Honeywell 2002 Annual Report Download - page 266

Download and view the complete annual report

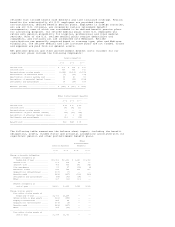

Please find page 266 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.lated form. There is a group of potential claimants consisting largely of

professional brake mechanics. From 1981 through December 31, 2002, we have

resolved approximately 60,000 Bendix claims at an average indemnity cost per

claim of approximately two thousand dollars. Through the second quarter of 2002,

Honeywell had no out-of-pocket costs for these cases since its insurance

deductible was satisfied many years ago. Beginning with claim payments made in

the third quarter of 2002, Honeywell began advancing indemnity and defense claim

costs which amounted to approximately $70 million in payments in the second half

of 2002. A substantial portion of this amount is expected to be reimbursed by

insurance and $57 million has been recorded as a receivable. There are currently

approximately 50,000 claims pending and we have no reason to believe that the

historic rate of dismissal will change.

On January 30, 2003, Honeywell and Federal-Mogul Corp. (Federal-Mogul) entered

into a letter of intent (LOI) pursuant to which Federal-Mogul would acquire

Honeywell's automotive Bendix Friction Materials (Bendix) business, with the

exception of certain U.S. based assets. In exchange, Honeywell would receive a

permanent channeling injunction shielding it from all current and future

personal injury asbestos liabilities related to Honeywell's Bendix business.

Federal-Mogul, its U.S. subsidiaries and certain of its United Kingdom

subsidiaries voluntarily filed for financial restructuring under Chapter 11 of

the U.S. Bankruptcy Code in October 2001. Federal-Mogul will seek to establish

one or more trusts under Section 524(g) of the U.S. Bankruptcy Code as part of

its reorganization plan, including a trust for the benefit of Bendix asbestos

claimants. The reorganization plan to be submitted to the Bankruptcy Court for

approval will contemplate that the U.S. Bankruptcy Court in Delaware would issue

an injunction in favor of Honeywell that would channel to the Bendix 524(g)

trust all present and future asbestos claims relating to Honeywell's Bendix

business. The 524(g) trust created for the benefit of the Bendix claimants would

receive the rights to proceeds from Honeywell's Bendix related insurance

policies and would make these proceeds available to the Bendix claimants.

Honeywell would have no obligation to contribute any additional amounts toward

the settlement or resolution of Bendix related asbestos claims.

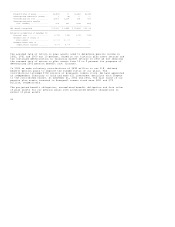

In the fourth quarter of 2002, we recorded a charge of $167 million consisting

of a $131 million reserve for the sale of Bendix to Federal-Mogul, our estimate

of asbestos related liability net of insurance recoveries and costs to complete

the anticipated transaction with Federal-Mogul. Completion of the transaction

contemplated by the LOI is subject to the negotiation of definitive agreements,

the confirmation of Federal-Mogul's plan of reorganization by the Bankruptcy

Court, the issuance of a final, non-appealable 524(g) channeling injunction

permanently enjoining any Bendix related asbestos claims against Honeywell, and

the receipt of all required governmental approvals. We do not believe that

completion of such transaction would have a material adverse impact on our

consolidated results of operations or financial position. There can be no

assurance, however, that the transaction contemplated by the LOI will be

completed. Honeywell presently has $2 billion of insurance coverage remaining

with respect to Bendix related asbestos claims. Although it is impossible to

predict the outcome of pending or future claims, in light of our potential

exposure, our prior experience in resolving these claims, and our insurance

coverage, we do not believe that the Bendix related asbestos claims will have a

material adverse effect on our consolidated financial position.

Another source of claims is refractory products (high temperature bricks and

cement) sold largely to the steel industry in the East and Midwest by North

American Refractories Company (NARCO), a business we owned from 1979 to 1986.

Less than 2 percent of NARCO's products contained asbestos.

When we sold the NARCO business in 1986, we agreed to indemnify NARCO with

respect to personal injury claims for products that had been discontinued prior

to the sale (as defined in the sale agreement). NARCO retained all liability for

all other claims. NARCO had resolved approximately 176,000 claims through

January 4, 2002, the date NARCO filed for reorganization under Chapter 11 of the

U.S. Bankruptcy Code, at an average cost per claim of two thousand two hundred

dollars. Of those claims, 43 percent were dismissed on the ground that there was

insufficient evidence that NARCO was responsible for the claimant's asbestos

exposure. As of the date of NARCO's bankruptcy filing, there were approximately

116,000 remaining claims pending against NARCO, including approximately 7

percent in which Honeywell was also named as a defendant. Since 1983, Honeywell

and our insurers have contributed to the defense and settlement costs associated

with NARCO claims. We have approximately $2 billion of insurance remaining that

can be specifically allocated to NARCO related liability.

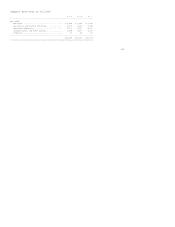

As a result of the NARCO bankruptcy filing, all of the claims pending against

NARCO are automatically stayed pending the reorganization of NARCO. In addition,

because the claims pending against Honeywell necessarily will impact the

liabilities of NARCO, because the insurance policies held by Honeywell are

essential to a successful NARCO reorganization, and because Honeywell has

offered to commit the value of those policies to the reorganization, the

bankruptcy court has temporarily enjoined any claims against Honeywell, current

or future, related to NARCO. Although the stay has been extended eleven times

since January 4, 2002, there is no assurance that such stay will remain in