Honeywell 2002 Annual Report Download - page 209

Download and view the complete annual report

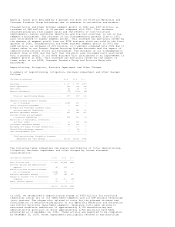

Please find page 209 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.detail in the repositioning, litigation, business impairment and other charges

section of this MD&A.

Review of Business Segments

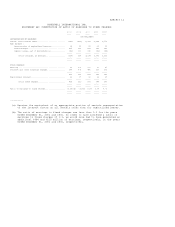

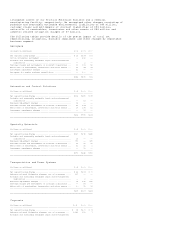

(Dollars in millions) 2002 2001 2000

---------------------------------------------------------------------

Net Sales

Aerospace.............................. $ 8,855 $ 9,653 $ 9,988

Automation and Control Solutions....... 6,978 7,185 7,384

Specialty Materials.................... 3,205 3,313 4,055

Transportation and Power Systems....... 3,184 3,457 3,527

Corporate.............................. 52 44 69

---------------------------------------------------------------------

$22,274 $23,652 $25,023

=====================================================================

Segment Profit

Aerospace.............................. $ 1,358 $ 1,741 $ 2,195

Automation and Control Solutions....... 890 819 986

Specialty Materials.................... 57 52 334

Transportation and Power Systems....... 357 289 274

Corporate.............................. (154) (153) (160)

---------------------------------------------------------------------

$ 2,508 $ 2,748 $ 3,629

=====================================================================

A reconciliation of segment profit to consolidated income (loss) before taxes is

as follows:

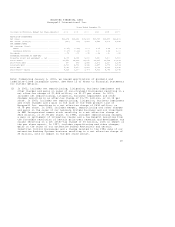

(Dollars in millions) 2002 2001 2000

--------------------------------------------------------------------

Segment profit......................... $2,508 $2,748 $3,629

(Loss) gain on sale of non-strategic

businesses.......................... (124) -- 112

Asbestos related litigation charges,

net of insurance.................... (1,548) (159) (7)

Business impairment charges............ (877) (145) (410)

Repositioning and other charges........ (634) (2,490) (549)

Equity in income of affiliated

companies........................... 55 7 47

Other income........................... 19 22 57

Interest and other financial charges... (344) (405) (481)

--------------------------------------------------------------------

Income (loss) before taxes............. $ (945) $ (422) $2,398

====================================================================

See Note 23 of Notes to Financial Statements for further information on our

reportable segments and our definition of what constitutes segment profit.

Segment profit for 2001 and 2000 includes pretax amortization of goodwill and

indefinite-lived intangible assets of $204 and $206 million, respectively

(Aerospace -- $60 and $60 million, Automation and Control Solutions -- $92 and

$86 million, Specialty Materials -- $32 and $40 million and Transportation and

Power Systems -- $20 and $20 million, respectively). Such amortization expense

is excluded from the 2002 results, in conformity with SFAS No. 142.

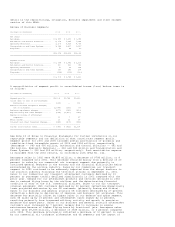

Aerospace sales in 2002 were $8,855 million, a decrease of $798 million, or 8

percent compared with 2001. This decrease resulted mainly from a decline of 20

percent in sales by our commercial air transport segment due primarily to

continued general weakness in the economy and the financial difficulties being

encountered by the airline industry. Sales by our commercial air transport

segment in 2002 continued to be adversely impacted from the abrupt downturn in

the aviation industry following the terrorist attacks on September 11, 2001.

Sales to our commercial air transport aftermarket customers declined by 13

percent as passenger traffic declined significantly in 2002 compared with the

prior year. Demand for our aftermarket products and services declined in 2002

due to reduced flying hours by the airlines and the deteriorating financial

condition of many of the U.S. commercial airlines. Sales to our air transport

original equipment (OE) customers declined by 32 percent reflecting dramatically

lower projected deliveries by our OE customers (primarily Boeing and Airbus).

Sales to our business and general aviation OE customers decreased by 27 percent

reflecting a decline in deliveries of regional and business jet airplanes. This

decrease was partially offset by higher sales in our defense and space segment,

with OE sales up by 13 percent and aftermarket sales higher by 12 percent,

resulting primarily from increased military activity and growth in precision

guidance and spare parts. Sales to our business and general aviation aftermarket

customers also increased by 7 percent largely due to increases in engine

maintenance because of higher flying hours by fractional jets. Aerospace sales

in 2001 were $9,653 million, a decrease of $335 million, or 3 percent compared

with 2000. This decrease principally reflected a decrease of 10 percent in sales

by our commercial air transport aftermarket and OE segments and the impact of