IBM 2000 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2000 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

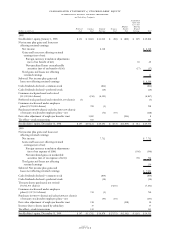

KFINANCIAL INSTRUMENTS

The company maintains on- and off-balance sheet portfolios

of financial instruments.

Financial Instruments On-Balance Sheet

(excluding derivatives)

Cash and cash equivalents, marketable securities, notes and

other accounts receivable and other investments are financial

assets with carrying values that approximate fair value.

Accounts payable, other accrued expenses and liabilities, and

short-term and long-term debt are financial liabilities with

carrying values that approximate fair value.

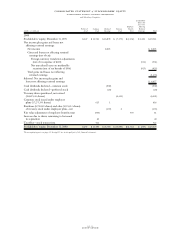

The following table summarizes the company’s marketable

securities, all of which are considered available for sale, and

alliance investments.

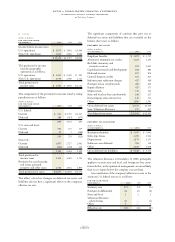

MARKETABLE SECURITIES*

(dollars in millions) Fair Value

AT DECEMBER 31: 2000 1999

Current marketable securities:

U.S. government securities $««««««— $÷÷÷15

Time deposits and other obligations 153 746

Non-U.S. government securities and

other fixed-term obligations 627

Total $««««159 $««««788

Marketable securities

—

non-current:**

Time deposits and other obligations $««««163 $÷÷105

Non-U.S. government securities and

other fixed-term obligations 88

Total $««««171 $÷÷113

Non-equity method alliance

investments** $««««909 $«1,439

*Gross unrealized gains (before taxes) on marketable securities and alliance

investments were $47 million and $1,310 million at December 31, 2000 and

1999, respectively. Gross unrealized losses (before taxes) on marketable securities

and alliance investments were $175 million and $7 million at December 31,

2000 and 1999, respectively. See note M, “Stockholders’ Equity Activity,” on

page 79 for accumulated and net change in unrealized gains and losses

on marketable securities.

** Included within Investments and sundry assets on the Consolidated Statement of

Financial Position. (See note H, “Investments and Sundry Assets,” on page 74.)

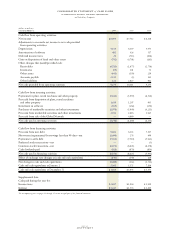

Financial Instruments Off-Balance Sheet

(excluding derivatives)

The company has guaranteed certain loans and financial

commitments of its affiliates. The approximate amount of

these financial guarantees was $0.4 billion and $1.2 billion at

December 31, 2000 and 1999, respectively.

The company extended lines of credit, of which the

unused amounts were $4.2 billion and $4.5 billion at

December 31, 2000 and 1999, respectively. A portion of

these amounts was available to the company’s dealers to

support their working capital needs.

The company enters into contracts that effectively pro-

vide the company with committed future borrowings in

select foreign currencies. The aggregate amount of these

contracts was $9.0 billion and $6.4 billion at December 31,

2000 and 1999, respectively. The terms of these contracts

generally are less than eighteen months. Foreign exchange

gains and losses associated with these contracts are recorded

in net income as they are realized. These amounts have not

been and are not expected to be material to the company’s

financial results.

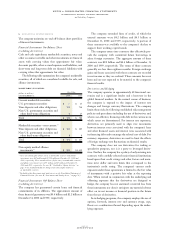

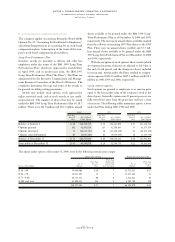

Derivatives and Hedging

The company operates in approximately 40 functional cur-

rencies and is a significant lender and a borrower in the

global financial markets. In the normal course of business,

the company is exposed to the impact of interest rate

changes and foreign currency fluctuations. The company

limits these risks by following established risk management

policies and procedures including the use of derivatives and,

where cost-effective, financing with debt in the currencies in

which assets are denominated. For interest rate exposures,

derivatives are primarily used to align rate movements

between interest rates associated with the company’s lease

and other financial assets and interest rates associated with

its financing debt and to manage the related cost of debt. For

currency exposures, derivatives are used to limit the effects

of foreign exchange rate fluctuations on financial results.

The company does not use derivatives for trading or

speculative purposes, nor is it a party to leveraged deriva-

tives. Further, the company has a policy of only entering into

contracts with carefully selected major financial institutions

based upon their credit ratings and other factors and main-

tains strict dollar and term limits that correspond to the

institution’s credit rating. The company’s current credit

exposure under these agreements is limited to the fair value

of instruments with a positive fair value at the reporting

date. When viewed in conjunction with the underlying and

offsetting exposure that the derivatives are designed to

hedge, the company has not sustained a material loss from

these instruments nor does it anticipate any material adverse

effect on its net income or financial position in the future

from the use of derivatives.

In its hedging programs, the company employs the use of

options, forwards, interest rate and currency swaps, caps,

floors or a combination thereof depending upon the under-

lying exposure.

notes to consolidated financial statements

international business machines corporation

and Subsidiary Companies

page no.

seventy-six