IBM 2000 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

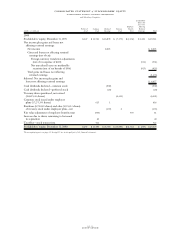

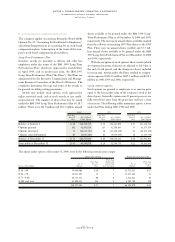

At December 31, 2000 At December 31, 1999

Notional Carrying Fair Notional Carrying Fair

(dollars in millions) Value Value Value*Value Value Value*

Derivative financial instruments $«18,873 $«(21) $«178 $«31,535 $«(198) $«(437)

Amounts in parentheses are liabilities.

*The estimated fair value of derivatives both on- and off-balance sheet at December 31, 2000 and 1999, comprises assets of $393 million and $616 million, respectively, and

liabilities of $215 million and $1,053 million, respectively.

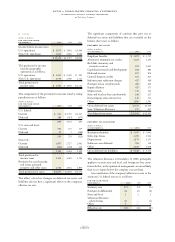

A description of the major hedging programs follows:

DEBT RISK MANAGEMENT

The company issues debt in the global capital markets,

principally to fund its Global Financing lease and loan port-

folio. Access to cost-effective financing can result in interest

rate and/or currency mismatches with the underlying assets.

To manage these mismatches and to reduce overall interest

cost, the company uses interest-rate and currency instru-

ments, principally swaps, to convert a portion of its

fixed-rate debt into variable-rate debt and to convert a por-

tion of its variable-rate debt to fixed-rate debt. Interest rate

and currency rate differentials that arise under these swap

contracts are recognized in interest expense over the life of

the contracts. The resulting cost of funds is usually lower

than that which would have been available if debt with

matching characteristics was issued directly. The weighted-

average remaining maturity of these swaps is approximately

six years.

ANTICIPATED ROYALTIES AND INTERCOMPANY TRANSACTIONS

The company’s operations generate significant non-functional

currency intercompany payments for royalties and goods

and services among the company’s non-U.S. subsidiaries and

with the parent company. In anticipation of these foreign

currency cash flows and in view of the volatility of the

currency markets, the company selectively employs foreign

currency contracts to manage its currency risk. The terms of

these instruments are generally less than eighteen months,

commensurate with the underlying hedged anticipated cash

flows. The effects of these instruments are reported in net

income when the underlying transaction occurs.

For purchased options that hedge qualifying anticipated

transactions, gains and losses are deferred and recognized in

net income in the same period that the underlying transac-

tion occurs, expires or otherwise is terminated. At December

31, 2000 and 1999, there were no material deferred gains or

losses. The premiums associated with entering into these

option contracts generally are amortized over the life of the

options and are not material to the company’s results.

Unamortized premiums are recorded in prepaid assets.

Gains and losses on purchased options that are intended to

hedge anticipated transactions and do not qualify for hedge

accounting are recorded in net income as they occur and are

not material to the company’s results. Similarly, gains and

losses on written options are recorded in net income as they

occur and are not material to the company’s results.

SUBSIDIARY CASH AND FOREIGN CURRENCY

ASSET/LIABILITY MANAGEMENT

The company uses its Global Treasury Centers to manage

the cash of its subsidiaries. These centers principally use cur-

rency swaps to convert cash flows in a cost-effective manner,

predominantly for the company’s European subsidiaries. In

addition, the company uses foreign exchange forward contracts

to hedge, on a net basis, the foreign currency exposure of a

portion of the company’s non-functional currency assets and

liabilities. The terms of these forward and swap contracts are

generally less than one year. The interest rate differentials of

these instruments are generally recognized in interest

expense over the life of the contracts.

LONG TERM INVESTMENTS IN FOREIGN SUBSIDIARIES

(“NET INVESTMENT”)

A significant portion of the company’s foreign denominated

debt portfolio is designated as a hedge to reduce the volatility

in stockholders’ equity caused by changes in foreign exchange

rates in the functional currency of major foreign subsidiaries

with respect to the U.S. dollar. The company also uses cur-

rency swaps and other foreign currency contracts for this risk

management purpose. The currency effects of these hedges

are reflected in the Accumulated gains and losses not affecting

retained earnings section of stockholders’ equity thereby off-

setting a portion of the translation of the net foreign assets.

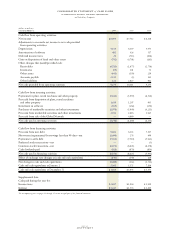

The following table summarizes the notional value,

carrying value and fair value of the company’s derivative

financial instruments, principally interest rate and currency

contracts, both on- and off-balance sheet. The notional

value at December 31 provides an indication of the extent of

the company’s involvement in these instruments at that time,

but does not represent exposure to credit, interest rate or

foreign exchange rate market risks.

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

page no.

seventy-seven