Honeywell 2002 Annual Report Download - page 211

Download and view the complete annual report

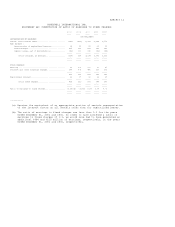

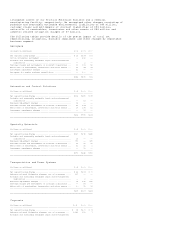

Please find page 211 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Automation and Control Solutions sales in 2002 were $6,978 million, a decrease

of $207 million, or 3 percent compared with 2001. Sales declined by 3 percent

for our Automation and Control Products business primarily due to the

disposition of our Consumer Products business and softness in capital spending

partially offset by increased demand for security-related products. Sales for

our Industry Solutions business declined by 4 percent resulting from ongoing

softness in industrial production and capital spending. Sales for our Service

business also decreased by 3 percent due primarily to general weakness in the

economy. Automation and Control Solutions sales in 2001 were $7,185 million, a

decrease of $199 million, or 3 percent compared with 2000. Excluding the impact

of foreign exchange, acquisitions and divestitures, sales decreased

approximately 2 percent. This decrease resulted primarily from lower sales for

our Automation and Control Products business primarily due to weakness in key

end-markets partially offset by higher sales for our security related products

due principally to our acquisition of Pittway in the prior year. Our Service

business also had lower sales due primarily to weakness in our security

monitoring business. This decrease was partially offset by higher sales for our

Industry Solutions business.

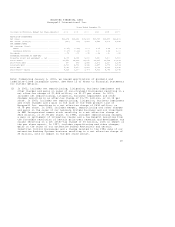

Automation and Control Solutions segment profit in 2002 was $890 million, an

increase of $71 million, or 9 percent compared with 2001. Excluding goodwill

amortization expense in 2001, segment profit in 2002 decreased by 2 percent

compared with 2001. This decrease resulted primarily from the impact of lower

sales volumes and pricing pressures, mainly in our Automation and Control

Products and Service businesses. This decrease was partially offset by lower

costs due to the benefits of repositioning actions, mainly workforce reductions.

Automation and Control Solutions segment profit in 2001 was $819 million, a

decrease of $167 million, or 17 percent compared with 2000. This decrease

resulted principally from lower sales for our Automation and Control Products

and Service businesses, higher raw material costs and pricing pressures across

the segment, higher retirement benefit costs and the impact of prior year

divestitures. This decrease was partially offset by the impact of cost-reduction

actions, primarily workforce reductions.

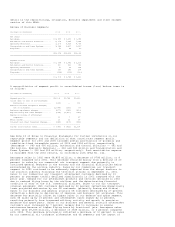

Specialty Materials sales in 2002 were $3,205 million, a decrease of $108

million, or 3 percent compared with 2001. This decrease was driven by a 44

percent decline in sales for our Advanced Circuits business due to weakness in

the telecommunications industry and the divestiture of our PFC business. Sales

declined by 7 percent for our Performance Fibers business mainly due to weak

demand. Sales for our Fluorines business also declined by 2 percent generally

due to lower demand and pricing pressures. This decrease was partially offset by

higher sales for our Electronic Materials and Nylon System businesses of 8 and 5

percent, respectively, due principally to increased demand. Specialty Materials

sales in 2001 were $3,313 million, a decrease of $742 million, or 18 percent

compared with 2000. Excluding the effect of divestitures, sales decreased by 13

percent. This decrease was driven by a decline in sales for our Electronic

Materials and Advanced Circuits businesses of 36 and 34 percent, respectively,

due to weakness in the electronics and telecommunications markets. Sales also

declined for our Performance Fibers and Nylon System businesses by 18 and 8

percent, respectively, due to weakness in the automotive and carpet end-markets.

Specialty Materials segment profit in 2002 was $57 million, an increase of $5

million, or 10 percent compared with 2001. Excluding goodwill amortization

expense in 2001, segment profit in 2002 decreased by 32 percent compared with

2001. Segment profit in 2002 was negatively impacted by significant pricing

pressures in many of our markets and by start-up costs for our new Fluorines

plant. This decrease in segment profit was partially offset by the impact of

higher volumes in our Electronic Materials and Nylon System businesses, lower

raw material costs, and lower costs resulting from plant shutdowns and workforce

reductions. Specialty Materials segment profit in 2001 was $52 million, a

decrease of $282 million, or 84 percent compared with 2000. This decrease

resulted primarily from lower volumes and price declines, principally in our

Electronic Materials, Nylon System and Performance Fibers businesses. Higher

energy and raw material costs principally in our Nylon System and Performance

Fibers businesses and the impact of prior year divestitures also contributed to

the decrease in segment profit. This decrease in segment profit was partially

offset by the impact of cost-reduction actions, principally plant shutdowns and

workforce reductions.

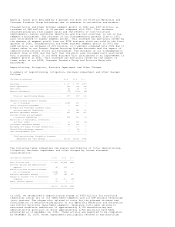

Transportation and Power Systems sales in 2002 were $3,184 million, a decrease

of $273 million, or 8 percent compared with 2001. Excluding the effect of the

disposition of our BCVS business, sales increased by 3 percent. This increase

was due mainly to a 6 percent increase in sales for our Garrett Engine Boosting

Systems business due to higher build rates for medium and heavy-duty vehicles in

Asia and North America. Sales for our Consumer Products Group and Friction

Materials businesses also both increased 2 percent due to higher demand and

favorable foreign exchange. Transportation and Power Systems sales in 2001 were

$3,457 million, a decrease of $70 million, or 2 percent compared with 2000.

Excluding the effects of foreign exchange, acquisitions and divestitures, sales

were flat. Sales increased by 13 percent for our Garrett Engine Boosting Systems

business due to continued strong demand for turbochargers in the European

diesel-powered passenger car market. This increase was offset by a 16 percent

decrease in sales for our BCVS business due to decreased heavy-duty truck builds