Honeywell 2002 Annual Report Download - page 250

Download and view the complete annual report

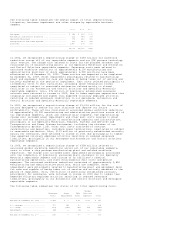

Please find page 250 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The amount of federal tax net operating losses available for carryback or

carryforward at December 31, 2002 was $1.1 billion, including $987 million

generated in 2002. The current year's loss can be carried back five years or

carried forward twenty years. Also, included are $118 million of loss

carryforwards that were generated by certain subsidiaries prior to their

acquisition and have expiration dates through 2019. The use of pre-acquisition

operating losses is subject to limitations imposed by the Internal Revenue Code.

We do not anticipate that these limitations will affect utilization of the

carryforwards prior to their expiration. Various subsidiaries have state tax net

operating loss carryforwards of $4.2 billion at December 31, 2002 with varying

expiration dates through 2022. We also have foreign net operating losses of $1.2

billion which are available to reduce future income tax payments in several

countries, subject to varying expiration rules.

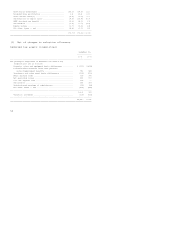

In 2002, we reported a U.S. net capital loss of $559 million. This loss will be

carried back to 1999 and 2000 where there are sufficient capital gains to absorb

this loss.

We have U.S. tax credit carryforwards of $101 million at December 31, 2002,

including carryforwards of $71 million with various expiration dates through

2022, and tax credits of $30 million which are not subject to expiration. In

addition, we have $152 million of foreign tax credits available for carryback

or carryforward at December 31, 2002.

The increase in the valuation allowance of $80 million in 2002 was primarily due

to foreign tax credits which are not expected to be realized and state tax net

operating loss carryforwards (net of federal impact) which we believe will

expire unutilized. The portion of the valuation allowance charged to contributed

capital was $18 million (net of federal impact), therefore the future

realization of any of these tax benefits will be allocated to contributed

capital.

Deferred income taxes have not been provided on approximately $2.2 billion of

undistributed earnings of foreign affiliated companies, which are considered to

be permanently reinvested. It is not practicable to estimate the amount of tax

that might be payable on the eventual remittance of such earnings.

Cash payments (refunds) of income taxes during the years 2002, 2001 and 2000

were $(14), $79 and $442 million, respectively.

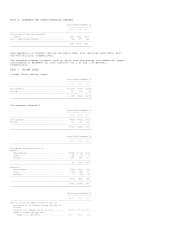

NOTE 8. EARNINGS (LOSS) PER SHARE

The following table sets forth the computations of basic and diluted earnings

(loss) per share:

Net Average Per Share

Income (Loss) Shares Amount

--------------------------------------------------------------------------------

2002

Earnings (loss) per share of common

stock -- basic .................... $ (220) 820,292,870 $(0.27)

Dilutive securities issuable in

connection with stock plans ....... --

--------------------------------------------------------------------------------

Earnings (loss) per share of common

stock -- assuming dilution ........ $ (220) 820,292,870 $(0.27)

================================================================================

2001

Earnings (loss) per share of common

stock -- basic .................... $ (99) 812,273,417 $(0.12)

Dilutive securities issuable in

connection with stock plans ....... --

--------------------------------------------------------------------------------

Earnings (loss) per share of common

stock -- assuming dilution ........ $ (99) 812,273,417 $(0.12)

================================================================================

2000

Earnings per share of common

stock -- basic .................... $1,659 800,317,543 $ 2.07

Dilutive securities issuable in

connection with stock plans ....... 9,149,959

--------------------------------------------------------------------------------

Earnings per share of common

stock -- assuming dilution ........ $1,659 809,467,502 $ 2.05

================================================================================

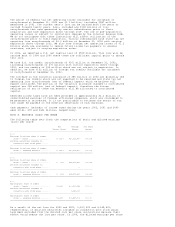

As a result of the net loss for 2002 and 2001, 2,527,229 and 4,269,601,

respectively, of dilutive securities issuable in connection with stock plans

have been excluded from the diluted loss per share calculations because their

effect would reduce the loss per share. In 2000, the diluted earnings per share