Business Innovation

Services recovered in the second half of 2000 as customers

shifted from mature offerings such as custom systems inte-

gration and Y2Kremediation to the company’s e-business

offerings. Business Innovation Services revenue, exclusive of

Y2Kand custom systems integration, experienced strong

growth in 2000.

e-business spans many of the Global Services offerings

and contributed significantly to 2000 performance. The

company’s total discrete e-business revenue grew more than

70 percent to approximately $5 billion in 2000. This increase

was driven by e-commerce consulting, e-business enablement

and e-hosting services.

In 2000, the company signed contracts totaling $55 bil-

lion, including 60 contracts in excess of $100 million, 6 of

which exceeded $1 billion. These transactions contributed to

a services backlog at December 31, 2000, of $85 billion com-

pared with $60 billion at December 31, 1999. The company

continued to meet the demand for its services by hiring more

than 19,000 employees in 2000 and 17,000 employees in 1999.

Global Services gross profit dollars were essentially flat in

2000 compared to 1999 and increased 13.8 percent in 1999

versus 1998. The decline in gross profit margin in 2000 of

0.9 points was driven by lower utilization rates in Business

Innovation Services and Integrated Technology Services due

to rapid hiring and retraining associated with rebalancing

skills toward e-business services. Also contributing to the

decline was a revenue shift to OEM alliances, which have a

lower gross profit margin. The maintenance gross profit mar-

gin improved 0.6 points in 2000 versus 1999 due to continued

productivity improvements and effective cost management.

Global Services gross profit dollars and gross profit

margins improved in 1999 as compared with 1998 due to

significant productivity improvements that more than offset

competitive pressures and the negative effect of the chang-

ing mix of services and maintenance within the Global

Services portfolio.

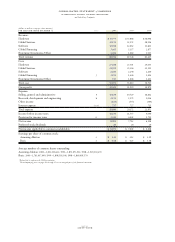

Software

(dollars in millions) 2000 1999 1998

Revenue $«12,598 $«12,662 $«11,863

Cost 2,283 2,240 2,260

Gross profit $«10,315 $«10,422 $«««9,603

Gross profit margin 81.9% 82.3% 80.9%

Software revenue declined 0.5 percent (up 4 percent at

constant currency) in 2000 from 1999, following an increase

of 6.7 percent (8 percent at constant currency) from 1998.

The company’s middleware products had revenue growth of

3 percent in 2000 and 12 percent in 1999. Middleware

comprises data management, transaction processing, Tivoli

systems management and Lotus Notes messaging and

collaboration for both IBM and non-IBM platforms. This

growth was driven by the company’s key products on UNIX

and Windows NT platforms, led by WebSphere (Web appli-

cation server software), MQSeries (business integration

software) and DB2 (data management) offerings. These

increases in middleware revenue were partially offset by

revenue declines for Tivoli products as they were affected by

a transition in the systems management software marketplace.

The company continues to focus on helping customers use

its software to transform their businesses to e-businesses,

particularly in collaboration with the company’s Global

Services offerings, Independent Software Vendors, Web

integrators and other service providers.

Operating systems software revenue declined 9 percent in

2000 and 4 percent in 1999 when compared with the previous

period. The decline in 2000 was driven by lower revenue

associated with eSeries servers and legacy products. The

1999 decline was driven by lower AS/400 revenue.

Software gross profit dollars decreased 1.0 percent in

2000 from 1999, following an increase of 8.5 percent in 1999

from 1998. The decline in gross profit dollars in 2000 was

primarily because of lower revenue, higher costs for pur-

chased vendor software and higher vendor royalty payments,

partially offset by lower amortization and services costs.

Increased revenue and lower amortization costs associated

with previously capitalized software development spending

drove the 1999 improvement, partially offset by higher vendor

royalty payments primarily due to increased volumes.

management discussion

international business machines corporation

and Subsidiary Companies

page no.

fifty-five