Honeywell 2002 Annual Report Download - page 260

Download and view the complete annual report

Please find page 260 of the 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.changed $1,132 and $1,096 million, respectively, of fixed rate debt at an

average rate of 6.51 and 6.55 percent, respectively, to LIBOR based floating

rate debt. Our interest rate swaps mature through 2007.

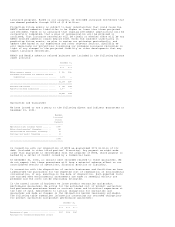

Fair Value of Financial Instruments

The carrying value of cash and cash equivalents, trade accounts and notes

receivables, payables, commercial paper and short-term borrowings contained in

the Consolidated Balance Sheet approximates fair value. Summarized below are the

carrying values and fair values of our other financial instruments at December

31, 2002 and 2001. The fair values are based on the quoted market prices for the

issues (if traded), current rates offered to us for debt of the same remaining

maturity and characteristics, or other valuation techniques, as appropriate.

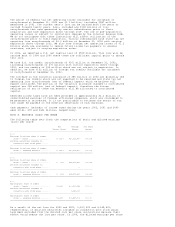

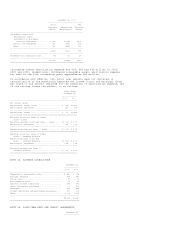

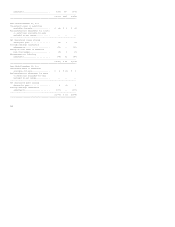

December 31, 2002 December 31, 2001

--------------------------------------------------------------------------

Carrying Fair Carrying Fair

Value Value Value Value

--------------------------------------------------------------------------

Assets

Available-for-sale equity

securities................ $ -- $ -- $ 92 $ 92

Long-term receivables........ 464 443 154 145

Interest rate swap

agreements................ 76 76 5 5

Foreign currency exchange

contracts................. 8 8 5 5

Forward commodity

contracts................. 5 5 1 1

Liabilities

Long-term debt and related

current maturities

(excluding capitalized

leases)................... $(4,812) $(5,261) $(5,121) $(5,407)

Interest rate swap

agreements................ -- -- (10) (10)

Foreign currency exchange

contracts................. (16) (16) (11) (11)

Forward commodity

contracts................. -- -- (7) (7)

==========================================================================

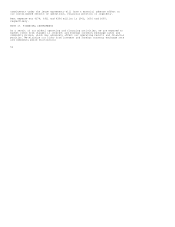

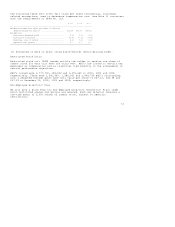

NOTE 18. CAPITAL STOCK

We are authorized to issue up to 2,000,000,000 shares of common stock, with a

par value of one dollar. Common shareowners are entitled to receive such

dividends as may be declared by the Board, are entitled to one vote per share,

and are entitled, in the event of liquidation, to share ratably in all the

assets of Honeywell which are available for distribution to the common

shareowners. Common shareowners do not have preemptive or conversion rights.

Shares of common stock issued and outstanding or held in the treasury are not

liable to further calls or assessments. There are no restrictions on us relative

to dividends or the repurchase or redemption of common stock.

We are authorized to issue up to 40,000,000 shares of preferred stock, without

par value, and can determine the number of shares of each series, and the

rights, preferences and limitations of each series. At December 31, 2002, there

was no preferred stock outstanding.

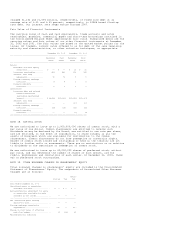

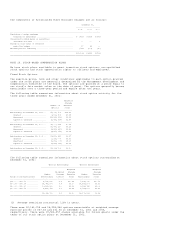

NOTE 19. OTHER NONOWNER CHANGES IN SHAREOWNERS' EQUITY

Total nonowner changes in shareowners' equity are included in the Consolidated

Statement of Shareowners' Equity. The components of Accumulated Other Nonowner

Changes are as follows:

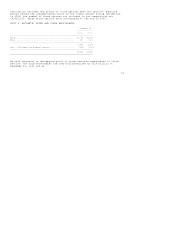

After-

Pretax Tax Tax

----------------------------------------------------------------

Year Ended December 31, 2002

Unrealized gains on securities

available-for-sale.................. $ -- $ -- $ --

Reclassification adjustment for gains

on securities available-for-sale

included in net income.............. -- -- --

----------------------------------------------------------------

Net unrealized gains arising

during the year..................... -- -- --

Foreign exchange translation

adjustments......................... 310 -- 310

Change in fair value of effective

cash flow hedges.................... 35 (13) 22

Minimum pension liability