Honeywell 2002 Annual Report Download - page 264

Download and view the complete annual report

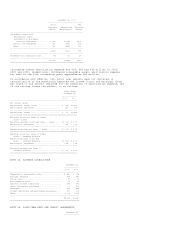

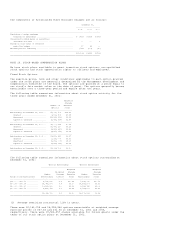

Please find page 264 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Directors' Plan provides for an annual grant to each director of options to

purchase 2,000 shares of common stock at the fair market value on the date of

grant. We have set aside 450,000 shares for issuance under the Directors' Plan.

Options generally become exercisable over a three-year period and expire after

ten years.

Employee Stock Match Plans

We sponsor employee savings plans under which we match, in the form of our

common stock, certain eligible U.S. employee savings plan contributions. Shares

issued under the stock match plans were 5.6, 4.9 and 3.9 million in 2002, 2001

and 2000, respectively, at a cost of $173, $185 and $161 million, respectively.

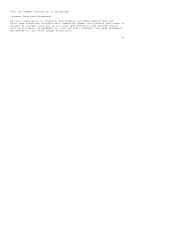

NOTE 21. COMMITMENTS AND CONTINGENCIES

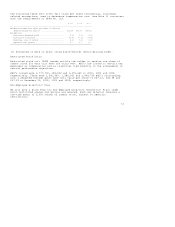

Shareowner Litigation

Honeywell and seven of its current and former officers were named as defendants

in several purported class action lawsuits filed in the United States District

Court for the District of New Jersey (the Securities Law Complaints). The

Securities Law Complaints principally allege that the defendants violated

federal securities laws by purportedly making false and misleading statements

and by failing to disclose material information concerning Honeywell's financial

performance, thereby allegedly causing the value of Honeywell's stock to be

artificially inflated. On January 15, 2002, the District Court dismissed the

consolidated complaint against four of Honeywell's current and former officers.

The Court has granted plaintiffs' motion for class certification defining the

purported class as all purchasers of Honeywell stock between December 20, 1999

and June 19, 2000.

The parties have agreed to participate in a two day settlement mediation in

April, 2003 in an attempt to resolve the cases without resort to a trial. All

significant discovery in the cases has been stayed pending further order of the

court.

Notwithstanding our agreement to mediate, we believe there is no factual or

legal basis for the allegations in the Securities Law Complaints. Although it is

not possible at this time to predict the litigation outcome of these cases, we

expect to prevail if the cases are not resolved through mediation. However, an

adverse litigation outcome could be material to our consolidated financial

position or results of operations. As a result of the uncertainty regarding the

outcome of this matter no provision has been made in our financial statements

with respect to this contingent liability.

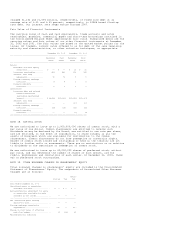

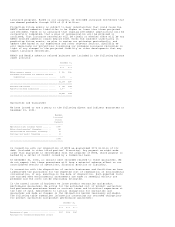

Environmental Matters

We are subject to various federal, state and local government requirements

relating to the protection of employee health and safety and the environment. We

believe that, as a general matter, our policies, practices and procedures are

properly designed to prevent unreasonable risk of environmental damage and

personal injury to our employees and employees of our customers and that our

handling, manufacture, use and disposal of hazardous or toxic substances are in

accord with environmental laws and regulations. However, mainly because of past

operations and operations of predecessor companies, we, like other companies

engaged in similar businesses, have incurred remedial response and voluntary

cleanup costs for site contamination and are a party to lawsuits and claims

associated with environmental matters, including past production of products

containing toxic substances. Additional lawsuits, claims and costs involving

environmental matters are likely to continue to arise in the future.

With respect to environmental matters involving site contamination, we

continually conduct studies, individually at our owned sites, and jointly as a

member of industry groups at non-owned sites, to determine the feasibility of

various remedial techniques to address environmental matters. It is our policy

to record appropriate liabilities for environmental matters when environmental

assessments are made or remedial efforts or damage claim payments are probable

and the costs can be reasonably estimated. With respect to site contamination,

the timing of these accruals is generally no later than the completion of

feasibility studies. We expect to fund expenditures for these matters from

operating cash flow. The timing of cash expenditures depends on a number of

factors, including the timing of litigation and settlements of personal injury

and property damage claims, regulatory approval of cleanup projects, remedial

techniques to be utilized and agreements with other parties.

Although we do not currently possess sufficient information to reasonably

estimate the amounts of liabilities to be recorded upon future completion of

studies, litigation or settlements, and neither the timing nor the amount of the

ultimate costs associated with environmental matters can be determined, they

could be material to our consolidated results of operations. However,

considering our past experience and existing reserves, we do not expect that

these matters will have a material adverse effect on our consolidated financial

position.