IBM 2000 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

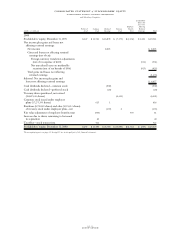

Divestitures

During 1999, the company completed the sale of its Global

Network business to AT&T for $4,991 million. More than

5,300 IBM employees joined AT&T as a result of these sales

of operations in 71 countries.

During 1999, the company recognized a pre-tax gain of

$4,057 million ($2,495 million after tax, or $1.33 per diluted

common share). The net gain reflects dispositions of plant,

rental machines and other property of $410 million, other

assets of $182 million and contractual obligations of $342

million. The gain was recorded as a reduction of Selling,

general and administrative expense in the Consolidated

Statement of Earnings.

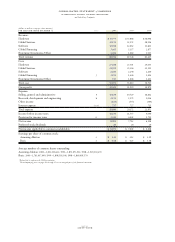

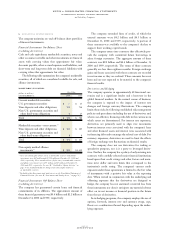

EINVENTORIES

(dollars in millions)

AT DECEMBER 31: 2000 1999

Finished goods $«1,446 $«1,162

Work in process and raw materials 3,319 3,706

Total $«4,765 $«4,868

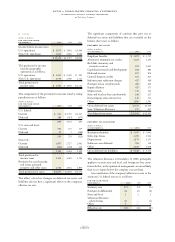

FFINANCING RECEIVABLES

The following table includes receivables resulting from leas-

ing activities and installment loans to customers, as well as

commercial financing activities primarily to dealers, arising

from the Global Financing business. See note X, “Segment

Information,” on pages 89 through 93 for information on

the total assets of the Global Financing segment, which also

includes cash, rental machine fixed assets, intercompany

amounts and other.

(dollars in millions)

AT DECEMBER 31: 2000 1999

Short term:

Commercial financing receivables $«««6,851 $«««6,062

Customer loan receivables 4,065 3,764

Installment payment receivables 1,221 1,110

Net investment in sales-type leases 6,568 6,220

Total short-term financing

receivables $«18,705 $«17,156

Long term:

Commercial financing receivables $««««««779 $«««0,030

Customer loan receivables 4,359 4,219

Installment payment receivables 574 848

Net investment in sales-type leases 7,596 7,981

Total long-term financing receivables $«13,308 $«13,078

Net investment in sales-type leases is for leases that relate

principally to IBM equipment and is generally for terms

ranging from two to five years. Net investment in sales-type

leases includes unguaranteed residual values of approximately

$751 million and $737 million at December 31, 2000 and

1999, respectively, and is reflected net of unearned income at

those dates of approximately $1,500 million and $1,600 mil-

lion, respectively. Scheduled maturities of minimum lease

payments outstanding at December 31, 2000, expressed as a

percentage of the total, are approximately as follows: 2001,

50 percent; 2002, 30 percent; 2003, 14 percent; 2004, 4 per-

cent; and 2005 and beyond, 2 percent.

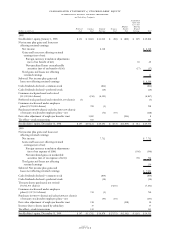

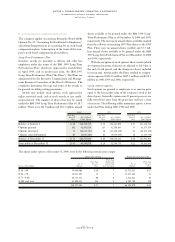

GPLANT, RENTAL MACHINES AND OTHER PROPERTY

(dollars in millions)

AT DECEMBER 31: 2000 1999

Land and land improvements $««««««896 $«««1,026

Buildings and building improvements 9,904 10,395

Plant, laboratory and

office equipment 22,354 22,503

33,154 33,924

Less: Accumulated depreciation 18,857 19,268

14,297 14,656

Rental machines 5,301 5,692

Less: Accumulated depreciation 2,884 2,758

2,417 2,934

Total $«16,714 $«17,590

HINVESTMENTS AND SUNDRY ASSETS

(dollars in millions)

AT DECEMBER 31: 2000 1999

Deferred taxes $«««2,968 $«««2,654

Prepaid pension assets 6,806 5,636

Alliance investments:

Equity method 629 595

Other 909 1,439

Goodwill (less accum. amortization) 848 1,045

Marketable securities

—

non-current 171 113

Software 782 663

Other assets 1,334 1,527

Total $«14,447 $«13,672

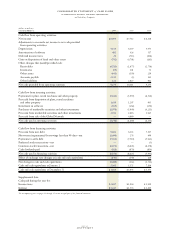

ISALE AND SECURITIZATION OF RECEIVABLES

The company manages assets of $136 million and $273 mil-

lion from the securitization of loans, leases and trade

receivables, at year-end 2000 and 1999, respectively. The

company did not sell any receivables in 2000, and therefore

had no cash proceeds for the year. Cash proceeds from the

sale and securitization of these receivables and assets were

$1,311 million in 1999. No significant gain or loss resulted

from these transactions. The company expects recourse

amounts associated with the aforementioned sale and securi-

tization activities to be minimal and has adequate reserves to

cover potential losses.

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

page no.

seventy-four