Honeywell 2002 Annual Report Download - page 256

Download and view the complete annual report

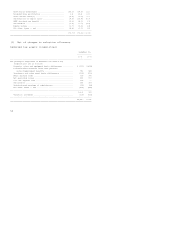

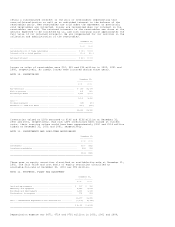

Please find page 256 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We maintain $2 billion of bank revolving credit facilities with a group of banks

which are comprised of: (a) a $1 billion Five-Year Credit Agreement and (b) a $1

billion 364-Day Credit Agreement. The credit agreements are maintained for

general corporate purposes including support for the issuance of commercial

paper. We had no balance outstanding under either agreement at December 31,

2002.

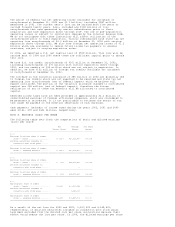

Neither of the credit agreements restricts our ability to pay dividends and

neither contains financial covenants. The failure to comply with customary

conditions or the occurrence of customary events of default contained in the

credit agreements would prevent any further borrowings and would generally

require the repayments of any outstanding borrowings under such credit

agreements. Such events of default include (a) non-payment of credit agreement

debt and interest, (b) noncompliance with the terms of the credit agreement

covenants, (c) default on other debt in certain circumstances, (d) bankruptcy

and (e) defaults upon obligations under the Employee Retirement Income Security

Act. Additionally, each of the banks has the right to terminate its commitment

to lend under the credit agreements if any person or group acquires beneficial

ownership of 30 percent or more of our voting stock or, during any 12-month

period, individuals who were directors of Honeywell at the beginning of the

period cease to constitute a majority of the Board of Directors (the Board).

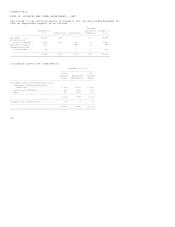

Loans under the Five-Year Credit Agreement are required to be repaid no later

than December 2, 2004. We have agreed to pay a facility fee of 0.065 percent per

annum on the aggregate commitment for the Five-Year Credit Agreement.

Interest on borrowings under the Five-Year Credit Agreement would be determined,

at our option, by (a) an auction bidding procedure; (b) the highest of the

floating base rate of the agent bank, 0.5 percent above the average CD rate, or

0.5 percent above the Federal funds rate or (c) the Eurocurrency rate plus 0.135

percent (applicable margin).

The commitments under the 364-Day Credit Agreement terminate on November 26,

2003. If the credit facility is drawn, any outstanding balance on November 26,

2003 may be converted to a one year term loan at our option. We have agreed to

pay a facility fee of 0.06 percent per annum on the aggregate commitment for the

364-Day Credit Agreement, and we have paid upfront fees of 0.04 percent.

Interest on borrowings under the 364-Day Credit Agreement would be determined,

at our option, by (a) an auction bidding procedure; (b) the highest of the

floating base rate of the agent bank, 0.5 percent above the average CD rate, or

0.5 percent above the Federal funds rate or (c) the Eurocurrency rate plus 0.24

percent (applicable margin). The applicable margin on and after the term loan

conversion is 0.60 percent.

The facility fee and the applicable margin over the Eurocurrency rate on both

the Five-Year Credit Agreement and the 364-Day Credit Agreement are subject to

increase or decrease if our long-term debt ratings change, but the revolving

credit facilities are not subject to termination based on a decrease in our debt

ratings.

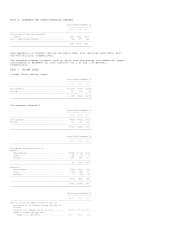

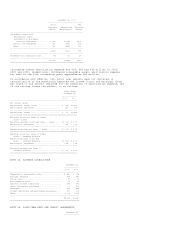

NOTE 16. LEASE COMMITMENTS

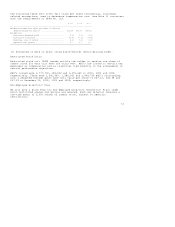

Future minimum lease payments under operating leases having initial or remaining

noncancellable lease terms in excess of one year are as follows:

At December 31,

---------------

2002

----------------------------------------------------

2003 ............................. $ 310

2004 ............................. 265

2005 ............................. 204

2006 ............................. 145

2007 ............................. 119

Thereafter ....................... 331

----------------------------------------------------

$1,374

====================================================

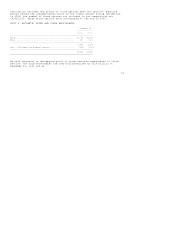

We have entered into agreements to lease land, equipment and buildings.

Principally all our operating leases have initial terms of up to 25 years, and

some contain renewal options subject to customary conditions. At any time during

the terms of some of our leases, we may at our option purchase the leased assets

for amounts that approximate fair value. In certain instances, to obtain

favorable financing terms from lessors, we used variable interest entities (as

defined in FIN 46) to finance leased property. At December 31, 2002, we were

leasing aircraft, equipment, land and buildings with related liabilities of

approximately $320 million on which we provided residual value guarantees on the

leased assets of approximately $265 million. Pursuant to FIN 46, we must

consolidate all variable interest entities in which we are the primary

beneficiary no later than July 1, 2003. We do not expect that any of our