Honeywell 2002 Annual Report Download - page 254

Download and view the complete annual report

Please find page 254 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. December 31, 2001

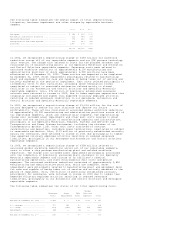

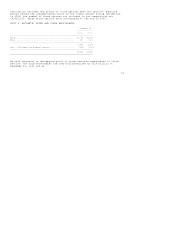

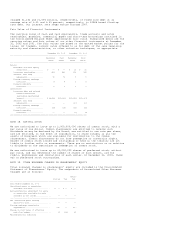

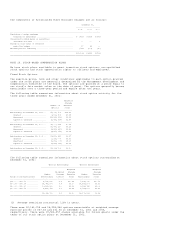

----------------------------------

Gross Net

Carrying Accumulated Carrying

Amount Amortization Amount

-----------------------------------------------------------------------

Intangible assets with

determinable lives:

Investments in Aerospace

customer incentives ........ $ 685 $ (78) $607

Patents and trademarks ........ 412 (276) 136

Other ......................... 320 (185) 135

-----------------------------------------------------------------------

1,417 (539) 878

-----------------------------------------------------------------------

Trademark with indefinite life ... 46 (9) 37

-----------------------------------------------------------------------

$1,463 $(548) $915

=======================================================================

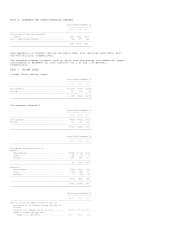

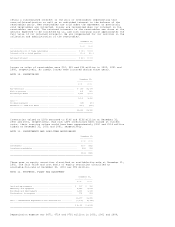

Intangible assets amortization expense was $59, $56 and $60 million in 2002,

2001 and 2000, respectively. Estimated intangible assets amortization expense

for each of the five succeeding years approximates $60 million.

In accordance with SFAS No. 142, prior year amounts were not restated. A

reconciliation of the previously reported net income (loss) and earnings (loss)

per share to the amounts adjusted for the reduction of amortization expense, net

of the related income tax effect, is as follows:

Years Ended

December 31,

---------------

2001 2000

-----------------------------------------------------------------

Net Income (Loss)

Reported net income (loss) .................... $ (99) $1,659

Amortization adjustment ....................... 196 197

-----------------------------------------------------------------

Adjusted net income ........................... $ 97 $1,856

=================================================================

Earnings (loss) per share of common

stock-- basic

Reported earnings (loss) per share -- basic ... $(0.12) $ 2.07

Amortization adjustment ....................... 0.24 0.25

-----------------------------------------------------------------

Adjusted earnings per share -- basic .......... $ 0.12 $ 2.32

=================================================================

Earnings (loss) per share of common

stock -- assuming dilution

Reported earnings (loss) per

share -- assuming dilution ................. $(0.12) $ 2.05

Amortization adjustment ....................... 0.24 0.24

-----------------------------------------------------------------

Adjusted earnings per share --

assuming dilution .......................... $ 0.12 $ 2.29

=================================================================

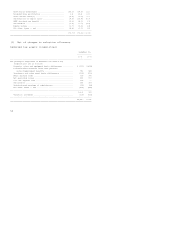

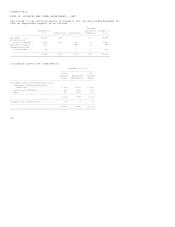

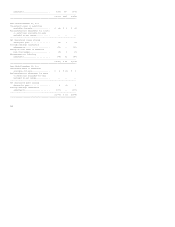

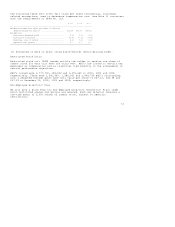

NOTE 14. ACCRUED LIABILITIES

December 31,

---------------

2002 2001

-------------------------------------------------------------------

Compensation and benefit costs .................. $ 440 $ 638

Customer advances ............................... 458 489

Income taxes .................................... 56 31

Environmental costs ............................. 75 81

Asbestos related liabilities .................... 741 182

Litton litigation settlement .................... -- 220

Severance ....................................... 325 484

Product warranties and performance guarantees ... 179 178

Other ........................................... 2,018 1,516

-------------------------------------------------------------------

$4,292 $3,819

===================================================================

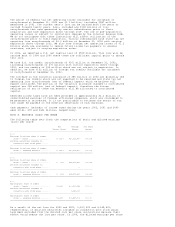

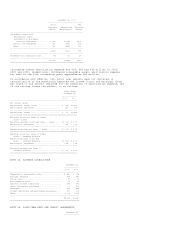

NOTE 15. LONG-TERM DEBT AND CREDIT AGREEMENTS

December 31,

---------------