Honeywell 2002 Annual Report Download - page 244

Download and view the complete annual report

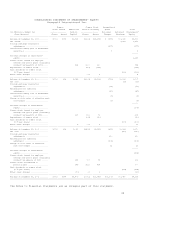

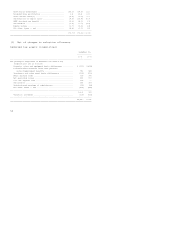

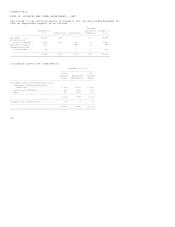

Please find page 244 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The following table summarizes the pretax impact of total repositioning,

litigation, business impairment and other charges by reportable business

segment.

2002 2001 2000

--------------------------------------------------------------------------------

Aerospace ............................................ $ 146 $ 895 $ 91

Automation and Control Solutions ..................... 212 785 108

Specialty Materials .................................. 976 242 399

Transportation and Power Systems ..................... 295 367 263

Corporate ............................................ 1,430 506 105

--------------------------------------------------------------------------------

$3,059 $2,795 $966

================================================================================

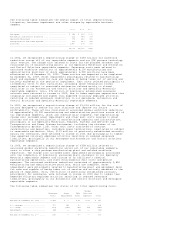

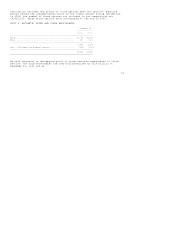

In 2002, we recognized a repositioning charge of $453 million for workforce

reductions across all of our reportable segments and our UOP process technology

joint venture. The charge also related to costs for the planned shutdown and

consolidation of manufacturing plants in our Specialty Materials and Automation

and Control Solutions reportable segments. Severance costs were related to

announced workforce reductions of approximately 8,100 manufacturing and

administrative positions of which approximately 2,900 positions have been

eliminated as of December 31, 2002. These actions are expected to be completed

by December 31, 2003. Asset impairments principally related to manufacturing

plant and equipment held for sale and capable of being taken out of service and

actively marketed in the period of impairment. Exit costs related principally to

incremental costs to exit facilities, including lease termination losses

negotiated or subject to reasonable estimation related mainly to closed

facilities in our Automation and Control Solutions and Specialty Materials

reportable segments. Also, $76 million of previously established severance

accruals were returned to income in 2002, due to fewer employee separations than

originally anticipated and higher than expected voluntary employee attrition

resulting in reduced severance liabilities in our Aerospace, Automation and

Control Solutions and Specialty Materials reportable segments.

In 2001, we recognized a repositioning charge of $1,016 million for the cost of

actions designed to reduce our cost structure and improve our future

profitability. These actions consisted of announced global workforce reductions

of approximately 20,000 manufacturing and administrative positions across all of

our reportable segments, which are substantially complete. The repositioning

charge also included asset impairments and other exit costs related to plant

closures and the rationalization of manufacturing capacity and infrastructure,

principally in our Specialty Materials, Engines, Systems and Services and

Transportation and Power Systems businesses, including the shutdown of our

Turbogenerator product line. Other exit costs consisted of contract

cancellations and penalties, including lease terminations, negotiated or subject

to reasonable estimation. Also, $119 million of previously established accruals,

mainly for severance, were returned to income in 2001 due principally to higher

than expected voluntary employee attrition resulting in reduced severance

liabilities, principally in our Aerospace and Automation and Control Solutions

reportable segments.

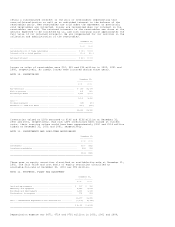

In 2000, we recognized a repositioning charge of $338 million related to

announced global workforce reductions across all of our reportable segments,

costs to close a chip package manufacturing plant and related workforce

reductions. The charge also included asset impairments principally associated

with the completion of previously announced plant shutdowns in our Specialty

Materials reportable segment and closure of an affiliate's chemical

manufacturing operations, and other environmental exit costs and period

expenses. The announced workforce reductions consisted of approximately 2,800

manufacturing and administrative positions, which are complete. Asset

impairments were principally related to manufacturing plant and equipment held

for sale and capable of being taken out of service and actively marketed in the

period of impairment. Also, $46 million of previously established accruals,

principally for severance, were returned to income in 2000 due to higher than

expected voluntary employee attrition resulting in reduced severance

liabilities, principally in our Automation and Control Solutions and Aerospace

reportable segments.

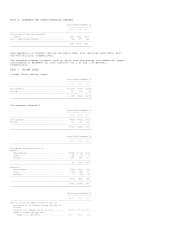

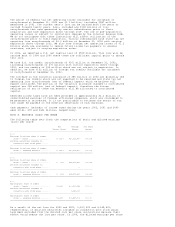

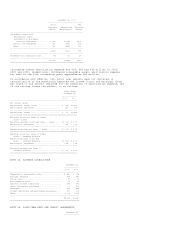

The following table summarizes the status of our total repositioning costs.

Merger

Severance Asset Exit Fees and

Costs Impairments Costs Expenses Total

----------------------------------------------------------------------------------------

Balance at December 31, 1999 ..... $ 424 $ -- $ 85 $ 58 $ 567

----------------------------------------------------------------------------------------

2000 charges ..................... 157 141 40 -- 338

2000 usage ....................... (303) (141) (41) (58) (543)

Adjustments ...................... (42) -- (4) -- (46)

----------------------------------------------------------------------------------------

Balance at December 31, 2000 ..... 236 -- 80 -- 316