Honeywell 2002 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.forecasts, general and industry trends and, economic projections and anticipated

cash flows. An impairment is assessed when the undiscounted expected future cash

flows derived from an asset are less than its carrying amount. Impairment losses

are measured as the amount by which the carrying value of an asset exceeds its

fair value and are recognized in earnings. We also continually evaluate the

estimated useful lives of all long-lived assets and periodically revise such

estimates based on current events.

Sales Recognition

Product and service sales are recognized when persuasive evidence of an

arrangement exists, product delivery has occurred or services have been

rendered, pricing is fixed or determinable, and collection is reasonably

assured. Sales under long-term contracts in the Aerospace and Automation and

Control Solutions segments are recorded on a percentage-of-completion method

measured on the cost-to-cost basis for engineering-type contracts and the

units-of-delivery basis for production-type contracts. Provisions for

anticipated losses on long-term contracts are recorded in full when such losses

become evident. Revenues from contracts with multiple element arrangements are

recognized as each element is earned based on the relative fair value of each

element and when there are no undelivered elements that are essential to the

functionality of the delivered elements. Amounts allocated to each element are

based on its objectively determined fair value, such as the sales price for the

product or service when it is sold separately or competitor prices for similar

products or services.

Aerospace Customer Incentives

We offer sales incentives to commercial aircraft manufacturers and airlines in

connection with their selection of our products. These incentives may consist of

free products, credits, discounts or upfront cash payments. The cost of these

incentives is recognized in the period incurred unless the incentive is subject

to recovery through a long-term product maintenance requirement mandated by the

Federal Aviation Administration for certified replacement equipment and service.

Amounts capitalized at December 31, 2002 and 2001 were $662 and $607 million,

respectively, and are being recognized over the estimated minimum life of the

aircraft (up to 25 years) as a reduction in future sales or increase in cost of

goods sold based on the type of incentive granted. We routinely evaluate the

recoverability of these amounts based on forecasted replacement equipment sales

over the estimated minimum life of the aircraft. See Note 13 for additional

details.

Environmental Expenditures

Environmental expenditures that relate to current operations are expensed or

capitalized as appropriate. Expenditures that relate to an existing condition

caused by past operations, and that do not provide future benefits, are expensed

as incurred. Liabilities are recorded when environmental assessments are made or

remedial efforts are probable and the costs can be reasonably estimated. The

timing of these accruals is generally no later than the completion of

feasibility studies. The liabilities for environmental costs recorded in Accrued

Liabilities and Other Liabilities at December 31, 2002 were $75 and $360

million, respectively, and at December 31, 2001 were $81 and $375 million,

respectively.

Research and Development

Research and development costs for company-sponsored research and development

projects are expensed as incurred. Such costs are classified as part of Cost of

Goods Sold and were $757, $832 and $818 million in 2002, 2001 and 2000,

respectively.

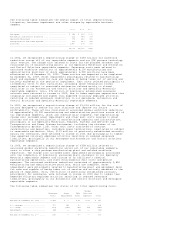

Stock-Based Compensation Plans

We account for our fixed stock option plans under Accounting Principles Board

Opinion No. 25, "Accounting for Stock Issued to Employees" (APB No. 25).

Accordingly, no compensation cost is recognized for our fixed stock option

plans. Statement of Financial Accounting Standards No. 123, "Accounting for

Stock-Based Compensation" (SFAS No. 123) allows, but does not require, companies

to record compensation cost for fixed stock option plans using a fair value

based method. As permitted by SFAS No. 123, we elected to continue to account

for compensation cost for our fixed stock option plans using the intrinsic value

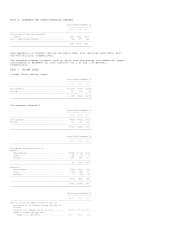

based method under APB No. 25. The following table sets forth pro forma

information as if compensation cost had been determined consistent with the

requirements of SFAS No. 123.

2002 2001 2000

---------------------------------------------------------------------------

Net income (loss), as reported.................. $ (220) $ (99) $1,659

Deduct: Total stock-based employee

compensation cost determined under fair

value method for fixed stock option

plans, net of related tax effects............ (64) (85) (75)