IBM 2000 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

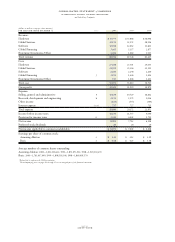

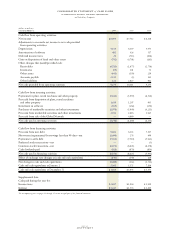

FOURTH QUARTER

The company’s fourth-quarter results reflect the momentum

that has been building steadily all year. For the quarter

ended December 31, 2000, the company had revenue of

$25.6 billion, an increase of 5.9 percent (12 percent at con-

stant currency) compared with the fourth quarter of 1999.

Fourth quarter 2000 net income was $2.7 billion ($1.48 per

diluted common share), compared with net income of $2.1

billion ($1.12 per diluted common share) in the fourth

quarter of 1999.

In the Americas, fourth-quarter revenue was $10.8 billion,

an increase of 3.3 percent (4 percent at constant currency)

from the 1999 period. Revenue from Europe/Middle East/

Africa was $7.4 billion, up 3.0 percent (18 percent at constant

currency). Asia Pacific revenue increased 13.3 percent (20

percent at constant currency) to $5.0 billion. OEM revenue

increased 13.4 percent (14 percent at constant currency) to

$2.4 billion compared with the fourth quarter of 1999.

Hardware revenue increased 9.7 percent (15 percent at

constant currency) to $11.4 billion from the fourth quarter

of 1999, with revenue growth across all server, storage and

technology hardware categories. The company began ship-

ping its new z900 server in mid-December, contributing to a

greater than 100 percent increase in shipments of mainframe

computing capacity in the fourth quarter, as measured in

MIPS. Revenue grew strongly for the pSeries UNIX servers,

with particular strength in the mid-range and high-end Web

server models. Revenues for the mid-range iSeries servers

also increased, with growth across all geographic areas.

Personal Systems revenue grew significantly and the unit

was profitable in the quarter. Microelectronics revenue also

increased strongly, principally due to continued acceleration

in growth of sophisticated, leading-edge custom chips.

Revenue for HDDs increased as well. Excluding networking

products, storage revenue increased, driven by Shark and

shipment of its advanced functions.

Revenue from Global Services, including maintenance,

grew 5.2 percent (12 percent at constant currency) in the

fourth quarter to $9.2 billion, reflecting revenue growth

across all services categories. e-business services revenue grew

more than 70 percent year over year. Revenue comparisons

for Global Services were adversely affected by a year-over-

year decline in the Y2Kservices business and the sale of the

Global Network in 1999. After adjusting for these factors,

Global Services revenue (excluding maintenance) increased

10.1 percent (17 percent at constant currency). The com-

pany signed more than $12.5 billion in services contracts in

the quarter.

Software revenue totaled $3.6 billion, decreasing 1.0 per-

cent (up 6 percent at constant currency) versus the fourth

quarter of 1999. Revenues continued to grow strongly in the

company’s middleware segment, with significant growth in

database and Web-management software. Tivoli revenues

declined in the quarter, reflecting an ongoing transition in

this product area.

Global Financing revenue increased 6.2 percent (10 per-

cent at constant currency) in the fourth quarter to $1.0 billion,

primarily as a result of increased sales of used equipment.

Revenue from the Enterprise Investments/Other area,

which includes custom hardware and software products for

specialized customer uses, declined 10.7 percent (3 percent

at constant currency) year over year to $425 million.

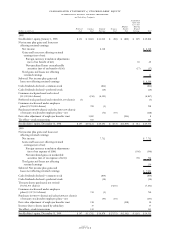

The company’s total gross profit margin was 37.7 percent

in the fourth quarter of 2000 compared with 36.7 percent in

the fourth quarter of 1999. The increase was driven by a 3.5

point improvement in the hardware gross profit margin as

eServer, personal computer and HDD gross profit margins

improved year over year. In addition, the Global Financing

gross profit margin increased 6.1 points, primarily as a result

of higher margins for hardware remarketing. These

increases were partially offset by a decline in the Global

Services gross profit margin of 0.9 points. This decline was

primarily driven by lower Business Innovation Services

revenue, which benefited from Y2Kservices in 1999, par-

tially offset by an improvement in the Strategic Outsourcing

Services gross profit margin.

Total fourth-quarter 2000 expense declined 0.3 percent

when compared with the fourth quarter of 1999. SG&A

expense decreased 2.4 percent, primarily driven by the

effects of currency, while RD&E expense increased 2.4 per-

cent year over year. The expense-to-revenue ratio in the

fourth quarter of 2000 was 23.0 percent, compared with 24.4

percent in 1999.

The company’s tax rate was 29.5 percent in the fourth

quarter, down slightly as compared with 30.0 percent in the

fourth quarter of last year.

The company spent approximately $1.4 billion on common

share repurchases in the fourth quarter. The average number

of common shares outstanding assuming dilution was lower

by 57.2 million shares in fourth quarter 2000 versus fourth

quarter 1999, primarily as a result of these repurchases. The

average number of shares assuming dilution was 1,790.6 mil-

lion in fourth quarter 2000 versus 1,847.8 million in fourth

quarter 1999.

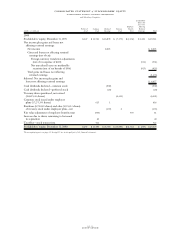

management discussion

international business machines corporation

and Subsidiary Companies

page no.

fifty-eight