IBM 2000 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page no.

eighty-four

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

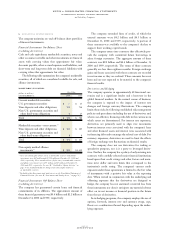

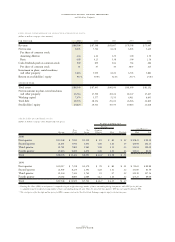

2000 1999 1998

Wtd. Avg. Wtd. Avg. Wtd. Avg.

Exercise No. of Shares Exercise No. of Shares Exercise No. of Shares

Price Under Option Price Under Option Price Under Option

Balance at January 1 $««60 146,136,523 $««36 131,443,850 $«27 123,456,722

Options granted 102 42,601,014 115 42,786,845 53 41,175,350

Options exercised 35 (18,243,347) 28 (23,160,228) 22 (29,633,476)

Options canceled/expired 87 (9,937,187) 61 (4,933,944) 36 (3,554,746)

Balance at December 31 $««73 160,557,003 $««60 146,136,523 $«36 131,443,850

Exercisable at December 31 $««45 66,599,878 $««29 51,599,735 $«22 46,191,636

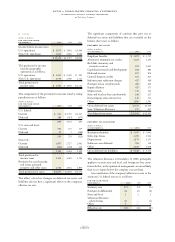

The shares under option at December 31, 2000, were in the following exercise price ranges:

Options Outstanding Options Currently Exercisable

Wtd. Avg.

Wtd. Avg. Remaining Wtd. Avg.

No. of Exercise Contractual No. of Exercise

Exercise Price Range Options Price Life (in years) Options Price

$10

—

40 50,046,086 $«28 5 42,552,911 $«27

$41

—

70 30,932,902 52 7 13,935,446 52

$71

—

100 16,777,572 88 8 3,911,821 85

$101 and over 62,800,443 116 9 6,199,700 129

160,557,003 $«73 7 66,599,878 $«45

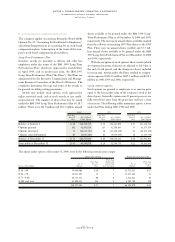

USTOCK-BASED COMPENSATION PLANS

The company applies Accounting Principles Board (APB)

Opinion No. 25, “Accounting for Stock Issued to Employees,”

and related Interpretations in accounting for its stock-based

compensation plans. A description of the terms of the com-

pany’s stock-based compensation plans follows:

Long-Term Performance Plan

Incentive awards are provided to officers and other key

employees under the terms of the IBM 1999 Long-Term

Performance Plan, which was approved by stockholders

in April 1999, and its predecessor plan, the IBM 1997

Long-Term Performance Plan (“the Plans”). The Plans are

administered by the Executive Compensation and Manage-

ment Resources Committee of the Board of Directors. The

committee determines the type and terms of the awards to

be granted, including vesting provisions.

Awards may include stock options, stock appreciation

rights, restricted stock, cash or stock awards, or any combi-

nation thereof. The number of shares that may be issued

under the IBM 1999 Long-Term Performance Plan is 118.7

million. There were 121.9 million and 118.7 million unused

shares available to be granted under the IBM 1999 Long-

Term Performance Plan as of December 31, 2000 and 1999,

respectively. The increase in unused shares available resulted

from the rollover of remaining 1997 Plan shares to the 1999

Plan. There were no unused shares available and 33.7 mil-

lion unused shares available to be granted under the IBM

1997 Long-Term Performance Plan as of December 31, 2000

and 1999, respectively.

With the exception of stock options, these awards (which

are expressed in terms of shares) are adjusted to fair value at

the end of each period, and the change in value is included

in net income. Awards under the Plans resulted in compen-

sation expense of $134.0 million, $267.3 million and $322.4

million in 2000, 1999 and 1998, respectively.

STOCK OPTION GRANTS

Stock options are granted to employees at an exercise price

equal to the fair market value of the company’s stock at the

date of grant. Generally, options vest 25 percent per year, are

fully vested four years from the grant date and have a term

of ten years. The following tables summarize option activity

under the Plans during 2000, 1999 and 1998: