Honeywell 2002 Annual Report Download - page 16

Download and view the complete annual report

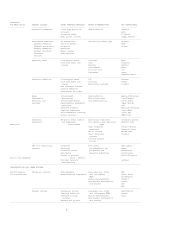

Please find page 16 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STRATEGIC

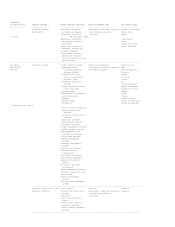

BUSINESS UNITS PRODUCT CLASSES MAJOR PRODUCTS/SERVICES MAJOR CUSTOMERS/USES KEY COMPETITORS

-------------- --------------- ----------------------- -------------------- ---------------

Consumer Products Aftermarket Oil, air, fuel, Automotive and heavy AC Delco

Group filters, spark plugs, transmission and coolant vehicle aftermarket channels, Bosch

electronic components and filters OEMs and OES Champion

car care products PCV valves Auto supply retailers Champ Labs

Spark plugs Specialty installers Havoline/Texaco

Wire and cable Mass merchandisers Mann & Hummel

Antifreeze/coolant NGK

Ice-fighter products Peak/Old World

Windshield washer fluids Industries

Waxes, washes and Pennzoil-Quaker

specialty cleaners State

Purolator/Arvin Ind

STP/ArmorAll/

Clorox

Turtle Wax

Various Private

Label

Wix/Dana

Zerex/Valvoline

-------------------------------------------------------------------------------------------------------------------------------

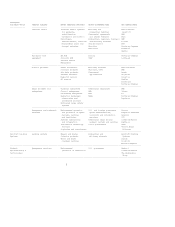

Friction Materials Friction materials Disc brake pads and shoes Automotive and heavy vehicle Akebono

Aftermarket brake hard Drum brake linings OEMs, OES, brake Dana

parts Brake blocks manufacturers and aftermarket Delphi

Disc and drum brake channels Federal-Mogul

components Mass merchandisers ITT Galfer

Brake hydraulic Installers JBI

components Railway and commercial/ Nisshinbo

Brake fluid military aircraft OEMs TMD

Aircraft brake linings and brake manufacturers Roulunds

Railway linings

-------------------------------------------------------------------------------------------------------------------------------

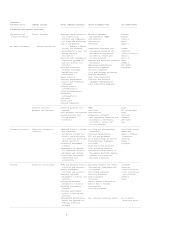

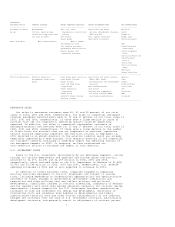

AEROSPACE SALES

Our sales to aerospace customers were 40, 41 and 40 percent of our total

sales in 2002, 2001 and 2000, respectively. Our sales to commercial aerospace

original equipment manufacturers were 9, 12 and 11 percent of our total sales in

2002, 2001 and 2000, respectively. If there were a large decline in sales of

aircraft that use our components, operating results could be negatively

impacted. In addition, our sales to commercial aftermarket customers of

aerospace products and services were 14, 15 and 17 percent of our total sales in

2002, 2001 and 2000, respectively. If there were a large decline in the number

of flight hours for aircraft that use our components or services, operating

results could be negatively impacted. The terrorist attacks on September 11,

2001 resulted in an abrupt downturn in the aviation industry which was already

negatively impacted by a weak economy. This dramatic downturn in the commercial

air transport industry continued to adversely impact the operating results of

our Aerospace segment in 2002. In response, we have accelerated our

cost-reduction actions to mitigate the impact of this downturn.

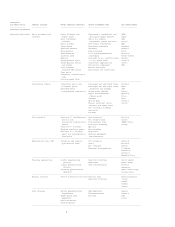

U.S. GOVERNMENT SALES

Sales to the U.S. Government (principally by our Aerospace segment), acting

through its various departments and agencies and through prime contractors,

amounted to $2,277, $2,491 and $2,219 million in 2002, 2001 and 2000,

respectively, which included sales to the U.S. Department of Defense of $1,833,

$1,631 and $1,548 million in 2002, 2001 and 2000, respectively. U.S. defense

spending increased in 2002 and is also expected to increase in 2003.

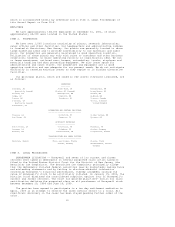

In addition to normal business risks, companies engaged in supplying

military and other equipment to the U.S. Government are subject to unusual

risks, including dependence on Congressional appropriations and administrative

allotment of funds, changes in governmental procurement legislation and

regulations and other policies that may reflect military and political

developments, significant changes in contract scheduling, complexity of designs

and the rapidity with which they become obsolete, necessity for constant design

improvements, intense competition for U.S. Government business necessitating

increases in time and investment for design and development, difficulty of

forecasting costs and schedules when bidding on developmental and highly

sophisticated technical work and other factors characteristic of the industry.

Changes are customary over the life of U.S. Government contracts, particularly

development contracts, and generally result in adjustments of contract prices.

7