Honeywell 2002 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.receivable were lower compared with the prior year-end driven by an improvement

in working capital turnover. The decrease also resulted from asset writedowns in

connection with our repositioning actions.

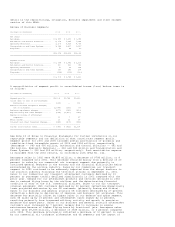

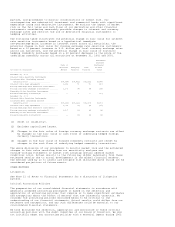

Cash Flow Summary

Cash provided by operating activities of $2,380 million during 2002 increased by

$384 million compared with 2001 mainly due to an improvement in working capital

(receivables and inventories) turnover and lower tax payments. This increase was

partially offset by a cash contribution to our U.S. defined benefit pension

plans of $130 million and higher spending for repositioning actions, mainly

severance. Cash provided by operating activities of $1,996 million during 2001

increased by $7 million compared with 2000. This increase was driven by an

improvement in working capital turnover offset by lower earnings.

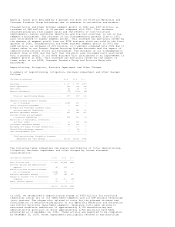

Cash used for investing activities of $870 million during 2002 decreased by $36

million compared with 2001 due to higher proceeds from sales of businesses and

lower capital spending. During 2002, we realized proceeds from the sales of our

BCVS, PFC and Consumer Products businesses. The decrease in capital spending

reflected the completion in 2002 of a major plant in our Fluorines business and

our intention to limit capital spending at non-strategic businesses. This

decrease in cash used for investing activities also reflects the proceeds from

the disposition of an equity investment in our Automation and Control Solutions

reportable segment. The decrease in cash used for investing activities was

partially offset by an increase in spending for acquisitions, principally

reflecting the acquisition of Invensys Sensor Systems in October 2002. Cash used

for investing activities of $906 million during 2001 decreased by $1,808 million

compared with 2000 due principally to our acquisition of Pittway in 2000. This

decrease was partially offset by lower proceeds from sales of businesses and

property, plant and equipment and a slight increase in capital spending.

Cash used for financing activities of $882 million during 2002 decreased by $11

million compared with 2001 mainly due to lower net debt repayments in the

current year partially offset by a decrease in proceeds from issuance of common

stock. Total debt of $5,089 million at December 31, 2002 was $181 million, or 3

percent lower than at December 31, 2001 principally reflecting scheduled

repayments of long-term debt. Cash used for financing activities of $893 million

during 2001 increased by $823 million compared with 2000. This increase resulted

principally from reduced long-term borrowings in 2001. During 2001, we issued

$500 million of 5 1/8% Notes due 2006, $500 million of 6 1/8% Notes due 2011 and

$247 million of 5.25% Notes due 2006. During 2000, we issued $1 billion of 7.50%

Notes due 2010 and $750 million of 6.875% Notes due 2005. Total debt of $5,270

million at December 31, 2001 was $353 million, or 6 percent lower than at

December 31, 2000. This decrease resulted from lower levels of commercial paper

outstanding at year-end. The increase in cash used for financing activities also

resulted from lower proceeds from issuances of common stock partially offset by

lower repurchases of common stock.

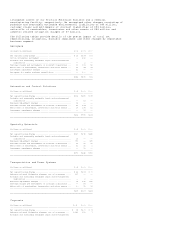

Liquidity

We manage our businesses to maximize operating cash flows as the principal

source of our liquidity. Operating cash flows were $2.4 billion in 2002. We have

approximately $6.0 billion in working capital (trade receivables and

inventories) and each of our businesses has developed a strategic plan to

further improve working capital turnover in 2003 to increase operating cash

flows. Considering the current economic environment in which each of our

businesses operate and our business plans and strategies, including our focus on

cost reduction and productivity initiatives, we believe that our operating cash

flows will remain our principal source of liquidity. In addition to our

operating cash flows and available cash, additional sources of liquidity include

committed credit lines, access to the public debt markets using debt securities

and commercial paper, as well as our ability to sell trade accounts receivables.

A source of liquidity is our short-term borrowings in the commercial paper

market. Our ability to access the commercial paper market and the related cost

of these borrowings is affected by the strength of our credit ratings and our $2

billion committed bank revolving credit facility (Revolving Credit Facility).

Our credit ratings are periodically reviewed by the major credit rating

agencies. Our current ratings as provided by Moody's Investors Service, Standard

& Poor's and Fitch, Inc. are A-2, A and A+, respectively, for long-term debt and

P-1, A-1 and F-1, respectively, for short-term debt. Our credit ratings by each

of the three major credit rating agencies reflect a "negative outlook" due

principally to the lower operating results for our Aerospace segment due to the

depressed market conditions in the commercial air transport industry. The

"negative outlook" ratings have not impaired, nor do we expect it to impair, our

access to the commercial paper markets.

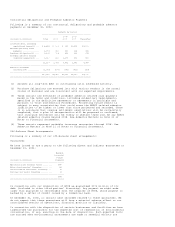

We may from time to time issue unsecured short-term promissory notes in the

commercial paper market. The commercial paper notes may bear interest or may be

sold at a discount and have a maturity of not more than 364 days from date of

issuance. Borrowings under the commercial paper program are available for

general corporate purposes. There was $201 and $3 million of commercial paper

outstanding at year-end 2002 and 2001, respectively.