IBM 2000 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The increase in 1999 compared to 1998, excluding the

benefit from the action taken by the company in 1999, was

primarily driven by the company’s ongoing investments in

software marketing and major marketing campaigns includ-

ing the e-business campaign. These expenditures were

consistent with the company’s objective of growing revenue

while improving the expense-to-revenue ratio over time.

Research, development and engineering (RD&E)

expense declined 2.3 percent in 2000 from 1999, following

an increase of 4.5 percent in 1999 from 1998. The decline in

2000 is primarily due to a $111 million pre-tax charge taken

in 1999 for acquired in-process research and development

(IPR&D) associated with the acquisition of Sequent

Computer Systems, Inc., Mylex Corporation and DASCOM,

Inc. See note D, “Acquisitions/Divestitures,” on pages 72

through 74 for further detail about the IPR&D charge.

Overall, the company continues to invest in high-growth

opportunities such as e-business, Tivoli software products

and initiatives to support Linux.

As a result of its ongoing research and development

efforts, the company received 2,886 patents in 2000, placing

it number one in patents granted in the United States for the

eighth consecutive year. The application of these technolog-

ical advances transforms the company’s research and

development into new products.

Recent advances include high-quality inductors and

transformers that can be integrated into silicon chips with-

out consuming excess chip area, enhancing miniaturization.

These high-speed circuits are used in wireless communica-

tions applications and can operate at high frequencies, which

extends the use of circuits in many applications, such as cell

phones and personal digital assistants.

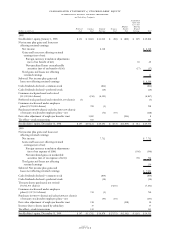

Included in the company’s cost and expense is $327 mil-

lion of benefit for retirement-related plans, including

pension plans and nonpension postretirement benefits, for

the year ended December 31, 2000. The comparable

amounts for the years ended December 31, 1999 and 1998,

were additional costs of $83 million and $286 million,

respectively. See note V, “Retirement Plans,” on pages 85

through 88 and note W, “Nonpension Postretirement

Benefits,” on pages 88 and 89 for the benefit and cost

amounts for the major pension and nonpension postretire-

ment plans.

For the year ended December 31, 2000, the company

realized cost and expense reductions of $1,171 million due to

the funded status of its pension plans. Of the total 2000

reductions, the change in actuarial assumptions for the pri-

mary U.S. plan contributed an estimated $221 million.

For the year ended December 31, 1999, the company

realized cost and expense reductions of $694 million due to

the funded status of its pension plans. Of the total 1999

reductions, the amendment to the U.S. plan, as more fully

discussed in note V, “Retirement Plans,” on pages 85

through 88, contributed an estimated $167 million. The

impact in 1999 of changes in actuarial assumptions for the

U.S. Plan was approximately $143 million of additional cost.

This amount is included in the $694 million cost and

expense reduction amount previously noted.

The change in the discount rate from 7.75 percent to

7.25 percent, effective December 31, 2000, is not expected to

have a material effect on the company’s 2001 results of oper-

ations. Effective January 1, 2001, the company increased

pension benefits to recipients who retired before January 1,

1997. The increases ranged from 2.5 percent to 25 percent,

and are based on the year of retirement and the pension

benefit currently being received. This improvement is

expected to result in an additional cost to the company of

approximately $100 million in 2001.

The company does not expect to provide additional fund-

ing for the U.S. plan in 2001 because of the aforementioned

items. Future effects of pension plans, including the changes

noted above, on the operating results of the company

depend on economic conditions, employee demographics,

mortality rates and investment performance.

See note X, “Segment Information,” on pages 89 through

93 for additional information about the pre-tax income of

each segment, as well as the methodologies employed by the

company to allocate shared expenses to the segments.

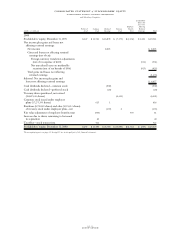

Other income increased 10.9 percent in 2000 from 1999

and declined 5.5 percent in 1999 from 1998. The increase

was primarily a result of gains from sales of available-for-sale

securities held by the company, partially offset by lower

interest income. The decline in 1999 versus 1998 was prima-

rily due to lower interest income.

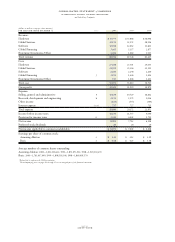

Provision for Income Taxes

The provision for income taxes resulted in an effective tax

rate of 29.8 percent for 2000, compared with the 1999 effective

tax rate of 34.4 percent and a 1998 effective tax rate of 30.0

percent. The 4.6 point decrease in the 2000 rate from the

1999 rate and the 4.4 point increase in the 1999 rate from the

1998 rate were primarily the result of the company’s 1999

sale of its Global Network business and various other actions

implemented during 1999.

As reflected in the reconciliation of the company’s effective

tax rate in note O, “Taxes,” on pages 80 and 81, the increased

benefit on the company’s tax rate of the foreign tax differential

in 2000 was principally due to the U.S. tax benefit from the

repatriation of profits previously subject to foreign taxes,

partially offset by a less favorable mix of profits arising in

markets with lower effective tax rates. The decreased benefit

of the foreign tax differential from 1998 to 1999 primarily

reflects a less favorable mix of profits arising in markets with

lower effective tax rates.

management discussion

international business machines corporation

and Subsidiary Companies

page no.

fifty-seven