IBM 2000 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

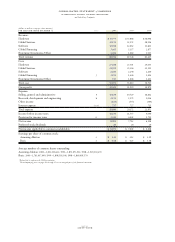

Global Financing

(dollars in millions) 2000 1999 1998

Revenue $«3,465 $«3,137 $«2,877

Cost 1,595 1,446 1,494

Gross profit $«1,870 $«1,691 $«1,383

Gross profit margin 54.0% 53.9% 48.1%

Global Financing revenue increased 10.4 percent (13 percent

at constant currency) in 2000 from 1999, following an increase

of 9.0 percent (10 percent at constant currency) in 1999 versus

1998. Growth in sales of used equipment and in commercial

financing drove the revenue increase in 2000. The revenue

increase in 1999 over 1998 was due to growth in commercial

financing and in financing of software and services.

Gross profit dollars increased 10.6 percent in 2000 versus

1999, following an increase of 22.3 percent in 1999 over

1998. The increase in 2000 was primarily driven by higher

sales of used equipment and an improving gross profit margin

on these sales. The increase in 1999, as well as in 2000,

reflects the company’s ongoing strategy to increase its use of

the Global Treasury Centers rather than have the Global

Financing business directly access external funding sources.

This strategy minimizes the company’s overall cost of bor-

rowing via an efficient and economical centralized funding

strategy that enables the company to access the global capital

markets. This results in a shift of some costs within the

Consolidated Statement of Earnings from Cost of Global

Financing to Interest expense. (See the Debt/Equity section

of the Management Discussion on page 60 for additional

discussion of Global Financing debt and note J,

“Borrowings,” on page 75 for additional discussion of the

company’s interest expense.)

Enterprise Investments/Other

(dollars in millions) 2000 1999*1998*

Revenue $«1,404 $«1,689 $«1,915

Cost 747 1,038 1,263

Gross profit $««««657 $««««651 $««««652

Gross profit margin 46.8% 38.5% 34.0%

*Reclassified to conform with 2000 presentation.

Enterprise Investments/Other revenue decreased 16.9 per-

cent (13 percent at constant currency) from 1999, following

a decrease of 11.8 percent (12 percent at constant currency)

in 1999 from 1998. The decrease in both years was driven

by lower revenue associated with the company’s decision in

1999 to discontinue certain product lines, such as auto-

mated teller machines (ATMs), partially offset by growth in

computer-aided three-dimensional interactive application

(CATIA) software.

The gross profit dollars from Enterprise Investments/

Other increased 0.9 percent in 2000 versus 1999, and were

flat in 1999 versus 1998. The increase in 2000 gross profit

dollars and gross profit margin was primarily due to a shift

in the mix of revenue to software products that have a higher

gross profit margin than the hardware product lines the

company discontinued in 1999.

Expenses

(dollars in millions) 2000 1999 1998

Selling, general and

administrative $«15,639 $«14,729 $«16,662

Percentage of revenue 17.7% 16.8% 20.4%

Research, development

and engineering $«««5,151 $«««5,273 $«««5,046

Percentage of revenue 5.8% 6.0% 6.2%

Selling, general and administrative (SG&A) expense increased

6.2 percent in 2000 versus 1999, following a decline of

11.6 percent in 1999 compared with 1998. The increase in

2000 was primarily driven by the 1999 net pre-tax benefit of

$2,107 million associated with the sale of the Global

Network, actions taken by the company in 1999 to improve

its competitiveness and to strengthen the company’s over-

all business portfolio, and implementation of a change

in personal computers’ depreciable lives. (See note D,

“Acquisitions/Divestitures,” on pages 72 through 74, and

note Q, “1999 Actions,” on pages 81 and 82 for further

information.) Excluding the 1999 actions and sale of the

Global Network, 2000 SG&A expense would have declined

7.1 percent versus 1999 and increased 1.0 percent in 1999

compared with 1998. In addition, its percentage of revenue

would have been 17.7 percent for 2000, 19.2 percent for

1999 and 20.4 percent for 1998.

This improved expense-to-revenue ratio in 2000 results

from the company’s aggressive management of its infrastruc-

ture expense and discretionary spending, and improvements

in its productivity through the use of technology and other

productivity tools. Examples include revenue generation and

customer services capabilities of ibm.com and a significant

increase in electronic processing within the procurement

function. The company also continues to benefit from growth

in its licensing of intellectual property. In addition, the

company has lower expenses as a result of the sale of the

Global Network and actions taken in 1999 to exit such

businesses as networking hardware and DRAM (dynamic

random access memory) manufacturing. SG&A expense also

benefited from the effects of currency and asset sales, exclud-

ing securities, in 2000.

management discussion

international business machines corporation

and Subsidiary Companies

page no.

fifty-six