Honeywell 2002 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297

|

|

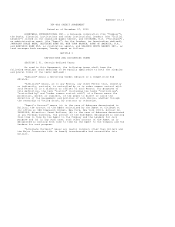

-5-

such amounts currently payable to a Participant). The Corporation shall reserve

the right to accept or reject any such request at any time and such election

shall be subject to such restrictions and limitations as the Corporation shall

determine in its sole discretion, provided that any new election shall generally

be required to be made at least twelve (12) months prior to any scheduled

payment date.

Notwithstanding any provision in this Plan to the contrary, if all or a

portion of a Participant's Account is determined to be includible in the

Participant's gross income and subject to income tax at any time prior to the

time such Account would otherwise be paid, the Participant's Account or that

portion of the Participant's Account shall be distributed to the Participant.

For this purpose, an amount is determined to be includible in the Participant's

gross income upon the earliest of: (i) a final determination by the Internal

Revenue Service addressed to the Participant which is not appealed, (ii) a final

determination by the United States Tax Court or any other federal court

affirming an IRS determination, or (iii) an opinion addressed to the Corporation

by the tax counsel for the Corporation that, by reason of the Code, Treasury

Regulations, published Internal Revenue Service rulings, court decisions or

other substantial precedent, the amount is subject to federal income tax prior

to payment.

8. Distribution on Death

If a Participant should die before all amounts credited to the

Participant's Account have been distributed, the balance in the Account shall be

paid as soon as practical thereafter to the beneficiary designated in writing by

the Participant. Payment to a beneficiary pursuant to a designation by a

Participant shall be made in one lump sum to the designated beneficiary as soon

as practicable following the death of the Participant. Such beneficiary

designations shall be effective when received by the Corporation, and shall

remain in effect until rescinded or modified by the Participant by an

appropriate written direction. If no beneficiary is properly designated by the

Participant or if the designated beneficiary shall have predeceased the

Participant, such balance in the Account shall be paid to the estate of the

Participant.

9. Payment in the Event of Hardship

Upon receipt of a request from a Participant, delivered in writing to the

Corporation along with a Certificate of Unavailability of Other Resources form,

the Committee, the Senior Vice President - Human Resources and Communications,

or his designee, may cause the Corporation to accelerate (or require the

subsidiary of the Corporation which employs or employed the Participant to

accelerate) payment of all or any part of the Deferral Amount and Interest

Equivalents credited to the Participant's Account, if it finds in its sole

discretion that payment of such amounts in accordance with the Participant's

prior election under paragraph 3 would result in severe financial hardship to

the Participant and such hardship is the result of an unforeseeable emergency

caused by circumstances beyond the control of the Participant. Acceleration of

payment may not be made under this paragraph 9 to the extent that such hardship

is or may be relieved (i) through reimbursement or compensation by insurance or

otherwise, (ii) by liquidation of the Participant's assets, to the extent the

liquidation of assets would not itself cause severe financial hardship or (iii)

by cessation of deferrals under this Plan or any tax-qualified savings plan of

the Corporation.