Honeywell 2002 Annual Report Download - page 236

Download and view the complete annual report

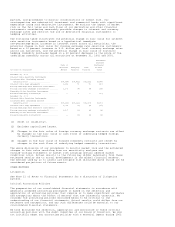

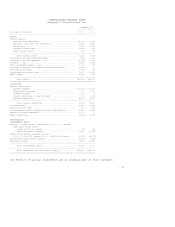

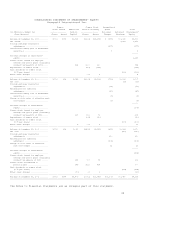

Please find page 236 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. NOTES TO FINANCIAL STATEMENTS

Honeywell International Inc.

(Dollars in Millions, Except Per Share Amounts)

--------------------------------------------------------------------------------

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Honeywell International Inc. is a diversified technology and manufacturing

company, serving customers worldwide with aerospace products and services,

control, sensing and security technologies for buildings, homes and industry,

automotive products, specialty chemicals, fibers, and electronic and advanced

materials. The following is a description of the significant accounting policies

of Honeywell International Inc.

Principles of Consolidation

The consolidated financial statements include the accounts of Honeywell

International Inc. and all of its subsidiaries in which a controlling interest

is maintained. All intercompany transactions and balances are eliminated in

consolidation.

Cash and Cash Equivalents

Cash and cash equivalents includes cash on hand and on deposit and highly

liquid, temporary cash investments with an original maturity of three months or

less.

Inventories

Inventories are valued at the lower of cost or market using the first-in,

first-out or the average cost method and the last-in, first-out (LIFO) method

for certain qualifying domestic inventories.

Investments

Investments in affiliates over which we have a significant influence, but not a

controlling interest, are accounted for using the equity method of accounting.

Other investments are carried at market value, if readily determinable, or cost.

All equity investments are periodically reviewed to determine if declines in

fair value below cost basis are other-than-temporary. Significant and sustained

decreases in quoted market prices and a series of historic and projected

operating losses by investees are considered in the review. If the decline in

fair value is determined to be other-than-temporary, an impairment loss is

recorded and the investment is written down to a new cost basis.

Property, Plant and Equipment

Property, plant and equipment are recorded at cost less accumulated

depreciation. For financial reporting, the straight-line method of depreciation

is used over the estimated useful lives of 10 to 40 years for buildings and

improvements and 3 to 15 years for machinery and equipment.

Goodwill and Indefinite-Lived Intangible Assets

Goodwill represents the excess of acquisition costs over the fair value of net

assets of businesses acquired and, prior to January 1, 2002, was amortized on a

straight-line basis over appropriate periods up to 40 years. Effective January

1, 2002, we adopted Statement of Financial Accounting Standards No. 142,

"Goodwill and Other Intangible Assets" (SFAS No. 142). SFAS No. 142 requires

that goodwill and certain other intangible assets having indefinite lives no

longer be amortized to income, but instead be replaced with periodic testing for

impairment. Intangible assets determined to have definite lives will continue to

be amortized over their useful lives. With the adoption of SFAS No. 142, we

reassessed the useful lives and residual values of all acquired intangible

assets to make any necessary amortization period adjustments. Based on that

assessment, an amount related to a trademark in our automotive consumer products

business was determined to be an indefinite-lived intangible asset because it is

expected to generate cash flows indefinitely. There were no other adjustments

made to the amortization period or residual values of other intangible assets.

We also completed our goodwill impairment testing during the three months ended

March 31, 2002 and determined that there was no impairment as of January 1,

2002. Additionally, we have elected to make March 31 the annual impairment

assessment date for our reporting units and will perform additional impairment

tests when events or changes in circumstances occur. See Note 13 for additional

details.

Other Intangible Assets with Determinable Lives

Other intangible assets with determinable lives are amortized on a straight-line

basis over the expected period benefited by future cash inflows up to 25 years.

Long-Lived Assets