IBM 2000 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page no.

fifty-four

The company took actions in 1999 in the microelectronics

and storage areas that were aimed at strengthening the Tech-

nology segment over the long term. Those actions were

intended to shift the focus of the Technology segment to

higher margin businesses and more efficient operations. To

further achieve these goals, the company sold its MiCRUS

semiconductor business in June 2000. (See note Q, “1999

Actions,” on pages 81 and 82 for additional information.)

Strong growth in OEM technology, primarily custom

logic and high-performance static random access memory

(SRAM) revenue drove the increase in 1999 revenue. A slower

growth rate in HDD storage revenue in 1999 versus 1998

reflected pricing pressures.

Personal Systems revenue grew 0.8 percent in 2000 from

1999, following an increase of 20.1 percent in 1999 versus

1998. The change in 2000 revenue was driven by increased

revenue in xSeries servers and mobile products, partially

offset by lower desktop personal computer and retail store

solutions revenue. The decline in desktop revenue was driven

by consumer products, as the company decided in 1999 to

exit retail channels in the United States and Europe. The

Personal Systems segment has benefited from the company-

wide focus on building a competitive cost and expense

structure, which has been crucial in enabling the company to

price personal computers competitively. The segment was

profitable for the second half of 2000 despite a challenging

industry environment. The increase in 1999 revenue versus

1998 was primarily driven by strong revenue growth in

Netfinity servers and mobile products. Mobile revenue was

constrained due to a shortage of flat-panel displays in the

second half of 1999.

In October 2000, the company announced IBM eServers

to manage the unprecedented demands of e-business. This

new generation of servers features mainframe-class reliability

and scalability, broad support of open standards for the devel-

opment of new applications, and capacity on demand. The

new servers feature technology from the company’s high-end

server brands and share the best attributes of all mainframe-

class computing. The entire IBM eServer family uses Tivoli

e-infrastructure management software which manages all

components of a heterogeneous e-business infrastructure.

IBM zSeries mainframe servers are at the heart of the

e-business infrastructure for mission-critical data and trans-

action processing.

IBM pSeries servers are the most powerful, technologi-

cally advanced UNIX servers.

IBM iSeries mid-range servers are integrated mid-range

business servers that run sophisticated business applications.

IBM xSeries servers are Intel-based servers.

In 2000, Enterprise Systems revenue declined 1.4 percent

from 1999, following a decrease of 16.9 percent in 1999 ver-

sus 1998. Revenue grew for the pSeries UNIX servers with

particular strength in the mid-range and high-end Web

servers in 2000 versus 1999. This increase was more than

offset by revenue declines for the mid-range iSeries servers

and the zSeries servers in 2000 as compared to 1999. Although

zSeries servers revenue declined, total deliveries of computing

power increased more than 20 percent as measured in MIPS

(millions of instructions per second) versus 1999. In addition,

revenue from the company’s storage systems products, which

include “Shark,” increased year over year, while revenue

from networking products declined, consistent with the

company’s divestment strategy.

In 1999, lower revenue primarily from S/390, AS/400

and RS/6000 servers drove the revenue decline versus 1998.

These declines were primarily driven by Y2K-related issues

that affected the second-half results. Many of the company’s

large customers locked down their systems and technology

purchases heading into the Y2Ktransition. In addition, the

storage networking product decreases resulted, in part, from

the sale of routing and switching intellectual property to

Cisco Systems, Inc.

Hardware gross profit dollars increased 4.3 percent in

2000 from 1999, following a 10.0 percent decline in 1999

versus 1998. The increase in gross profit dollars was prima-

rily driven by increased revenue and improvements in the

gross profit margin for microelectronics and personal com-

puters. The decline in gross profit dollars in 1999 resulted

from a shift in the company’s revenue away from servers,

pricing pressures associated with HDDs, and memory chip

price declines.

The hardware gross profit margin increased in 2000 by

1.2 points versus 1999 and declined 4.5 points in 1999 com-

pared to 1998. The increase in 2000 was primarily driven

by improved margins in microelectronics and personal

computers. The decrease in 1999 was driven by the shift in

the company’s revenue away from servers to lower gross

profit products, such as personal computers, OEM chip tech-

nology and HDDs, as well as price pressures.

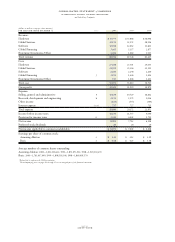

Global Services

(dollars in millions) 2000 1999 1998

Revenue $«33,152 $«32,172 $«28,916

Cost 24,309 23,304 21,125

Gross profit $«««8,843 $«««8,868 $«««7,791

Gross profit margin 26.7% 27.6% 26.9%

management discussion

international business machines corporation

and Subsidiary Companies