IBM 2000 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page no.

eighty-eight

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

time to time, the company contributes additional amounts as

it deems appropriate. Liabilities for amounts in excess of

these funding levels are accrued and reported in the company’s

Consolidated Statement of Financial Position. The assets of

the various plans include corporate equities, government

securities, corporate debt securities and real estate.

Other

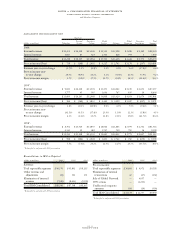

At December 31, 2000, the material non-U.S. defined bene-

fit plans in which the fair value of plan assets exceeded the

benefit obligation had obligations of $16,941 million and

assets of $20,915 million. The material non-U.S. defined

benefit plans in which the benefit obligation exceeded the

fair value of plan assets had obligations of $4,209 million and

assets of $3,919 million.

At December 31, 1999, the material non-U.S. defined

benefit plans in which the fair value of plan assets exceeded

the benefit obligation had obligations of $21,168 million and

assets of $27,400 million. The material non-U.S. defined

benefit plans in which the benefit obligation exceeded the

fair value of plan assets had obligations of $602 million and

assets of $443 million.

The change from 1999 to 2000 was the result of the

company’s pension plan in Japan. In 1999, the Japan pension

plan assets exceeded its benefit obligation by approximately

15 percent. In 2000, the benefit obligation exceeded assets

by approximately 3 percent. Total assets of this plan at

December 31, 2000 exceeded $3,500 million.

WNONPENSION POSTRETIREMENT BENEFITS

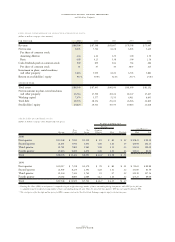

The total (income)/cost of the company’s nonpension post-

retirement benefits for the years ended December 31, 2000,

1999 and 1998 were $401 million, $371 million and $375

million, respectively. The company has a defined benefit

postretirement plan that provides medical, dental and life

insurance for U.S. retirees and eligible dependents. The total

net (income)/cost of this plan for the years ended December

31, 2000, 1999 and 1998, was $374 million, $342 million and

$331 million, respectively. Effective July 1, 1999, the com-

pany established a “Future Health Account (FHA) Plan” for

employees who are more than five years away from retirement

eligibility. Employees who can retire within five years retain

the benefits under the company’s preexisting retiree health

benefits plan. Under either the FHA or the preexisting plan,

there is a maximum cost to the company for retiree health

care. For employees who retired before January 1, 1992, that

maximum will become effective in the year 2001. For all

other employees, the maximum is effective on retirement.

Certain of the company’s non-U.S. subsidiaries have sim-

ilar plans for retirees. However, most of the retirees outside

the United States are covered by government-sponsored and

administered programs. The total net (income)/cost of these

plans for the years ended December 31, 2000, 1999 and 1998

was $27 million, $29 million and $44 million, respectively.

At December 31, 2000 and 1999, Other liabilities on the

Consolidated Statement of Financial Position include non-

U.S. postretirement benefit liabilities of $208 million and

$219 million, respectively.

The net periodic postretirement benefit cost for the U.S.

plan for the years ended December 31 include the following

components:

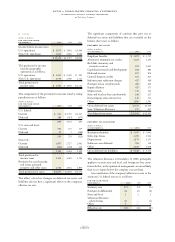

(dollars in millions) 2000 1999 1998

Service cost $«««50 $«««48 $«««42

Interest cost 449 424 427

Expected return on

plan assets (2) (6) (5)

Amortization of

prior service costs (147) (143) (133)

Recognized actuarial losses 24 19 —

Net periodic post-

retirement benefit cost $«374 $«342 $«331

The changes in the benefit obligation and plan assets of the

U.S. plan for 2000 and 1999 are as follows:

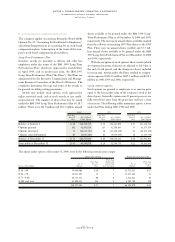

(dollars in millions) 2000 1999

Change in benefit obligation:

Benefit obligation at beginning of year $««6,178 $««6,457

Service cost 50 48

Interest cost 449 424

Amendments — (127)

Actuarial gains (69) (445)

Actuarial losses 432 371

Benefits paid from trust (87) (325)

Direct benefit payments (510) (225)

Benefit obligation at end of year 6,443 6,178

Change in plan assets:

Fair value of plan assets at

beginning of year 105 123

Actual loss on plan assets (14) (18)

Employer contributions — 325

Benefits paid, net of employee

contributions (87) (325)

Fair value of plan assets at end of year 4 105

Benefit obligation in excess

of plan assets (6,439) (6,073)

Unrecognized net actuarial losses 986 631

Unrecognized prior service costs (801) (948)

Accrued postretirement benefit

liability recognized in the

Consolidated Statement

of Financial Position $«(6,254) $«(6,390)

The plan assets primarily comprise short-term fixed income

investments.