IBM 2000 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

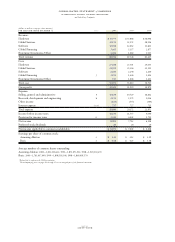

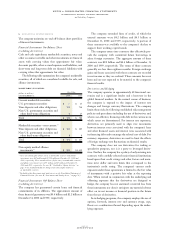

The following table presents the allocation of the purchase

price of the 2000 acquisitions.

(dollars in millions) LGS Other

Purchase price $«190 $«321

Tangible net assets 31 68

Identifiable intangible assets —36

Goodwill «159 «««220

In-process research

and development —9

Deferred tax liabilities

related to identifiable

intangible assets «— «««(12)

1999

In 1999, the company completed 17 acquisitions at a cost of

approximately $1,551 million. Three of the major acquisi-

tions for the year are detailed in the following discussion.

On September 24, 1999, the company acquired all of the

outstanding capital stock of Sequent Computer Systems,

Inc., an acknowledged leader in systems based on NUMA

(non-uniform memory access) architecture, for approxi-

mately $837 million.

On September 29, 1999, the company acquired all of the

outstanding stock of Mylex Corporation, a leading developer

of technology for moving, storing, protecting and managing

data in desktop and networked environments, for approxi-

mately $259 million.

On September 27, 1999, the company acquired all

the outstanding stock of DASCOM, Inc., an industry

leader in Web-based and enterprise-security technology, for

approximately $115 million.

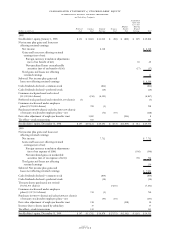

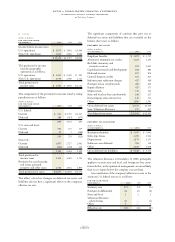

The following table presents the allocation of the purchase

price of the 1999 acquisitions.

(dollars in millions) Sequent Mylex DASCOM Other

Purchase price $«837*$«259 $«115 $«340

Tangible net assets/

(liabilities) 382 «67 (17) «45

Identifiable intangible

assets 187 «35 13 «—

Current technology «87 26 «19 9

Goodwill 192*«145 «92 286

In-process research

and development 85 7 19 «—

Deferred tax liabilities

related to identifiable

intangible assets (96) (21) «(11) —

*In 2000, the total purchase price and goodwill numbers were adjusted primarily

for increased stock options being exercised versus being converted to IBM options

and at a higher gain per option than originally assumed.

1998

In 1998, the company completed nine acquisitions at a cost of

approximately $828 million. In January 1998, the company

acquired all of the outstanding stock of Software Artistry,

Inc., a leading provider of both consolidated service desk and

customer relationship management solutions for distributed

enterprise environments for approximately $203 million. In

2000, the company sold most of Software Artistry, represent-

ing the part of the business that is no longer considered

strategic. In March 1998, the company acquired all of the

outstanding stock of CommQuest Technologies, Inc., a com-

pany that designs and markets advanced semiconductors for

wireless communications applications such as cellular phones

and satellite communications for approximately $183 million.

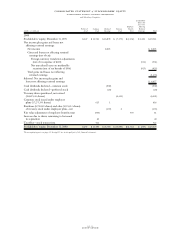

The following table presents the allocation of the pur-

chase price of the 1998 acquisitions.

Software

(dollars in millions) Artistry CommQuest Other

Purchase price «$«203 $«183 $«442

Tangible net assets «22 2 «188

Identifiable intangible assets «24 79 «—

Current technology «46 «12 —

Goodwill 66 «81 254

In-process research

and development 70 41 «—

Deferred tax liabilities

related to identifiable

intangible assets (25) «(32) —

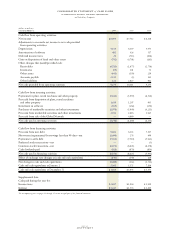

All of these acquisitions were accounted for as purchase

transactions, and accordingly, the assets and liabilities of the

acquired entities were recorded at their estimated fair value at

the date of acquisition. The effects of these acquisitions on the

company’s consolidated financial statements were not material.

Hence, the company has not provided pro forma financial

information as if the companies had combined at the beginning

of the current period or the immediately preceding period.

The tangible net assets comprise primarily cash, accounts

receivable, land, buildings and leasehold improvements. The

identifiable intangible assets comprise primarily patents,

trademarks, customer lists, assembled workforce, employee

agreements and leasehold interests. The identifiable intangi-

ble assets and goodwill will be amortized on a straight-line

basis, generally not to exceed five years.

In connection with these acquisitions, the company

recorded pre-tax charges of $9 million, $111 million and

$111 million for acquired in-process research and develop-

ment (IPR&D) for 2000, 1999 and 1998, respectively. At the

date of the acquisitions, the IPR&D projects had not yet

reached technological feasibility and had no alternative

future uses. The value of the IPR&D reflects the relative

value and contribution of the acquired research and devel-

opment to the company’s existing research or product lines.

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

page no.

seventy-three