IBM 2000 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

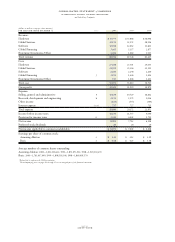

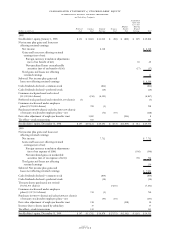

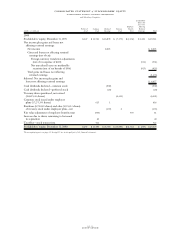

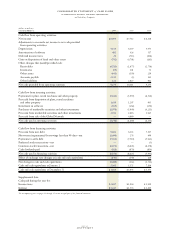

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

page no.

seventy-one

Depreciation

Plant, rental machines and other property are carried at cost

and depreciated over their estimated useful lives using the

straight-line method.

The estimated useful lives of depreciable properties gen-

erally are as follows: buildings, 50 years; building equipment,

20 years; land improvements, 20 years; plant, laboratory and

office equipment, 2 to 15 years; and computer equipment,

1.5 to 5 years.

Software Costs

Costs that are related to the conceptual formulation and

design of licensed programs are expensed as research and

development. Also, for licensed programs, the company

capitalizes costs that are incurred to produce the finished

product after technological feasibility is established. The

annual amortization of the capitalized amounts is the greater

of the amount computed based on the estimated revenue

distribution over the products’ revenue-producing lives, or

the straight-line method, and is applied over periods ranging

up to three years. The company performs periodic reviews

to ensure that unamortized program costs remain recoverable

from future revenue. The company charges costs to support

or service licensed programs against net income as the costs

are incurred.

The company capitalizes certain costs that are incurred

to purchase or to create and implement internal use com-

puter software, which include software coding, installation,

testing and data conversion. Capitalized costs are amortized

on a straight-line basis over two years.

The company capitalizes costs incurred during certain

phases of internal Web site development. Capitalized costs

are amortized on a straight-line basis over two years.

Retirement Plans and Nonpension Postretirement Benefits

Current service costs of retirement plans and postretirement

health care and life insurance benefits are accrued in the

period. Prior service costs that result from amendments

to the plans are amortized over the average remaining serv-

ice period of the employees expected to receive benefits.

Unrecognized net gains and losses that exceed 10 percent of

the greater of the projected benefit obligation or the market-

related value of plan assets are amortized over the average

remaining service life of employees expected to receive

benefits. Experience gains and losses, as well as the effects of

changes in actuarial assumptions and plan provisions, are

amortized over the average future service period of employ-

ees. See note V, “Retirement Plans,” on pages 85 through 88

and note W, “Nonpension Postretirement Benefits,” on

pages 88 and 89 for further discussion.

Goodwill

Goodwill is amortized to expense on a straight-line basis

over the periods estimated to benefit, generally not to exceed

five years. The company performs reviews to evaluate the

recoverability of goodwill and takes into account events or

circumstances that warrant revised estimates of useful lives

or that indicate that an impairment exists.

Common Stock

Common stock refers to the $.20 par value capital stock as

designated in the company’s Certificate of Incorporation.

Treasury stock is accounted for using the cost method.

When treasury stock is reissued, the value is computed and

recorded using a weighted-average basis.

Earnings Per Share of Common Stock

Earnings per share of common stock

—

basic is computed by

dividing Net income applicable to common stockholders by

the weighted-average number of common shares outstanding

for the period. Earnings per share of common stock

—

assuming dilution reflects the maximum potential dilution

that could occur if securities or other contracts to issue com-

mon stock were exercised or converted into common stock

and would then share in the net income of the company. See

note S, “Earnings Per Share of Common Stock,” on page 83

for further discussion.

BACCOUNTING CHANGES

Standards Implemented

The company implemented new accounting standards in

2000, 1999 and 1998. These standards do not have a mate-

rial effect on the financial position or results of operations of

the company.

In 2000, the Financial Accounting Standards Board

(FASB) issued Interpretation (FIN) No. 44, “Accounting for

Certain Transactions Involving Stock Compensation, an

interpretation of Accounting Principles Board Opinion

No. 25.” The requirements of FIN No. 44 are either not

applicable to the company or are already consistent with the

company’s existing accounting policies.

Effective July 1, 2000, the company adopted Emerging

Issues Task Force (EITF) Issue No. 00-2, “Accounting for

Web Site Development Costs.” See note A, “Significant

Accounting Policies” on pages 69 through 71 for a description

of the company’s policies for Web site development costs.

Pursuant to the Securities and Exchange Commission’s

Staff Accounting Bulletin (SAB) No. 101, “Revenue

Recognition in Financial Statements,” the company has

reviewed its accounting policies for the recognition of

revenue. SAB No. 101 was required to be implemented in